INP-WealthPk

Muhammad Asad Tahir Bhawana

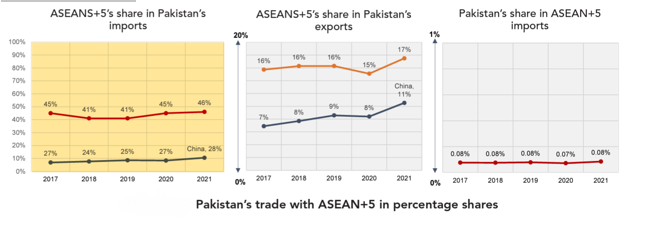

Pakistan’s trade with the ASEAN+5 countries is very small, especially in terms of exports, which have always been less than 0.1% of the total. On the other hand, ASEAN+5, particularly China, is a significant supplier of goods to Pakistan. China alone accounted for 28% of Pakistan's imports from the region in 2021. While Pakistan's product portfolio is not highly influential for ASEAN+5, the region plays a crucial role in Pakistan's exports and imports, with ASEAN+5's share in Pakistan's total exports standing at 17% in 2021, out of which 11% is absorbed by China. According to a recent study by Pakistan Business Council (PBC), to enhance trade integration, Pakistan has engaged in various trade agreements within the region. Notably, it has an operational Free Trade Agreement (FTA) with China, which is currently in its second phase.

Pakistan has also signed the Malaysia-Pakistan Closer Economic Partnership Agreement, which acts as an FTA, and has a Preferential Trade Agreement (PTA) with Indonesia. Furthermore, Pakistan is eligible for the Generalised System of Preferences (GSP) programmes of several Regional Comprehensive Economic Partnership (RCEP) countries such as Japan, New Zealand, and Australia, allowing eligible products to enjoy zero duties. When comparing the growth patterns of Pakistan's exports, it becomes evident that its exports to the ASEAN bloc and ASEAN+5 members have shown comparable or higher growth rates than exports to the rest of the world. Over a five-year period, Pakistan's exports to ASEAN+5 achieved a Compound Annual Growth Rate (CAGR) of 8%, surpassing the 6% CAGR for exports to the EU bloc, where Pakistani goods receive preferential treatment through the GSP plus programme. China and Malaysia emerge as significant target markets for Pakistan, with remarkable CAGR figures of 15% and 24%, respectively.

However, despite the growth in exports to ASEAN+5, market diversification has been limited, and Pakistan heavily relies on China for its trade within the region. Among the ASEAN+5 countries, Pakistan's exports are concentrated in traditional products such as cotton yarn, apparel, fabrics and various agricultural produce. Nonetheless, some new products, including copper, aluminium alloys, sesame seeds, maize, onions, dried peaches, frozen fish, and others, have gained traction in recent years. Remarkably, in 46 out of the top 100 products exported to ASEAN+5, Pakistan's Revealed Comparative Advantage (RCA) is higher than all RCEP member countries, including Bangladesh, which is a potential RCEP contender.

These products account for 46% of the total export value in dollars. In summary, Pakistan's trade with ASEAN+5 countries has shown growth, with China being a key partner in both imports and exports. Market diversification has been limited, and efforts to tap into other ASEAN+5 markets are essential. Some new product lines have gained prominence, indicating opportunities for market scoping within RCEP. By leveraging its comparative advantages and exploring potential partnerships within the ASEAN+5 region, Pakistan can position itself for deeper integration with RCEP.

Credit: INP-WealthPk