INP-WealthPk

Shams ul Nisa

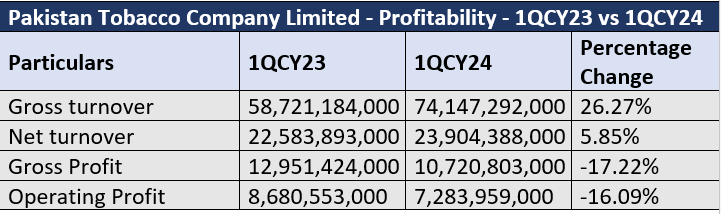

The net turnover of Pakistan Tobacco Company Limited (PTC) increased by 5.85% to Rs23.09 billion in the first quarter of the ongoing calendar year 2024 compared to the same period of 2023, reports WealthPK.

During this period, the company’s exports stood at $3.8 million.

The company’s gross turnover increased by 26.27% despite a decline in domestic sales volume by 23% mainly due to a price hike caused by the excise duty on cigarettes. This benefited the duty-not-paid brands compared to duty-paid/compliant manufacturers.

However, the gross profit fell to Rs10.72 billion in 1QCY24, down by 17.22% from Rs12.95 billion in the same period last year. Furthermore, the operating profit shrank by 16.09% and the profit-before-tax dropped by 10.12%, mainly on account of higher interest income. The company witnessed a significant 23.82% decline in profit-after-tax. This decrease was mainly driven by the imposition of 10% super tax during the period. Furthermore, earnings per share slipped to Rs20.11 in 1QCY24 from Rs26.4 in 1QCY23, suggesting lower shareholders earnings.

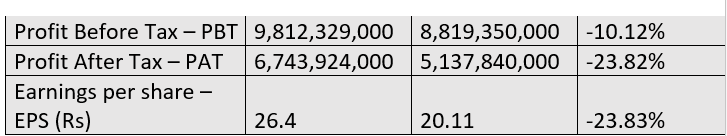

Profitability ratios 2018-23

The gross profit ratio for Pakistan Tobacco Company shows an overall upward trajectory from 2018 to a peak of 54.1% in 2023. This suggests more effective pricing strategies or increased production efficiency. Likewise, the net profit to sales ratio increased from 20% in 2018 to 26.3% in 2023. The highest net profit ratio of 27.1% was observed in 2020. Thus, over the past six years, strong operational performance translated into the EBITDA margin to sales growing stronger and reaching a maximum of 41.5% in 2023.

The operating leverage ratio varied over the years. In 2019, 2020, and 2022, this ratio remained greater than 1, suggesting the company’s operating income and sales volume were insufficient to meet its expenses. However, the company reported a steady operating leverage ratio of 0.9% in 2023. The return on equity ratio showed general stability during the period as it reached a high of 100.6% in 2021 from a low of 59.6% in 2018, and then falling to 74.3% in 2023. The exceptional profitability and effective use of shareholders' equity in 2021 reflected in the high return on equity.

Tobacco sector

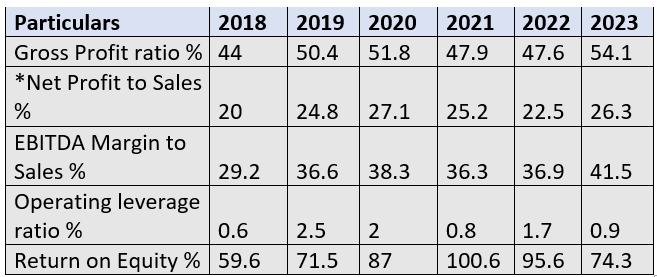

The profitability analysis of tobacco sector shows significant differences between the January-March period of 2023 and the January-March period of 2024. Khyber Tobacco Company Limited saw a sharp drop in sales, but its profit-after-tax increased by 19.34%. The earnings per share witnessed a decimal contraction during the period.

Despite a slight 5.85% increase in sales, Pakistan Tobacco Company’s after-tax profit decreased by 23.82%, suggesting higher operating expenses or taxes. The company’s EPS fell from Rs26.40 to Rs20.11, indicating lower net income available to shareholders. Philip Morris (Pakistan) Limited performed admirably well, increasing profit-after-tax by 15.48% and sales by 48.20% during the period under review. An increase in EPS from Rs6.16 to Rs7.11 indicates higher profitability per share. The tobacco industry saw a 10.59% increase in total sales, but an 18.17% decline in total net profit, indicating continued profitability issues in spite of the higher sales.

PTC’s future outlook

To better serve a dynamic customer base, the company will keep investing in growing its portfolio of lower-risk products. PTC has an exceptional skilled workforce, which puts it in a strong position to face future challenges. With strong risk management, cost-optimisation programmes and process simplification, PTC is unwavering in its resolve to protect and grow business value while providing unmatched value to customers through its brands.

Company profile

Pakistan Tobacco Company was established in 1947. The company’s core activities include the manufacture and sale of cigarettes and tobacco products.

Credit: INP-WealthPk