INP-WealthPk

Ayesha Mudassar

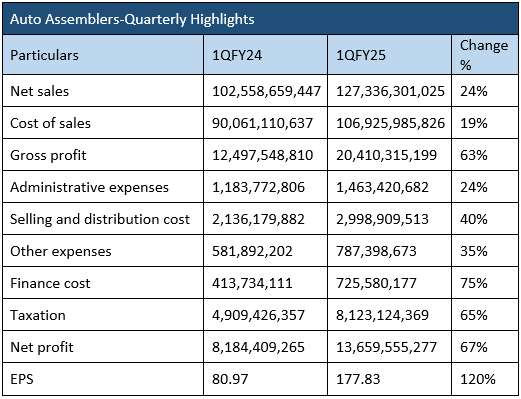

Large-cap automobile assemblers reported a net profit of Rs13.6 billion for the first quarter of the ongoing fiscal year 2024-25, marking a remarkable rise from a profit of Rs8.1 billion recorded in the corresponding period of the last fiscal, posting a 67% yearly increase, according to WealthPK.

The robust performance was due to a better sales mix, efficient treasury operations, and prudent management of enhanced liquidity. Key companies within the sector include Indus Motor Company Limited (INDU), Millat Tractors Limited (MTL), Atlas Honda Limited (ATLH), Sazgar Engineering Works Limited (SAZEW), and Ghandhara Industries Limited (GHNI).

As per the results available with WealthPK, the sector’s revenue increased by 24% year-on-year (YoY) to Rs127.3 billion, up from Rs102.5 billion in the first quarter of FY24. Furthermore, the cost of sales rose by 19% YoY, totalling Rs106.9 billion compared to Rs90.06 billion in 1QFY24. This resulted in a 63% rise in gross profit during the period under review. On the expense side, selling and distribution costs grew by 40% and other expenses by 35% YoY to Rs2.9 billion and Rs787.3 million, respectively, during the review period.

Moreover, the industry’s finance cost increased by 75% YoY to Rs725.5 million compared to Rs413.7 million in 1QFY24. On the tax front, the sector paid substantially higher taxes, worth Rs8.1 billion, compared to Rs4.9 billion paid during the corresponding period of last year, a 65% YoY rise. In 1QFY25, ATLH topped the peer companies by posting the highest quarterly sales of Rs45.5 billion, followed by INDU with net sales of Rs45.5 billion. SAZEW came in as the third largest revenue collector with sales of Rs26.3 billion.

MTL’s sales in the first quarter of FY25 were Rs7.8 billion, whereas GHNI made the lowest revenue of Rs6.05 billion. Concerning the net profit, INDU posted the highest profit of Rs5.09 billion, followed by SAZEW and ATLH, with net profits of Rs4.2 billion and Rs3.1 billion, respectively. GHNI earned a net profit of Rs638.6 million, and MTL posted the lowest profit of Rs569.2 million.

Companies’ analysis

ATLH

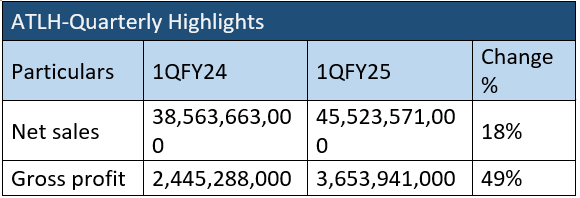

ATLH, one of Pakistan’s leading motorcycle manufacturers, reported a 61% increase in earnings for the quarter ended September 30, 2024, with a net profit of Rs3.1 billion compared to Rs1.9 billion during the same period last year.

The company observes its fiscal year from April to March. ATLH’s net sales increased by 18% YoY to Rs45.5 billion compared to Rs38.5 billion in 1QFY24. This growth can be attributed to the company’s sound market position and reliable customer base. Additionally, ATLH witnessed a 49% YoY increase in gross profit, reaching Rs3.6 billion in 1QFY25. This improvement was driven by a favourable sales mix, a stable exchange rate, and various cost-reduction initiatives.

INDU

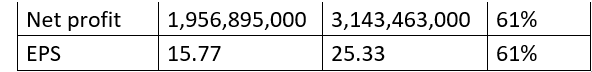

INDU reported significant financial growth in 1QFY25, with gross profit increasing by 69%, and net profit growing by 58% compared to the corresponding period of FY24.

The company earned a gross profit of Rs5.5 billion and a net profit of Rs5.09 billion in 1QFY25. Additionally, INDU posted earnings per share of Rs64.77 during the quarter under review. Factors contributing to this enhanced profitability include increased localisation, currency stability, cost control measures, and improved sales mix.

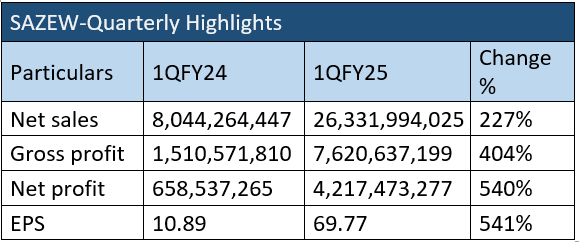

SAZEW

SAZEW’s profit-after-tax clocked in at Rs4.2 billion in 1QFY25 compared to a profit of Rs658.5 million in the same period last year.

The earnings during the period were greatly supported by its other income, which stood at Rs403.3 million in 1QFY25 compared to Rs79.6 million in 1QFY24.

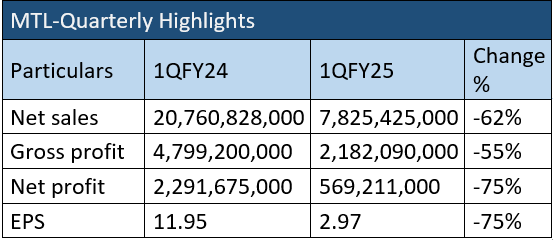

MTL

MTL reported a substantial YoY profit decline of 75%, reaching Rs569.2 million in 1QFY25. This marks a significant decline from the Rs2.2 billion profit recorded in 1QFY24.

The company’s revenue reduced 62% YoY to Rs7.8 billion, down from Rs20.7 billion in 1QFY24. Similarly, the gross profit declined by 55% YoY, totalling Rs2.1 billion compared to Rs4.7 billion in 1QFY24.

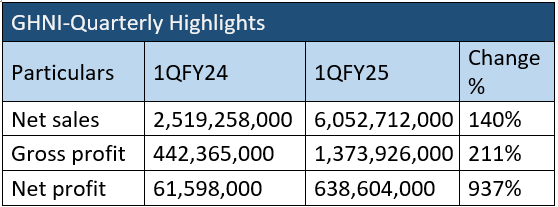

GHNI

GHNI’s sales rose 140% to Rs6.05 billion in the first quarter of FY25 compared to Rs2.5 billion in 1QFY24. The company’s gross profit also increased 211% to Rs1.3 billion from Rs442.3 million in 1QFY24.

Likewise, the net profit witnessed a substantial 937% rise to Rs638.6 million in 1QFY25 from Rs61.5 million in 1QFY24.

Credit: INP-WealthPk