INP-WealthPk

Muhammad Asad Tahir Bhawana

Pakistan reduced its reliance on imported chemicals by approximately 36% year-on-year during the first nine months of the last fiscal year 2022-23 (9MFY23). However, chemical exports also declined around 31% during the same period. Despite this, the chemical sector remains vital for the progress of various industries like textiles, leather, and automobiles. It serves both forward-linked industries, enabling their growth, and backward-linked industries such as surfactants used in oil refineries.

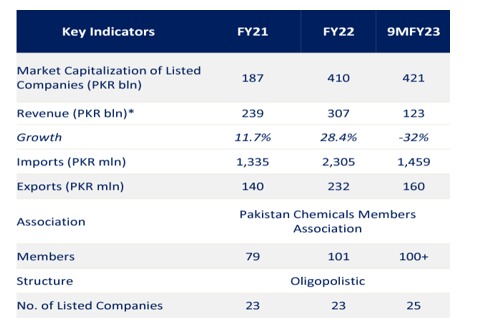

Pakistan Credit Rating Agency (PACRA) said that the market capitalisation of publicly listed chemical companies grew by approximately 3% year-on-year in 9MFY23, while the average KSE-100 index experienced a 2% decline, highlighting the chemical sector's strong performance compared to the overall market.

Pakistan’s chemical sector possesses immense potential for growth, given its significant role in everyday life and industrial advancement. However, the sector's development has been limited as only a few groups focus on expansion, leaving ample room for progress. Notably, the local market has made significant strides in producing basic inorganic chemicals such as polyvinyl chloride (PVC), caustic soda, soda ash and hydrogen peroxide, meeting market demands with increased production capacities. Moreover, the chemicals sector plays a crucial role in manufacturing various products utilised across diverse industries, and its demand closely correlates with the country's economic activity. Pakistan witnessed a commendable 6.1% GDP growth rate in FY22, but in FY23, the situation deteriorated significantly. Further, certain chemical segments faced challenges in profitability. T

he PVC and soda ash segments experienced declines in net profit margins due to higher operating costs, finance expenses and increased tax burdens. Similarly, the resins segment saw reduced operating and net margins despite an improvement in gross profit margin, primarily attributed to steady sales. Conversely, some chemical segments thrived with improved net profit margins. The caustic soda and hydrogen peroxide segments benefited from better cost management and reduced borrowings. The printing ink segment experienced a noteworthy 28% YoY increase in net profit margins in 3MCY23, while the paints segment maintained a steady net profit margin of 3% YoY in 9MFY23.

Energy-intensive production processes in the chemical sector were affected by rising production costs due to the devaluation of the Pakistani rupee and dependence on imported oil, gas and coal. However, after CY22, international commodity prices for coal, gas and oil significantly decreased, presenting an opportunity for low-performing chemical segments to improve profit margins in FY24. Looking ahead, with the projected GDP growth target of 3.5% for FY24, the IMF's approval of the Stand-By Arrangement, and expectations of declining inflation, the economy is poised for recovery from the setbacks of FY23. Given the chemical sector's strong interlinkages with other economic segments, increased demand is expected to drive revenue and sales growth within the industry.

Credit: INP-WealthPk