INP-WealthPk

By Ayesha Mudassar

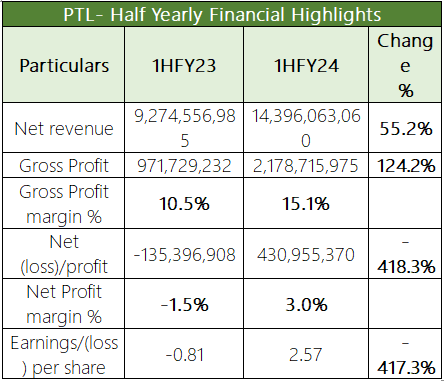

Panther Tyres Limited (PTL) posted a decent revenue growth, as its sales surged by 55% to Rs14.3 billion during the six months of the ongoing fiscal year (6MFY24), compared to Rs9.2 billion in the corresponding period of the previous fiscal year, reports WealthPK. The company's revenue growth momentum primarily resulted from an increase in the sales volume and cost-push price adjustments in all categories, including OEM, exports, and the replacement market. According to the results, the company's gross profit grew by 124.2% to Rs2.1 billion in 6MFY24 from Rs971 million during 6MFY23, signifying the company's efforts to manage costs and enhance operational efficiencies. Furthermore, the company earned a net profit of Rs430 million compared to a net loss of Rs135 million during 6MFY23.

The earnings per share (EPS) increased to Rs2.57 in 6MFY24, indicating a rise in the company's profitability. The selling and distribution expenses increased from Rs400 million to Rs696 million due to the higher marketing and branding spending, which will support the company in achieving its ambitious plans. The financial costs for the six months experienced a significant increase, rising from Rs549 million to Rs638 million. Implementing fiscal discipline is necessary to help the company stop escalating finance costs and achieve efficiency across all operations. On the tax front, the company paid a higher tax of Rs187 million against Rs28 million paid in the corresponding period of last year. During the half-year under review, the company struggled with notable changes characterized by consistent inflationary pressures, and uncertainty on both economic and political fronts. However, the company remains committed to leveraging its diverse product portfolio and implementing cost rationalization efforts to minimize adverse impacts and deliver sustainable results.

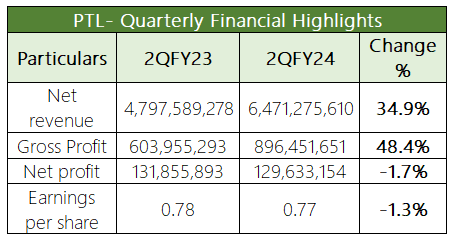

PTL- Quarterly Analysis

In comparison to the second quarter of FY23, Panther Tyres increased its revenues from Rs4.7 billion in 2QFY23 to Rs6.4 billion in 2QFY24, representing a notable growth of 34.9%. In addition, the company's gross profit of Rs603 million in 2QFY23 increased significantly by 48.4% to Rs896 million in 2QFY24.

However, the net profit decreased by 1.7% during 2QFY24, compared to the corresponding period of FY23.

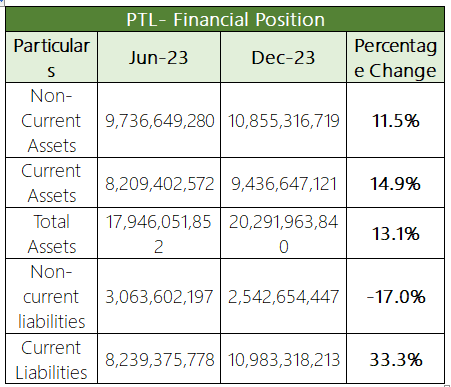

Company's financial position as of December 31, 2023

The company's financial position showed a growth of 11.5% in its non-current assets during the six-month period ending December 31, 2023, compared to 1HFY23. This rise indicates the company's investment towards enhancing production capacity and overall operations. Moreover, the current assets rose by Rs14.9% to Rs9.4 billion in 1HFY24 from Rs8.2 billion in 1HFY23. This was the result of a 51% rise in cash balance and 26% in stock in trade.

During 6MFY24, the non-current liabilities witnessed a decline of 17% compared to 6MFY23. This reduction shows that the company pays long-term liabilities during the period. In contrast, the current liabilities increased by 33.3% to Rs10.9 billion in 6MFY24 compared to Rs8.2 billion in 6MFY23.

Company Profit and Future Outlook

Panther Tyres Limited, established in Pakistan in 1983, is one of the leading manufacturers and suppliers of auto tyres, tubes, lubricants, and spare parts. The company is the top supplier of motorcycle tyres for both the regional equipment manufacturers and replacement markets. The company is likely to face headwinds in the coming times due to the worsened economic conditions and political uncertainty in the country. At the global level, a reduction in the prices of raw materials (natural rubber, butyl, carbon) is being witnessed, which will help partially offset the adverse impact of rupee-dollar parity. The company's management is aware of these challenges and is engaged in devising strategies to successfully address them.

Credit: INP-WealthPk