INP-WealthPk

Hifsa Raja

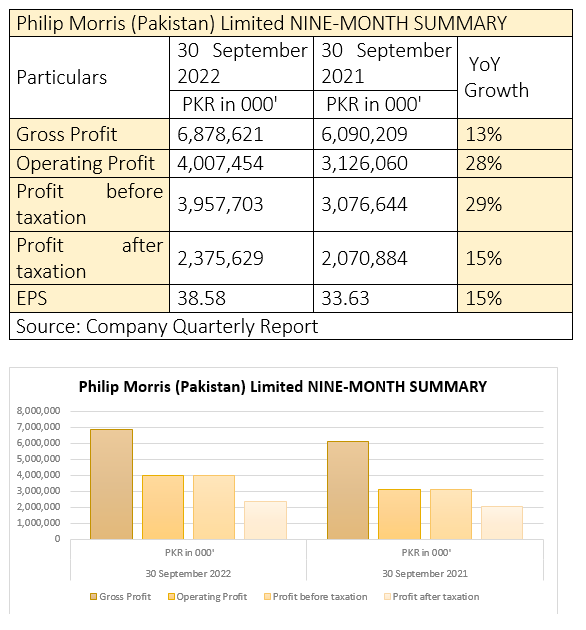

Philip Morris Pakistan Limited’s gross profit inched up 13% to Rs6.87 billion in the first nine months ending September 30, 2022, compared with Rs6.09 billion over the corresponding period of the previous year. Similarly, operating profit registered a 28% growth during 9MCY22 and clocked in at Rs4 billion compared to Rs3.12 billion over the same period of CY21. The profit-before-tax for 9MCY22 went up 29% to Rs3.95 billion from Rs3.07 billion over the same period of CY21. The profit-after-tax edged higher by 15% to Rs2.37 billion in 9MCY22 from Rs2.07 billion in 9MCY21, reports WealthPK.

Performance in 2021

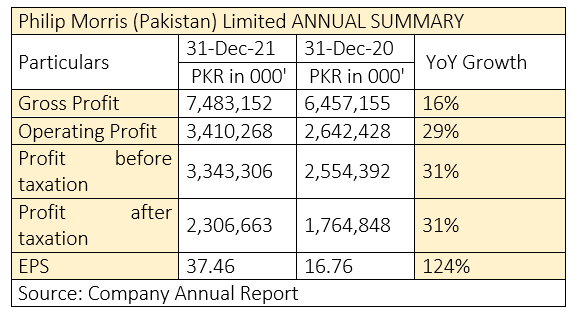

During the calendar year 2021, the company’s gross profit increased 16% to Rs7.48 billion from Rs6.45 billion in 2020. The company’s operating profit also increased 29% to Rs3.41 billion in 2021 from Rs2.64 billion in 2020. The profit-before-tax for CY21 stood at Rs3.34 billion, up 31% from Rs2.55 billion in CY20. The profit-after-tax for CY21 also increased 31% to Rs2.30 billion from Rs1.76 billion in CY20.

Earnings Per Share

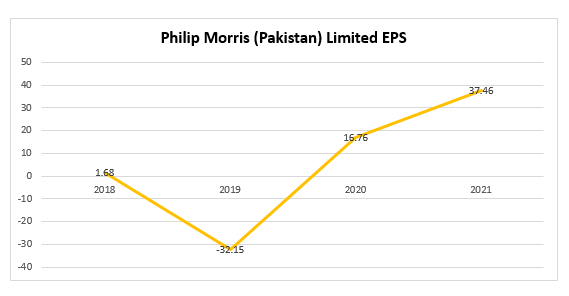

The company’s earnings per share in 2018 stood at Rs1.68, but plunged to minus Rs32.15 in 2019. However, the EPS rebounded and reached Rs16.76 in 2020, before jumping to Rs37.46 in 2021, showing the firm remained highly profitable in the latter years.

Shareholding

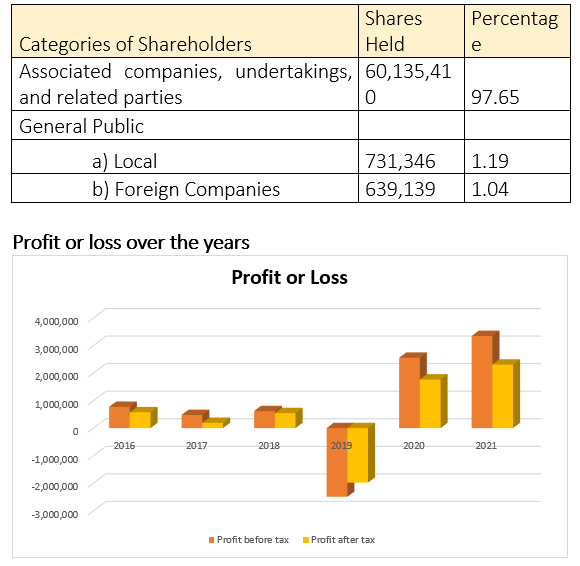

As of December 31, 2021, directors, associated companies, undertakings, and related parties owned 97.65% of the total shares of the company. Locals from the general public segment held 1.19% shares, and foreign companies 1.04% shares.

From 2016 to 2018, the before and after-tax profits showed a positive trend. However, in 2019, the twin profits showed a loss. In 2020 and 2021, the company posted robust gains. It is to note here that Philip Morris (Pakistan) Limited's principal activity is manufacturing and selling cigarettes and other tobacco products.

Credit : Independent News Pakistan-WealthPk