INP-WealthPk

Ayesha Mudassar

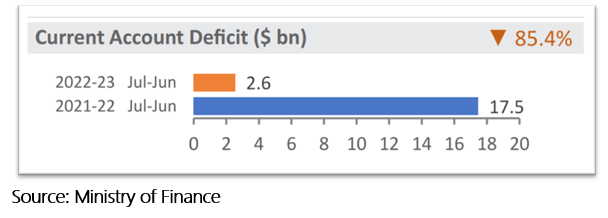

The government’s management of the external sector is crucial for the economic recovery and the potential of high growth in the next fiscal year. Pakistan’s balance of payment position continues to be under stress, despite a noticeable contraction in the Current Account Deficit (CAD). According to experts, the weakened position is mainly due to the adverse global shocks and domestic uncertainties.According to the Monthly Economic Update and Outlook July 2023, the import compression measures drove 85.4% contraction of the CAD during Jul-Jun FY2023. The deficit reached $2.6 billion against a

deficit of $17.5 billion in the same period last year. Exports declined by 14.1% and imports dropped by 27.3% during Jul-Jun FY23. Moreover, the current account deficit in July 2023 was $0.8 billion, which was lower than the $1.3 billion deficit in July 2022. The implementation of an aggressive yet selective import compression policy has proved an effective step towards shrinking the CAD, said Dr. Ashfaque Hassan, Dean National University of Science and Technology (NUST).

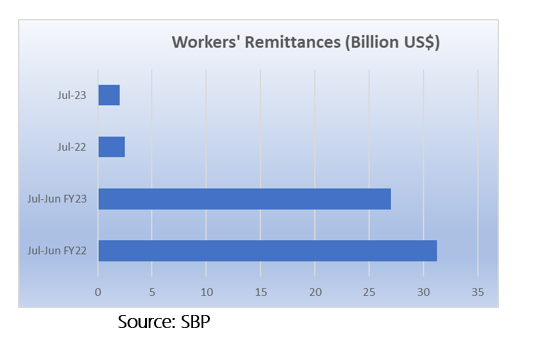

Dr. Ashfaque expressed optimism about this positive development, indicating that the current account is now boosting rather than depleting the country's forex reserves. However, the significant setback was that the remittances inflows through official channels dropped to a five-month low of $2 billion in July 2023. The State Bank of Pakistan (SBP) recorded a 19% decrease in remittances, with the figure plummeting to $2.03 billion in July, compared to the previous year’s $2.51 billion for the same month.

In a discussion with WealthPK, Deputy Executive Director at the Sustainable Development Policy Institute (SDPI) Dr. Sajid Amin Javed attributed the decline in remittances to the expatriates’ preference for utilizing the informal channels to send money amid significant exchange rate disparity between the interbank and open markets. “The availability of better foreign currency rates in the unofficial hawala-hundi market encouraged a portion of non-resident Pakistanis to opt for this unregulated channel to transfer funds to their families back home,” he added. Pakistan is a country with high political, economic, and financial volatility; hence, little can be expected on the foreign investment front.

The State Bank of Pakistan (SBP) has revealed data showing that the FDI has constricted by a staggering 25% in FY23 when compared with foreign investment of $1.93 billion in FY22. Asim Saeed, Member of the Planning Commission of Pakistan, assigned this decline primarily to the restrictions on the outbound repatriation of profits. Besides, persistent political unrest and economic mismanagement discouraged foreign investors from investing, Asim pointed out. The Monthly Outlook of the State Bank of Pakistan also illustrates that Pakistan's total liquid foreign exchange reserves increased significantly to $13 billion on August 25, 2023 from $8.8 billion on account of $3.0 billion disbursement from friendly countries ($2 billion from Saudi Arabia and $1 billion from UAE) and $ 1.2 billion from the IMF under Stand-By Arrangement.

Credit: INP-WealthPk