INP-WealthPk

Shams ul Nisa

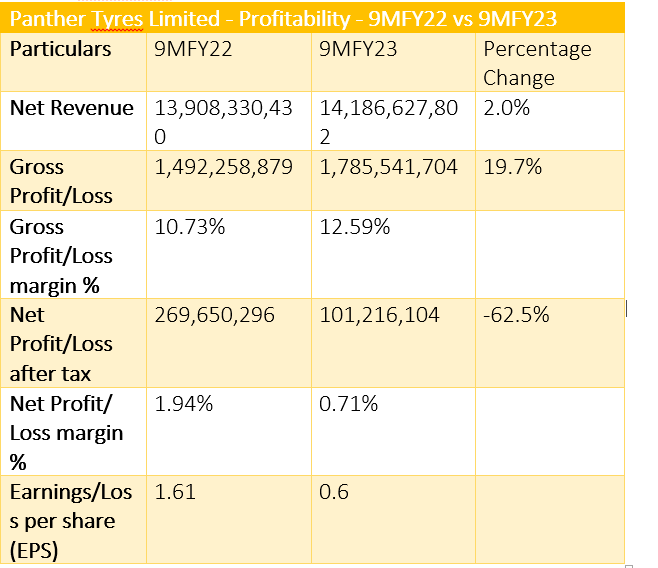

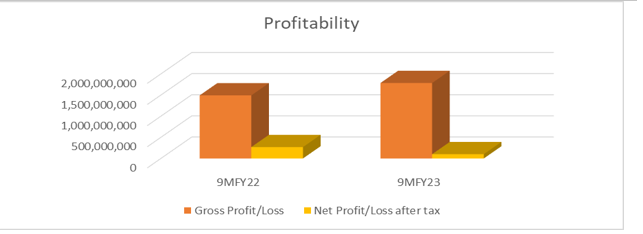

Though Panther Tyres Limited (PTL) posted a 19.7% growth in gross profit in the first nine months of the previous financial year 2022-23, the company’s net profit plunged 62% during this period as compared to the corresponding months of the year earlier, reports WealthPK.

The tyre maker’s revenue inched up 2% to Rs14.1 billion in 9MFY23 from Rs13.9 billion in 9MFY22. This was attributed to the company’s better planning and tight control over production costs despite the rise in inflation.

The gross profit posted a 19.7% growth to reach Rs1.7 billion in 9MFY23 from Rs1.4 billion in 9MFY22.

The net profit plunged to Rs101.2 million in 9MFY23 from Rs269.6 million in 9MFY22, marking a negative growth of 62.5%.

The gross profit ratio stood at 12.59% in 9MFY23 compared to 10.73% in 9MFY22. Whereas the net profit ratio fell to 0.71% in 9MFY23 from 1.94% in 9MFY22. Similarly, the company’s earnings per share (EPS) dropped to Rs0.6 in 9MFY23 from Rs1.61 over the corresponding period of last year.

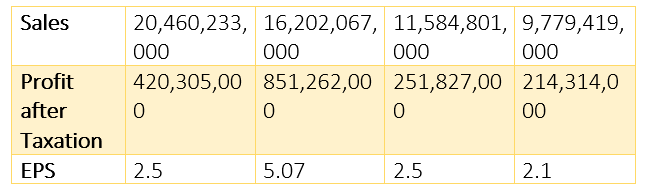

Analysis of last four years financials

The Panther Tyres Limited has shown a gradual increase in the sales from FY19 to FY22. This increase can be attributed to the company’s well-defined production policy and regular investment in sales and brand promotional activities. The company posted the highest profit in FY21 at Rs851 million, which plunged to Rs420.3 million in FY22. The company recorded its highest EPS of Rs5.07 in FY21, but it declined to Rs2.5 in FY22.

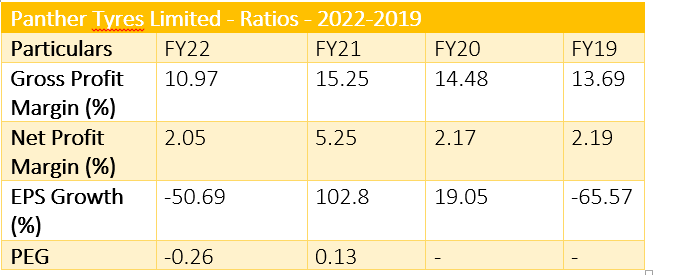

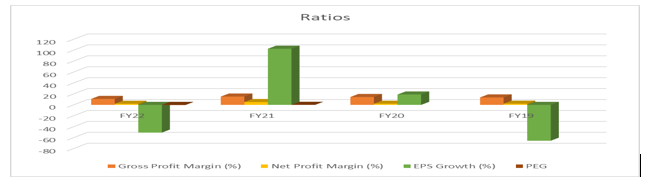

Analysis of last four years ratios

The company posted the highest gross profit margin of 15.25% in FY21 and the lowest in FY22 at 10.97%.

The net profit margin was also the highest at 5.25% in FY21 and the lowest at 2.05% in FY22.

The company witnessed a negative 50.69% and 65.57% EPS growth in FY22 and FY19. A positive EPS growth of 102.8% and 19.05% was observed in FY21 and FY20. Similarly, the price/earnings to growth ratio was -0.26 in FY22 and 0.13 in FY21.

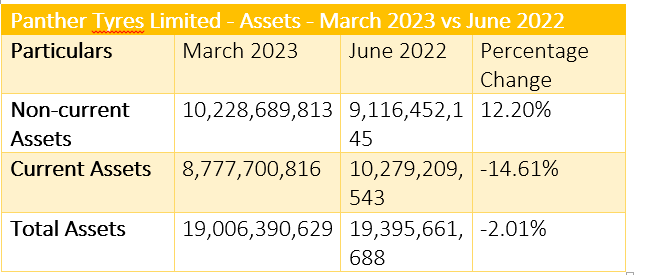

Total assets analysis

The company’s non-current assets were Rs10.2 billion in March 2023 compared to Rs9.1 billion in June 2022, posting a growth of 12.20%.

Whereas, the current assets posted a negative growth of 14.61%, falling form Rs10.2 billion in June 2022 to Rs8.7 billion in March 2023.

Overall, the assets experienced a negative growth of 2.01% as the total assets fell to Rs19 billion in March 2023 from Rs19.3 billion in June 2022.

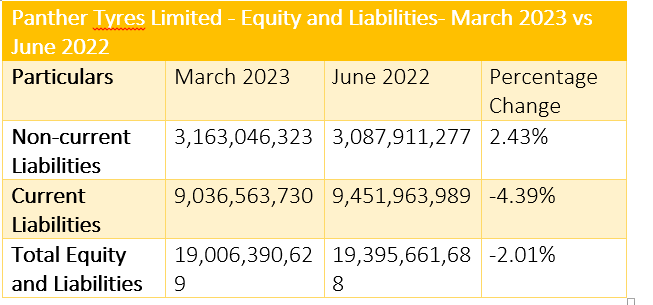

Total equity and liabilities analysis

The company’s non-current liabilities increased by 2.43%, while the current and total equity and liabilities dropped by 4.39% and 2.01% respectively during the period under review. In March 2023, the non-current liabilities increased to Rs3.1 billion from Rs3 billion in June 2022. The current liabilities fell to Rs9 billion in March 2023 from Rs9.4 billion in June 2022. Similarly, the total equity and liabilities dipped to Rs19 billion in March 2023 from Rs19.3 billion in June 2022.

Company profile

Founded in 1983, Panther Tyres Limited is one of the leading manufacturers and suppliers of tyres, tubes for vehicles, lubricants and spare parts in Pakistan. The company is the leading maker of motorcycle tyres for both the original equipment manufacturer and replacement markets. It is the first company that manufactures a wide range of products locally.

The company has established an excellent reputation among a diverse customer base by offering a wide range of products, superior quality, after-sale service and competitive prices. Moreover, the company has expanded its market presence by exporting its products to various regions, including Asia, the Middle East, Africa and Europe.

Credit: INP-WealthPk