INP-WealthPk

Shams ul Nisa

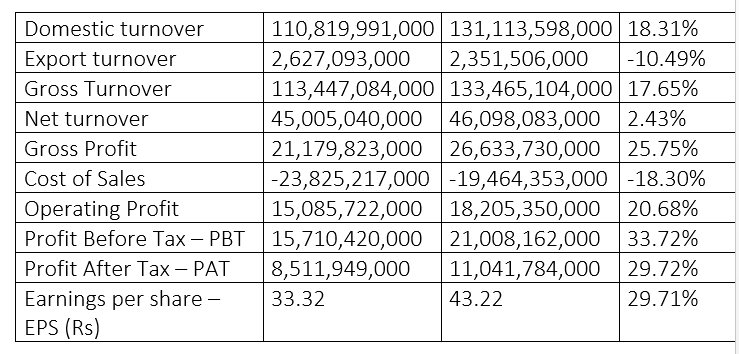

Pakistan Tobacco Company Limited posted growth of 17.65% in gross turnover, 2.43% in net turnover and 29.72% in net profitability in the first six months of the ongoing calendar year 2023 compared to the same period of 2022. During this period, the company increased the sales and production of tobacco-free modern oral nicotine pouches to reduce the health impact. Domestic turnover increased by 18.31% despite the rise in excise-led price during the period. However, the exports turnover fell by 10.49% to Rs2.35 billion in 1HCY23 from Rs2.62 billion in 1HCY22.

This decrease in the company’s exports was due to the depletion of foreign currency reserves, domestic currency devaluation and high inflation rate in the country. The company’s gross profit reached Rs26.63 billion in 1HCY23 as compared to Rs21.17 billion in 1HCY22, reporting a growth of 25.75%. The cost of sales plunged to Rs19.46 billion in 1HCY23 from Rs23.82 billion over the same period last year at an 8.30% growth rate. The company adopted optimisation process and productivity initiatives that led to growth of 20.68% in the operating profit during the period under review.

![]()

The company witnessed a surge of 33.72% in profit-before-tax (PBT) because of increased income from Treasury bills. The profit-after-tax (PAT) grew by 29.72% to Rs11.04 billion in 1HCY23 from Rs8.5 billion in 1HCY22. The PAT growth was lesser than PBT due to the enforcement of super tax. Earnings per share increased by 29.71% from Rs33.32 in 1HCY22 to Rs43.22 in 1HCY23.

Asset analysis

![]()

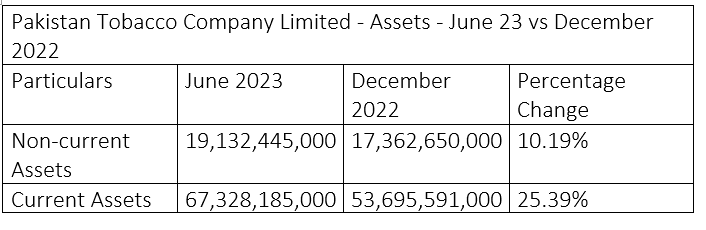

Pakistan Tobacco Company witnessed a notable surge of 21.86% in total assets between December 2022 and June 2023. This increase is because of a rise in both current and non-current assets by 25.39% and 10.19%, respectively, during the period under consideration. This rise indicates the company’s liquidity position has increased and it is focusing on investing in short and long-term assets.

Equity and liabilities analysis

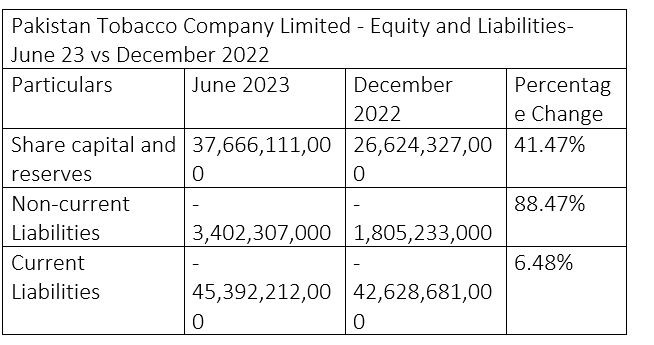

The company saw significant rise in its share capital and reserves by 41.47% to Rs37.66 billion in June 2023 from Rs26.6 billion in December 2022. This significant rise indicated that the company invested in capital during the period. On the other hand, the current and non-current assets of the company grew substantially by 6.48% and 88.47%, respectively, from December 2022 to June 2023. This hike signifies that the company’s short and long-term borrowing increased to finance its current and non-current assets during the period under review.

Cash flow analysis.

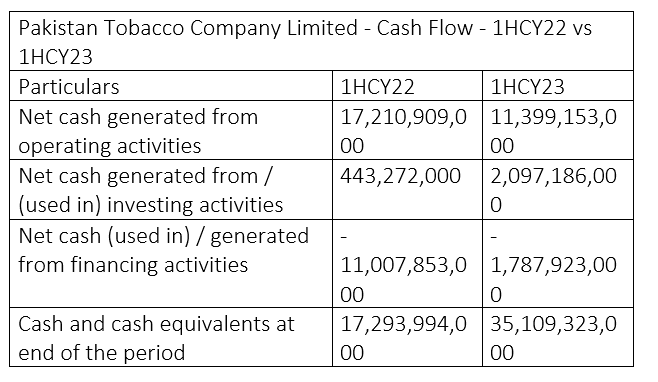

Pakistan Tobacco Company experienced a notable decline in its net cash generated from operational activities to Rs11.39 billion in 1HCY23 from Rs17.21 billion in 1HCY22. However, the company was able to sustain a significant hike in net cash generation from investing activities as the net cash rose to Rs2.09 billion in 1HCY23 from Rs443.2 million over the same period of 2002.

The company noticed a considerable fall in cash used for financing activities such as repayments of debt obligations. The net cash used for financing plunged to Rs1.78 billion in 1HCY23 from Rs11 billion in 1HCY22. At the end of the period, the company successfully achieved Rs35.109 billion of cash and cash equivalent compared to Rs17.29 billion in 1HCY22.

Credit: INP-WealthPk