INP-WealthPk

Amir Khan

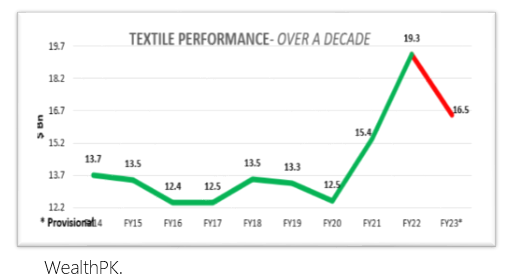

Pakistan's textile exports fell sharply by 15% or $2.8 billion in FY2023, and the decline continues in FY24. This steep decline warrants a thorough probe into the underlying causes, which include the rising energy cost, liquidity crisis, import restrictions, ineffective policy implementation, competition, and supply chain disruptions.Nadeem Maqbool, a member of All Pakistan Textile Mills Association (APTMA), said this while talking to

Source: Research Department of All Pakistan Textile Mills Association

“One of the main obstacles to the export sector is the flawed devaluation strategy used to boost exports. Pakistan's reliance on dollar-linked inputs and foreign markets makes it vulnerable to currency fluctuations, which has increased the cost of imported materials and reduced the profitability of exporters,” he said. “To offset this currency impact and meet the production demands, the industry needs twice as much working capital,” he pointed out. Nadeem said dearth of readily available capital and exorbitant interest rates, peaking at 22%, constrain borrowing and export expansion. This poses a considerable challenge for sustaining export levels in dollar terms. Delays in receiving the FBR refunds further limit liquidity, impeding investment and growth.

He explained that comprehensive implementation of these policies could have potentially led to an annual increase in textile exports ranging from 25% to 40%. Establishing policy stability and honoring contractual commitments are vital to restoring faith among the stakeholders, encouraging long-term investments, and unlocking the industry's export potential. Pakistan's exportable surplus predominantly lies in textiles, necessitating an increase in production capacity to further boost exports. He emphasized that the Textile Engineering Revival Fund (TERF) was introduced to meet this demand, resulting in the establishment of 100 new textile units, with approximately 50% currently operational.

“When fully operational, these units are expected to generate an additional exportable surplus ranging from $8-10 billion. These units, set up under TERF, rely on the state-of-the-art machinery to enhance sector efficiency. However, for these projects to thrive, competitive energy inputs are imperative,” he said. “Presently, more than $5 billion of installed capacity remains unutilized due to the non-provision of electricity and gas connections, jeopardizing the industry's global competitiveness,” he added.

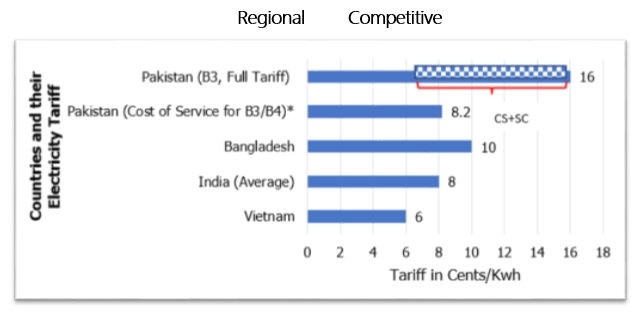

He highlighted that high energy costs had significantly elevated the operating expenses, rendering it challenging for the manufacturers to remain competitive. Discontinuation of Competitive Electricity Tariff (RCET) has dealt a severe blow to the export industry, impacting the balance of payments and economic outlook. Continuing, he said the export-oriented businesses were burdened by cross-subsidies and stranded costs within the power tariff structure, depriving them of essential support for competitiveness. To maintain the textile industry's global competitiveness, reliable and affordable energy sources are imperative, he added.

Energy Tariff

Source: National Electric Power Regulatory Authority

“Efforts to enhance tax collection in the textile industry should focus on curbing tax-evasion and underreporting, especially at the retail level. Comparing domestic sales to under-invoiced imports can help identify tax-evasion practices and increase revenue collection. Reforming sales tax collection and refund system is crucial to alleviating the burden of growing inventories and capital expenditures,” said the APTMA member. Nadeem said withdrawal of Zero-Rating (SRO 1125) and imposition of 18% GST on export-oriented sectors had posed substantial challenges to the industry.

“Restoring Zero Rating for the textile value chain, expediting the refund process, and collecting sales tax at the point of sale for domestic transactions are essential steps to alleviate the industry's financial burden and stimulate export growth,” he said. Collaboration between the industry stakeholders and government bodies, exemplified by organizations like the APTMA, plays a pivotal role in fostering innovation, investment attraction, and industry growth. Emphasizing collaboration and continued engagement with such organizations is essential for the sustainable development of Pakistan's textile sector. Concluding, he said, “By overcoming these challenges and implementing critical reforms, the textile sector can regain its competitive edge, boost economic growth, and contribute significantly to the nation's prosperity.”

Credit: INP-WealthPk