INP-WealthPk

Uzair bin Farid

Pakistan’s contingent liabilities decreased by 60% as a percentage of gross domestic product (GDP) from July-March FY22 to July-March FY23. According to Pakistan Economic Survey 2022-23, contingent liabilities are sovereign guarantees that the government issues against the loans or projects undertaken by the public sector enterprises (PSEs).

The purpose of taking on such loans is to ensure the creditworthiness of public sector enterprises involved in projects and operations with significant social and economic benefits for the country. In FY23, the Government of Pakistan overtook guarantees to the tune of Rs177 billion, which amounts to 0.2% of GDP.

As compared to FY23, the government undertook sovereign guarantees worth Rs344 billion during July-March period of FY22, which amounted to 0.5% of GDP. According to the Fiscal Responsibility and Debt Limitation (Amendment) Act, 2005, the government is not allowed to exceed the limit of 2% of GDP in giving new sovereign guarantees in a single fiscal year. Also, the total stock of outstanding government guarantees cannot exceed the limit of 10% of GDP.

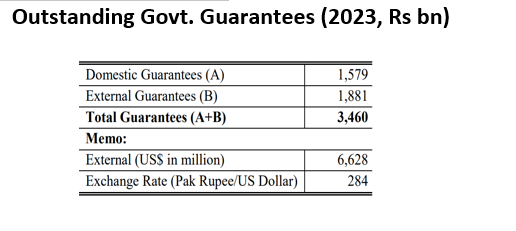

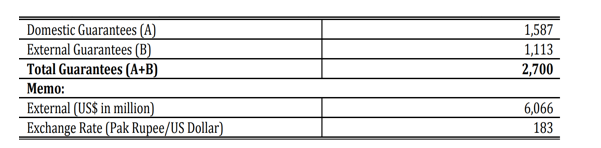

In FY23, the government had Rs3.490 trillion worth of outstanding government liabilities. Of these, total domestic guarantees by the government were to the tune of Rs1.579 trillion, and total external guarantees were to the tune of Rs1.881 trillion. Similarly, in the first nine months of FY22, the total outstanding government guarantees amounted to Rs2.7 trillion. Of these sovereign guarantees, domestic guarantees amounted to Rs1.587 trillion and external guarantees amounted to Rs1.113 trillion.

Outstanding Govt. Guarantees (2022, Rs bn)

The decrease in the overall level of sovereign guarantees assumed by the government represents a decrease in the amount of liabilities owed by the government as a percentage of GDP. If some sovereign guarantees remain unfulfilled at the end of the fiscal year ending in June, those sovereign guarantees are rolled over into the debt profile of the next fiscal year as “new guarantees” and not existing.

This shows that the government has taken fewer sovereign guarantees over the past year, as the percentage share of contingent liabilities of the total GDP over the first nine months of FY23 has decreased by 60% compared to the contingent liabilities incurred by the government in the same period of FY22.

Since over the past year, the growth in GDP was only a meagre 0.3%, a fall in the amount of new sovereign guarantees owes its explanation to measures taken by the government to improve fiscal responsibility. Pakistan is already looking into a deteriorating debt profile for the coming fiscal year. In that context, the fall in contingent liabilities represents a silver lining.

Credit : Independent News Pakistan-WealthPk