INP-WealthPk

Shams ul Nisa

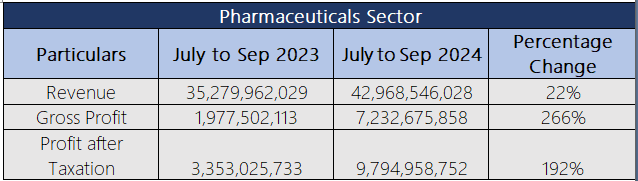

The pharmaceutical sector saw a substantial growth in the July-September 2024 period, with the revenue rising by 22%, gross profit by 266%, and net profit by 192%, reports WealthPK.

The revenue climbed from Rs35.28 billion in July-September 2023 to Rs42.97 billion in the same period in 2024, driven by an expanded healthcare access and the launch of new drug formulations. The gross profit surged to Rs7.23 billion, reflecting enhanced operational efficiencies, effective cost management, and possibly higher margins on new products. Additionally, the profit after tax increased from Rs3.35 billion to nearly Rs9.79 billion.

The data has been compiled from nine companies listed on the PSX, including The Searle Company Limited, Citi Pharma Ltd, BF Biosciences Limited, GlaxoSmithKline Pakistan Limited, Ferozsons Laboratories Limited, AGP Limited, Haleon Pakistan Limited, Abbott Laboratories (Pakistan) Limited, and Highnoon Laboratories Limited. Among these, both The Searle Company Limited and Ferozsons Laboratories Limited experienced declines in revenue, gross profit, and net profit during the review period.

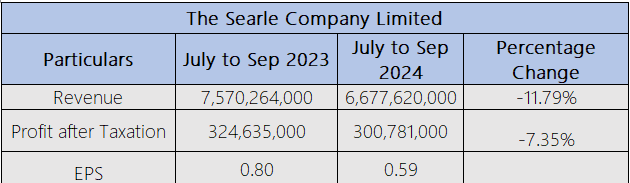

The Searle Company Limited

From July to September 2024, the company saw a decrease of 11.79% in revenue, largely attributed to the efforts to manage distributor inventory levels and adjust the product mix.

Likewise, the profit after tax dropped by 7.35% to Rs300.78 million, reflecting pressures on profit margins due to the rising production costs and operational challenges. Additionally, the earnings per share declined from Rs0.80 to Rs0.59, signaling reduced profitability.

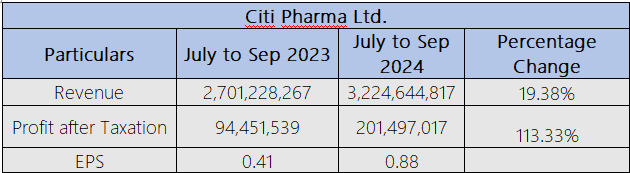

Citi Pharma Ltd

Citi Pharma Ltd. achieved substantial financial growth from July to September 2024, with the revenue rising by 19.38%. This increase points to a strong demand for Citi Pharma’s products, likely driven by effective marketing and market expansion efforts.

The profit after tax grew by 113.33%, from Rs94.45 million to Rs201.50 million, reflecting enhanced operational efficiency and better cost management. The company’s earnings per share (EPS) also doubled, moving from Rs0.41 to Rs0.88, signaling positive returns for shareholders and a higher market valuation.

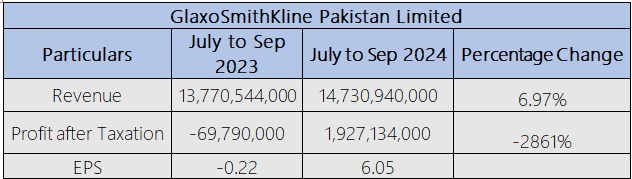

GlaxoSmithKline Pakistan Limited

GlaxoSmithKline Pakistan Limited achieved a notable financial recovery from July to September 2024, with the revenue rising by 6.97% to Rs14.73 billion. This growth is likely due to the strategic initiatives, new product launches, and increased engagement with the healthcare professionals (HCPs), as well as the use of digital channels and price adjustments over the previous year.

The company's profit after tax surged by 2861% to Rs1.9 billion compared to the net loss of Rs69.7 million. Additionally, the earnings per share (EPS) improved significantly, moving from a loss per share of Rs0.22 in the previous year to a solid Rs6.05 EPS in July-Sep 24. This impressive increase in profitability was supported by the higher formulation sales, lower material costs through the use of in-house API for production, well-managed financial expenses, and reduced electricity costs from a shift to solar energy.

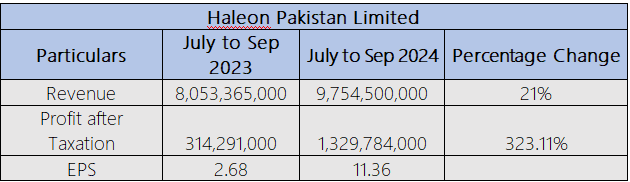

Haleon Pakistan Limited

Haleon Pakistan Limited saw a remarkable financial growth from July to September 2024, with the revenue rising by 21% to Rs9.7 billion. This increase was driven by growth in the toll manufacturing segment, along with successful marketing strategies and consistent access to innovative products for the consumers.

The profit after tax grew by 323.11%, reaching Rs1.33 billion, which reflects strong cost management and operational efficiency. The earnings per share (EPS) rose significantly, from Rs2.68 to Rs11.36, marking a substantial increase in shareholder value and promising further investment potential.

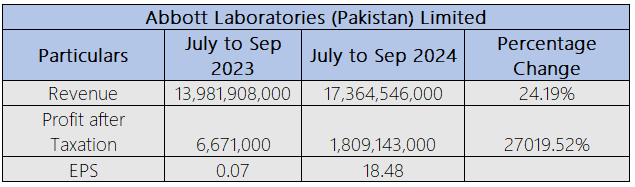

Abbott Laboratories (Pakistan) Limited

Abbott Laboratories (Pakistan) Limited reported an increase of 24.19% in revenue, rising from Rs13.9 billion to Rs17.3 billion between July and September 2024, driven by a 32% rise in pharmaceutical sales and a 12% rise in nutrition sales, both supported by price adjustments.

The company’s profit after tax surged by 27,019.52%, from Rs6.67 million to Rs1.81 billion, reflecting enhanced operational efficiency and effective cost management. The earnings per share (EPS) also saw a substantial improvement, increasing from Rs0.07 in the previous period to Rs18.48 in 2024, demonstrating a robust financial performance and boosting investor confidence in the company’s future outlook.

Future Outlook

The pharmaceutical sector is actively pursuing growth through capacity expansion, strategic acquisitions, and market diversification while navigating significant challenges such as inflation, regulatory constraints, and rising production costs. The companies are focusing on efficiency, innovation, and cost containment, supported by new initiatives like local biosimilar production, increased manufacturing capabilities, and efforts to stabilize raw material sourcing.

The recent regulatory changes, including deregulation of non-essential drug prices, aim to boost profitability and market competition, though reliance on imported ingredients and slow payment recoveries from government institutions remain obstacles. The industry players are optimistic about economic reforms, monetary easing, and supportive policies, which they believe will foster a stable, investment-friendly environment to sustain long-term growth and contribute to national healthcare advancements.

Credit: INP-WealthPk