INP-WealthPk

Ayesha Saba

The launch of initiatives like Pakistan Startup Fund (PSF) aim to attract investment and nurture entrepreneurship in the country’s fintech and e-commerce sectors to accelerate economic growth. With government support and global interest, the nation's fintech and e-commerce sectors promise sustained growth and global competitiveness. Asfandyar Khan, Director General of Information Technology, Ministry of Information Technology and Telecommunication, told WealthPK that over the past few years, Pakistan's economy had faced numerous challenges on multiple fronts, ranging from escalating inflation and the impacts of the Covid-19 pandemic to inflated energy costs and disruptions in the supply chain. “Amidst the prevailing economic uncertainty, the startup landscape emerges as both a beacon of hope and a sector in need of strategic support.”

He said that the pioneering PSF initiative was meant to catalyse venture investments within the country and position Pakistani startups as significant global players. “The government has announced an annual allocation of up to Rs2 billion for the PSF,” he added. “PSF is structured to mitigate the perceived risks that international investors may associate with investing in Pakistani startups. By offering support and incentives through PSF such as grants and other forms of assistance, the initiative aims to make the Pakistani startup ecosystem more attractive and accessible to foreign investors,” he said. Asfandyar pointed out that majority of investment inflow into the tech industry heavily favoured fintech and e-commerce. “The fintech sector in Pakistan has been gaining traction, driven by factors such as increasing smartphone penetration, a large unbanked population and government initiatives to promote digital financial services.

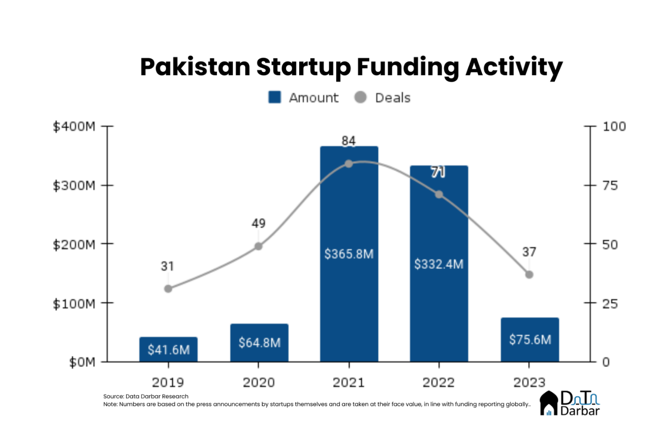

Startups focusing on digital payments, peer-to-peer lending, and blockchain-based solutions are likely to continue growing in 2024,” he said. He stressed that the present youth bulge could help catalyse digital adoption and, subsequently, economic growth. In 2023, Pakistan's startups only managed to attract a modest $75.6 million, according to data released by Data Darbar. This reflects a 77.2% year-on-year decline from the last year. Over half of the funds were raised in Q4 of 2023, with 15 investments totalling $38.6 million. E-commerce received the most funds, totalling $23.95 million. Moreover, 2023 was the best year for women-founded startups, attracting $10.5 million in funding. This increased their percentage of total investment to 13.9%, significantly higher than the average of 1.34% from 2019 to 2022.

Credit: INP-WealthPk