INP-WealthPk

Ayesha Mudassar

Pakistan's economy experienced low growth during the outgoing fiscal year (2022-23) on account of numerous challenges originating from an uncertain domestic and external economic environment. These challenges triggered heightened inflation, massive currency depreciation, and a low investment-to-GDP (gross domestic product) ratio. However, the fiscal consolidation measures and import compression policies adopted by the government in recent months enable the economy to reduce fiscal and current account deficits.

The consumer price index (CPI) inflation was recorded at 36.4% on year-on-year (YoY) basis during April 2023 compared to 35.4% during the previous month, according to the Monthly Economic Update and Outlook for May 2023 issued by the Ministry of Finance. On average, the CPI inflation stood at 28.2% during the first 10 months (July-April) of the current fiscal year against 11% during the corresponding period of last year.

At a briefing to the Senate’s Committee on Finance, Ehsan Malik, Chief Executive Officer (CEO) of Pakistan Business Council (PBC), stated that flood damages, disruptions in supply chains, and high input costs were the main reasons for unprecedented inflation during the past few months. The Pakistani rupee, which was valued at 199.5 against the US dollar in May 2022, ended May 2023 at 285.8 rupees – a depreciation of 43%. Furthermore, the total investment-to-GDP ratio hit a record low of 13.5% during the first 10 months of FY23. President of the Lahore Chamber of Commerce and Industry, Kashif Anwar, during the committee meeting, attributed this decline to uncertain taxation policies, a gigantic reduction in profits and continuing political tensions.

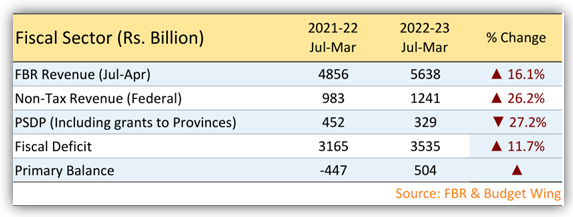

The monthly economic outlook illustrates a reduction in the budgetary deficit. It declined to 3.6% of GDP during July-March FY2023 from 3.9% last year. The total revenue of the government has shown an increase of 18.1% during July-March FY23 over the comparable period last year, while the total expenditures grew by 18.7% (mainly due to increased debt servicing). World Bank Senior Economist Ashraf Ghumman said at a recent seminar that fiscal consolidation measures -- revenue mobilisation and cutting down on unsustainable expenditures -- have resulted in a decline in non-interest expenditure and a build-up of surplus in primary balance.

The current account posted a surplus of $18 million during April 2023 against a deficit of $640 million during the same month last year. Overall, the current account displayed a deficit of $3.2 billion during 10MFY23 against a deficit of $13.6 billion during corresponding period of last year.

Talking to WealthPK, Dr Ashfaque Hassan, Dean National University of Science and Technology (NUST) Business School, said the implementation of an aggressive yet selective import compression policy proved an effective step in shrinking the country’s current account deficit. Similarly, the global economy has been experiencing stubborn inflation, tightened financing conditions, and deteriorating growth prospects. Global economic growth is expected to decline from 3.4% to 2.8% during 2023.

Credit: Independent News Pakistan-WealthPk