INP-WealthPk

Ayesha Mudassar

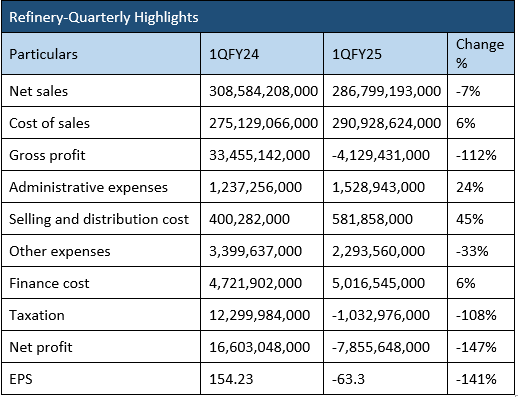

Pakistan’s refinery sector reported a net loss of Rs7.8 billion in the first quarter of the ongoing fiscal year 2024-25, marking a remarkable deterioration from the net profit of Rs16.6 billion recorded in the corresponding period of the last fiscal, according to WealthPK.

The sector’s net loss was primarily attributed to depressed global refining margins, driven by a sharp decline in crude oil and petroleum product prices. Additionally, nationwide demand for refined petroleum products, particularly diesel and furnace oil, experienced a volumetric decrease compared to the same quarter of the previous year.

Key companies within the sector include Cnergyico PK Limited (CNERGY), Pakistan Refinery Limited (PRL), National Refinery Limited (NRL) and Attock Refinery Limited (ATRL).As per the results available with WealthPK, the sector’s revenue declined by 7% year-on-year (YoY) to Rs286.7 billion, down from Rs308.5 billion in the first quarter of FY24. However, the cost of sales rose by 6% YoY, totalling Rs290.9 billion compared to Rs275.1 billion in 1QFY24. This resulted in a gross loss of Rs4.1 billion in FY24, a significant downturn from the prior year. On the expense side, selling and distribution costs grew by 45% YoY, while other expenses decreased by 33%. Moreover, the industry’s finance cost increased by 6% YoY to Rs5.01 billion from Rs4.7 billion in 1QFY24. On the tax front, the sector paid substantially lower taxes, worth Rs1.03 billion, compared to Rs12.2 billion paid during the corresponding period of last year, posting a 108% YoY decline.

Companies’ analysis

CNERGY

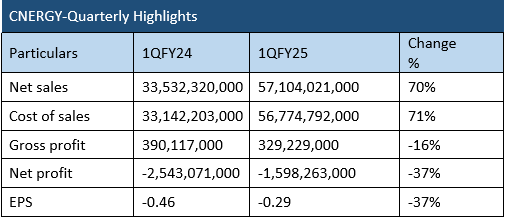

CNERGY recorded a net loss of Rs1.5 billion for the first quarter of FY25, showing a notable improvement from a net loss of Rs2.5 billion in the same period of FY24.

The company’s revenue rose 70% YoY to Rs57.1 billion, up from Rs33.5 billion in 1QFY24. Similarly, the cost of sales grew by 71% YoY, totalling Rs56.7 billion compared to Rs33.1 billion in 1QFY24. This translated into a gross profit of Rs329.2 million in 1QFY25, reflecting a 16% decline from the corresponding period of the previous year.

PRL

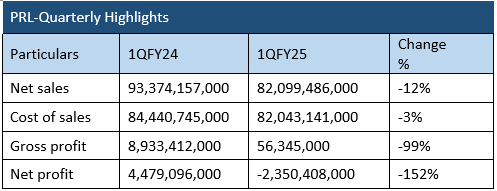

PRL posted a decline in both revenue and profit for 1QFY25 as its net sales fell to Rs82.09 billion, down 12% from Rs93.3 billion in 1QFY24. The reduction in revenue was primarily driven by lower petroleum product prices and record low production of high-speed diesel and motor gasoline.

![]()

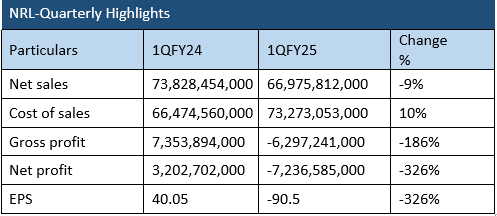

NRL

NRL incurred a net loss of Rs7.2 billion for 1QFY25 compared to a profit of Rs3.2 billion in the same period last year. The significant loss was primarily attributed to escalating operating costs, particularly driven by higher selling and distribution expenses as well as increased finance costs.

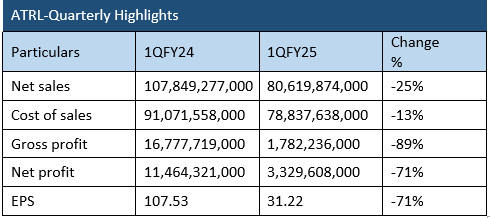

ATRL

ATRL, a subsidiary of Attock Oil Company Limited, experienced a 71% decline in its earnings for 1QFY25, with net profit dropping to Rs3.3 billion from Rs11.4 billion in 1QFY24.

The company’s revenue also decreased by 25% YoY totalling Rs80.6 billion compared to Rs107.8 billion in 1QFY24. Additionally, the elevated cost of sales led to an 89% reduction in gross profit for the quarter.

Credit: INP-WealthPk