INP-WealthPk

Abdul Ghani

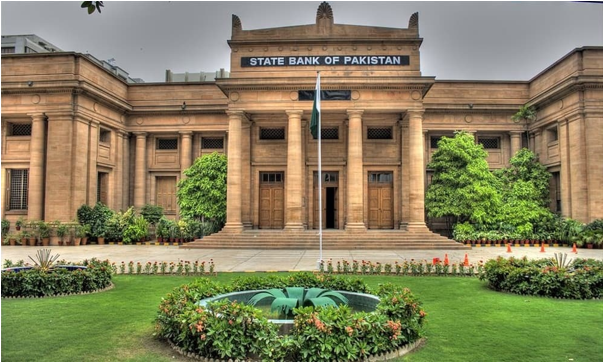

Pakistan’s monetary environment remained broadly stable during the opening months of FY2026, with the State Bank of Pakistan (SBP) maintaining the policy rate at 11 percent in its October review, while liquidity indicators showed restrained growth. However, investor sentiment in the equity market weakened during the same period, leading to a sharp decline in the benchmark index.

According to the Monthly Economic Update and Outlook for November 2025, the Monetary Policy Committee continued its cautious approach in October, leaving the rate unchanged “to support the price stability outlook” as the economy navigates global uncertainties, commodity price risks and domestic supply-side pressures. The rate has remained at 11 percent since June.

Monetary aggregates reflected tight conditions consistent with fiscal consolidation. Between 1 July and 31 October, money supply (M2) contracted by 1 percent, a smaller drawdown compared to the 1.7 percent contraction recorded last year. Net foreign assets of the banking system increased by Rs204.5 billion, while net domestic assets fell by Rs605 billion, showing continued restraint in domestic liquidity.

Government borrowing patterns also reflected disciplined financial management. During the same period, the government retired Rs1,078.4 billion in borrowing for budgetary support, following a larger retirement of Rs1,432.4 billion during the corresponding months of last year. In contrast, private sector borrowing remained muted, with businesses accessing only Rs66.1 billion in additional credit, compared to Rs806.3 billion in the previous year. Analysts attribute this slowdown to cautious investment behaviour and subdued working capital needs in several sectors.

While monetary indicators remained steady, financial markets experienced a downturn. The report shows that the Pakistan Stock Exchange (PSX) witnessed a significant correction in October, with the KSE-100 Index falling by 3,862 points, closing the month at 161,631. The decline wiped out Rs702 billion in market capitalisation, reducing it to Rs18.56 trillion by month-end. Market experts link the bearish trend to global volatility, profit-taking and investor caution over external financing flows.

Despite the market dip, the broader economic environment continues to show gradual stabilisation. Improved industrial activity, higher remittances and a firm revenue performance have supported overall confidence. The report notes that “economic performance has improved on the basis of favourable high-frequency indicators,” supported by reforms and relatively lower-than-expected flood-related disruptions.

However, risks remain, particularly from global oil price fluctuations, evolving tariff environments and potential food supply friction linked to agricultural losses. These factors will continue to influence the monetary and inflation outlook over the coming months.

For now, with inflation contained within manageable levels and liquidity under control, monetary conditions remain stable. Policymakers are expected to continue balancing growth and stability considerations as they prepare for upcoming reviews in an evolving economic landscape.

Credit: INP-WealthPk