INP-WealthPk

Ayesha Mudassar

Pakistan experienced low growth in the last fiscal year 2022-23 due to the uncertain domestic and external economic environment. However, the fiscal consolidation measures and import compression policies adopted by the government in FY23 helped reduce fiscal and current account deficits. Inflation measured by the Consumer Price Index was recorded at 29.4% on a year-on-year basis in June 2023 as compared to 21.3% in June 2022, according to the monthly Economic Update and Outlook for July 2023. On average, CPI inflation stood at 29.2% during FY23 as against 12.2% in FY22. Kashif Anwar, President of Lahore Chamber of Commerce and Industry, said that flood damages, disruptions in supply chains and high input costs were the potential reasons for the decades-high inflation in the past few months.

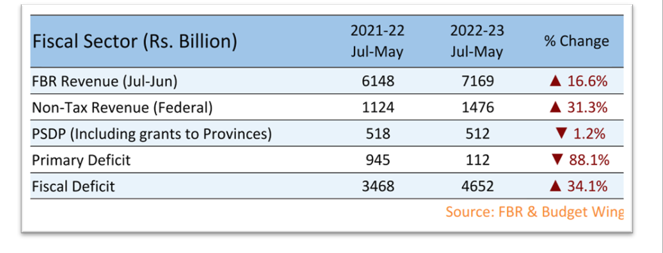

Furthermore, the Foreign Direct Investment (FDI) declined by 25% to $1.456 billion during FY23 from $1.936 billion during FY22. Asim Saeed, Member of the Planning Commission of Pakistan, attributed this decline primarily to the restrictions on the outbound repatriation of profits. He said the gigantic decline in profits and dividends had discouraged foreign investors, and it might take years to restore their confidence. “Besides, persistent political unrest and economic mismanagement, particularly the massive rupee devaluation, have discouraged foreign investors,” Asim pointed out. The fiscal front, however, has witnessed an important improvement, with the primary deficit reducing significantly from Rs945.3 billion in FY22 to Rs112 billion in FY23.

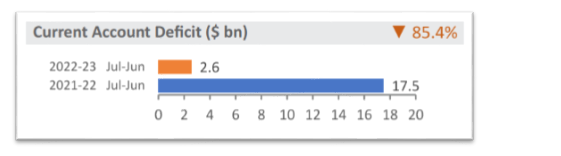

Fiscal consolidation measures like revenue mobilisation and cutting down on unsustainable expenditures have resulted in a decline in non-interest expenditure and a build-up of surplus in primary balance, said World Bank Senior Economist Ashraf Ghumman. He said the current fiscal performance indicates that despite a challenging economic environment, fiscal consolidation efforts are on track. Moreover, it is anticipated that the coming months would see a considerable decline in the fiscal deficit. In addition, the current account deficit also declined by 85.4% in FY23 as compared to FY22. The current account posted a deficit of $2.6 billion for FY23, a major reduction from the previous year's massive deficit of $17.5 billion.

As a result, the current account improved, resulting in a surplus of $334 million in June 2023. Talking to WealthPK, Dr Ashfaque Hassan, Dean of National University of Science and Technology (NUST), said the implementation of an aggressive yet selective import compression policy proved effective in shrinking the country’s current account deficit. Similarly, the global economy has been experiencing persistent high inflation, tightened monetary measures and deteriorated growth prospects.

Credit: INP-WealthPk