INP-WealthPk

Uzair bin Farid

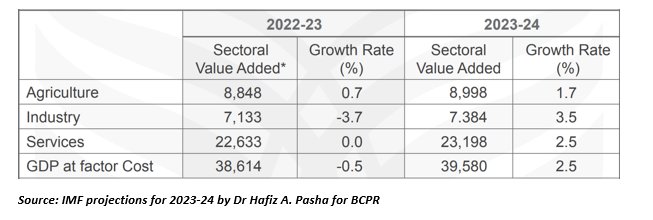

Pakistan’s industrial growth rate is projected to rise to 3.5% during the fiscal year 2023-24 after a -3.7% drop during FY23. According to the latest policy brief from the Beaconhouse National University’s Centre for Policy Research (BCPR), industrial growth of the country will move into the positive side during FY24. Industrial growth is expected to recover with the help of the new Stand-by Agreement (SBA) with the International Monetary Fund (IMF), where the government has pledged to liberalise the import regime.

Since Pakistan’s industrial sector is heavily dependent on imported raw materials, opening up the import channels will provide the necessary input for the industry to restart and regain its lost momentum. The services sector is also projected to pick up growth from the zero-growth level of FY23 to a growth level of 2.5% during FY24. The agricultural sector is projected to grow by 1 percentage point, from 0.7% in FY23 to 1.7% in FY24, showing a modest improvement.

Likely GDP growth rate by sector during FY24

Both public and private investment, which dropped by -18.5% in FY23, are expected to bounce back to a positive 6% growth in FY24. However, a 6% growth in investment will be lower than the levels of FY22 because of tight monetary policies maintained by the State Bank of Pakistan (SBP) to rein in inflation across the country. The policy brief by the BCPR has also raised concerns over the imminence of ‘severe stagflation’ during FY24. Since GDP (gross domestic product) is projected to grow by 2.5%, which is lower than the levels for a developing country, and since inflation will persist at 26%, and there will be high rate of unemployment with 0.7 million new people entering into the workforce, the poverty rate is expected to increase to 38%, which is very alarming.

Also, exports of goods are projected to grow at a rate of 14.7% over the previous fiscal year and imports of goods are expected to grow at 19.2%. However, the discrepancy in total exports and imports will persist. The total volume of goods exports will be $32 billion, whereas the total volume of imports is projected to be $62 billion over the whole course of FY24. This shows that imports will be almost twice as much as the exports of the country, posing a significant challenge for the government to finance its buying needs in the international markets. According to the policy brief, Pakistan’s economy faces ongoing challenges and the country will require a three-year Extended Fund Facility (EFF) from the IMF to finance its needs beyond the SBA period.

Credit: INP-WealthPk