INP-WealthPk

Hifsa Raja

Pasha Securities (Private) Limited was incorporated in Pakistan on March 15, 2006, under the Companies Ordinance, 1984. The company is housed in the Islamabad Stock Exchange tower.

Omer Iqbal Pasha, who is one of the directors of the company, has also remained the treasurer/vice-chairman and chairman of the Islamabad Stock Exchange.

WealthPK interviewed the company’s Equity Manager Muhammad Shahid to know his take on different aspects of the equity market, exchange rate volatility and other issues.

Q: What are the reasons behind fluctuations in the exchange rate, how it affects your company, and what steps are being taken to neutralise its effects?

A: Fluctuations in the exchange rate are also called currency risk, which impacts changes in a financial instrument's fair value or future cash flows. Currency risk arises mainly from future commercial transactions or receivables and payables that exist due to transactions in foreign currencies. The company is not exposed to this risk because it has no financial instruments in foreign currencies.

Q: How increasing exposure to changes in the economic and political environment may impact your business and how you are facing them?

A: Pasha Securities Private Limited keeps modifying its capital structure in conjunction with shifting economic conditions. The company may change the dividend distribution to shareholders or issue additional shares in order to maintain or modify the capital structure. The management aims to maintain a balance. Future events and economic situations are predicted because of the forward-looking information of the company. Through macroeconomic data, one can predict economic conditions.

Q: What strategy do you adopt for the risk management of the company? What are the kinds of risks your company is exposed to and how you are planning to do risk management?

A: Due to its operations, the company is prone to a number of financial risks, including credit risk, liquidity risk, and market risk, which includes currency risk, other pricing risks, and interest rate risk. The entire risk management strategy of the company concentrates on the unpredictability of the financial markets and aims to reduce any potential negative effects on the company's financial performance and maximise return to shareholders. The company's finance department does risk management under the policies approved by the Board of Directors.

Q: How is the company managing the price and liquidity risks?

A: Due to changes in fair value, the company's investment of Rs1.7 million in listed shares is subject to price risk. The risk that a business will face while fulfilling its financial liability-related obligations is known as liquidity risk. The company controls its liquidity risk by keeping enough cash and bank reserves. The company had bank balances of Rs20.5 million as of June 30, 2020.

Q: What are contingent liabilities? Is your company facing any contingent liability currently?

A: A contingent liability occurs when a company has a possible obligation as a result of past events. Contingent liability will be confirmed only by the occurrence or non-occurrence, of one or more uncertain future events. There were no contingencies or commitments of the company as of June 30, 2021.

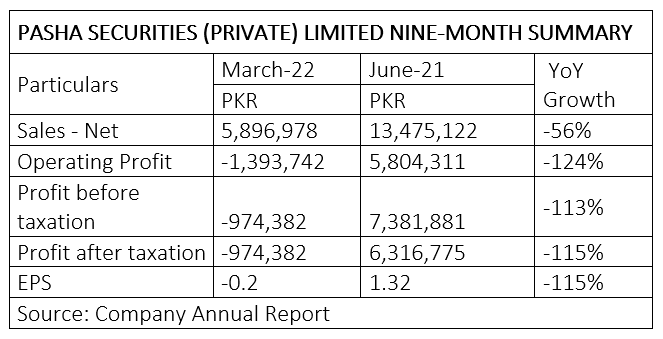

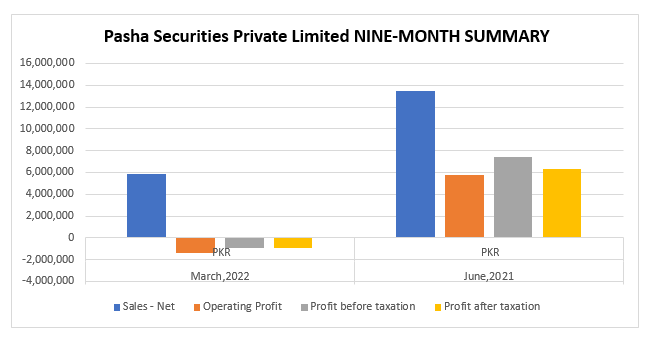

Company’s performance in 9MFY22

Pasha Securities Private Limited’s net sales declined 56% to Rs5.89 million in the first nine months of the previous fiscal year 2021-22 (9MFY22) from Rs13.47 million over the corresponding period of FY21.

The company suffered Rs1.39 million operating loss in 9MFY22 compared to Rs5.80 million operating profit over the same period of FY21, posting 124% decline year-on-year.

The before-tax profit decreased 113% to Rs974,000 in 9MFY22 from Rs7.38 million profit in 9MFY21.

The profit-after-tax also declined 115% to Rs974,000 in 9MFY22 from Rs6.31 million profit in 9MFY21.

Earnings per share (EPS) stood at minus Rs0.2 in 9MFY22 compared to Rs1.32 over the same period in FY21.

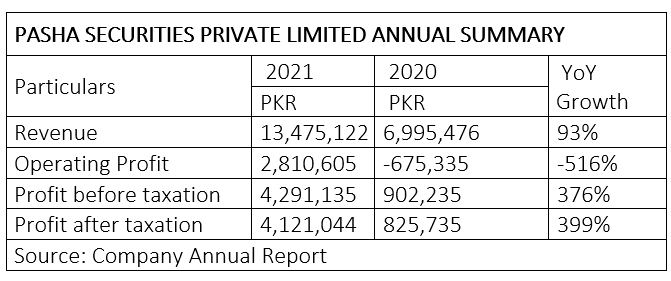

Performance in FY21

During the fiscal year 2020-21, the company generated revenue of Rs13.47 million over Rs6.99 million in 2019-20, registering an increase of 93%.

The operating profit for FY21 was Rs2.81 million, registering a 516% decrease from a loss of Rs675,000 in FY20.

Profit-before-tax for FY21 was Rs4.29 million compared to Rs902,000 in FY20, showing an increase of 376%.

Similarly, profit-after-tax for FY21 was Rs4.12 million as compared to Rs825,735 in FY21, showing a growth of 399%.

Credit : Independent News Pakistan-WealthPk