INP-WealthPk

Moaaz Manzoor

The surge in remittances has brought the much-needed relief for Pakistan's economy that has faced numerous challenges over the past year, from the rising inflation to the dwindling foreign reserves and mounting debt, reports WealthPK.

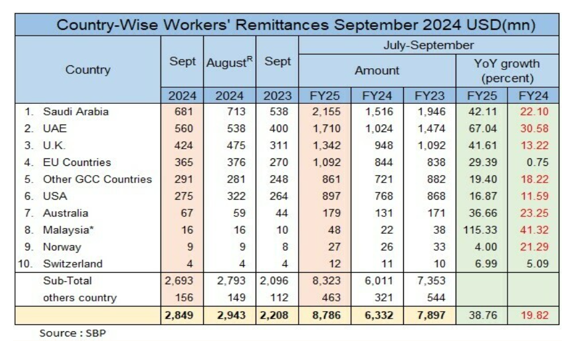

According to the State Bank of Pakistan (SBP), remittances surged by 39 percent during the first quarter of 2024 (July to September) compared to the same period last year, offering a glimmer of hope for the country's struggling economy.

Source:https://www.sbp.org.pk/ecodata/homeremit.pdf

One of the key factors behind this increase is the growing number of Pakistanis seeking work abroad. Facing economic hardship at home, many have emigrated in search of better prospects. There was a notable 26.6% rise in the emigration of highly qualified professionals between 2022 and 2023. While this exodus raises concerns over the loss of talent, it has significantly contributed to higher remittance inflows, as overseas Pakistanis send money back home to support their families. Talking to WealthPK, Dr. Junaid Ahmed, Senior Research Economist at the Pakistan Institute of Development Economics (PIDE), highlighted the role of the narrowing gap between the open market and interbank exchange rates in boosting the formal remittance inflows. "With a lower gap between the official and black-market rates, the migrants are now using formal channels more frequently to send money back home," he explained.

This shift is critical, as Pakistan previously lost nearly $3.7 billion annually to informal channels like hawala due to the large exchange rate disparity. Dr. Ahmed also emphasized the importance of temporary migrants in the Middle East, particularly in countries like Saudi Arabia and Qatar, where a significant portion of remittances originate. "These migrants are now using formal banking channels, encouraged by the government incentives for banks and exchange companies," he said. The SBP has introduced new incentives, offering both fixed and variable components to the banks and exchange companies to further encourage remittance flows through legal means. However, while the rise in remittances provides some relief, Dr. Ahmed cautions against over-reliance on this source of income. "The high level of emigration represents a significant loss of human capital," he said.

"The government must focus on creating a conducive environment for growth in the country by undertaking structural macroeconomic reforms." He pointed out that without addressing the root causes of emigration, such as limited economic opportunities and high inflation, the country risks losing valuable talent while relying on temporary financial relief from remittances. Despite these concerns, the surge in remittances has provided the much-needed cushion for economy, boosting foreign reserves and easing some financial pressures. But experts agree that remittances alone cannot solve the country's deep-seated economic problems. Structural reforms are necessary to build a more sustainable and resilient economic future for Pakistan.

Credit: INP-WealthPk