INP-WealthPk

Amir Khan

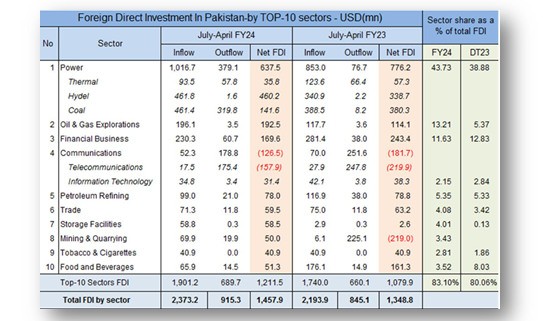

The amplification of foreign direct investment (FDI) in Pakistan, notably within the energy domain, has not only injected much-needed capital but also brought in advanced technology and expertise, facilitating infrastructure development and capacity expansion. Talking to WealthPK, Aslam Javed, Chief Economist at the Ministry of Planning, Development and Special Initiatives, stated that the power sector maintained its position as the primary recipient of FDI, albeit experiencing a decline in absolute value in the ongoing fiscal year (FY24) compared to the previous year. “Meanwhile, sectors such as telecom/IT and financial businesses witnessed diminishing net flows, further exacerbating the challenge of broadening the investment base,” he added. Furthermore, he said FDI trends over recent years revealed a pattern of stagnation, with net flows remaining modest and concentrated within selected sectors and countries.

“Notably, China continues to dominate Pakistan's FDI, with investments primarily focused on the power sector, particularly during the initial phases of the China-Pakistan Economic Corridor (CPEC).” Aslam explained that FDI in the energy sector helped address chronic energy shortages, improved efficiency, and enhanced the reliability of energy supply, which are essential prerequisites for sustainable economic growth. “Moreover, FDI in the energy sector contributes to job creation, skill development, and the overall modernization of the energy infrastructure, positioning the country for long-term competitiveness in the global market. Therefore, fostering a conducive environment for FDI in the energy sector is imperative for Pakistan to meet its growing energy demands, drive economic development, and ensure energy security,” he pointed out.A recent data report of the State Bank of Pakistan (SBP) shows

that FDI increased in April 2024, with net inflows of $359 million.

Source: State Bank of Pakistan

Although FDI in FY24 exhibited a marginal increase of 8.1% year-on-year, reaching a total of $1.46 billion, the concentration of investments from the Chinese mainland and Hong Kong remained pronounced. Together, the investments accounted for half of the total FDI during the period, underscoring the limited diversification in Pakistan's investment portfolio. The persisting uncertainties, both political and economic, coupled with the constrained FDI, continue to undermine investor confidence in Pakistan. Without significant reforms to address the structural impediments and diversify the investment base, the nation risks falling short of its economic aspirations despite incremental gains in FDI.

Credit: INP-WealthPk