INP-WealthPk

Ayesha Mudassar

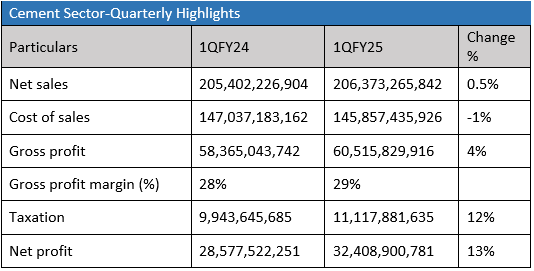

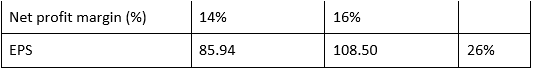

The cement sector demonstrated modest performance during the first quarter of the fiscal year 2024-25, achieving a 13% year-on-year (YoY) growth in earnings. The net profit for the period reached Rs32.4 billion compared to Rs28.5 billion in the corresponding period of the last fiscal year, reports WealthPK.

The sector’s stakeholders include Cherat Cement Company Limited (CHCC), DG Khan Cement Company Limited (DGKC), Dewan Cement Limited (DCL), Fauji Cement Company Limited (FCCL), Flying Cement Company Limited (FLYING), Kohat Cement Company Limited (KOHC), Lucky Cement Limited (LUCK), Maple Leaf Cement Factory Limited (MLCF), Pioneer Cement Limited (PIOC), Power Cement Limited (POWER), and Thatta Cement Company Limited (THCCL).

According to WealthPK’s analysis of the income statements of the 11 PSX-listed cement companies, the sector saw an increase of 0.5 % in net sales, worth Rs206.3 billion compared to Rs205.4 billion in 1QFY24. On the cost front, the cost of sales declined by 1% YoY, which stood at Rs145.8 billion in 1QFY25 compared to Rs147.03 billion in 1QFY24. In addition, the sector paid a higher tax worth Rs11.1 billion against Rs9.9 billion in the corresponding period of last year, depicting a rise of 12% YoY. During 1QFY25, LUCK beat its peers by recording the highest sales and net profit.

The robust performance is mainly attributable to the company’s strong focus on cost optimisation, risk management and innovation to deliver sustainable value to its stakeholders. On the other hand, POWER and DCL were underperforming, with negative net profits. Both companies have actively pursued cost-saving initiatives to mitigate losses. However, factors, including exorbitant input prices, and escalating energy charges, have adversely impacted their overall performance.

Challenges facing the cement sector

The cement industry faces two simultaneous but divergent challenges: Pakistan’s per capita cement consumption stands at 182 kilogrammes, which is lower than its regional counterparts, indicating untapped market potential. In addition, the cement industry’s heavy reliance on coal, which accounts for 66% of its energy consumption, exposes it to the fluctuations of global coal prices, diverging it from the global trend towards sustainable energy sources.

Overview of economy

Pakistan’s economy has exhibited notable progress during the first quarter of FY25, with several key economic indicators reflecting an upward trajectory. Inflation, which has been a persistent challenge over the years, continues to decline and is currently in single digits. This decline prompted the State Bank of Pakistan to ease its monetary policy, characterised by the significantly positive real interest rates that remained high throughout the period.

Credit: INP-WealthPk