INP-WealthPk

Arooj Zulfiqar

Pakistan should double down on its efforts to embrace the digital economy to overcome the persistent woes caused by the prevailing cash-based economy. “Pakistan is at a pivotal moment in its economic journey. The process of digitalisation is having a positive impact on the economies of many countries, and in Pakistan embracing the digital economy can help the country reshape its economic landscape. Hence, Pakistan must choose between maintaining its prevailing cash economy or embracing digital transformation,” said Azfar Ahsan, former chairman of the Board of Investment (BOI). Talking to WealthPK, he said, “The adoption of digital economy will ease the process of doing business.

The improvement in business regulations will boost trade and resolve the perennial issue of low investments. Besides, it will raise Pakistan’s exports by replacing traditional trade with e-commerce.” “Additionally, digitisation will make it simpler for the government to track the economy and raise more tax income, thus resolving the entrenched problem of fiscal deficit.” “Furthermore, the process will assist the government in striking a balance between the tax burden placed on the manufacturing and service sectors, improving their competitiveness and giving the next generation a chance to build multi-billion-dollar businesses with little money out of their pockets. These businesses will therefore bring in substantial sums of money from all around the world and help the country resolve its balance of payment crisis.”

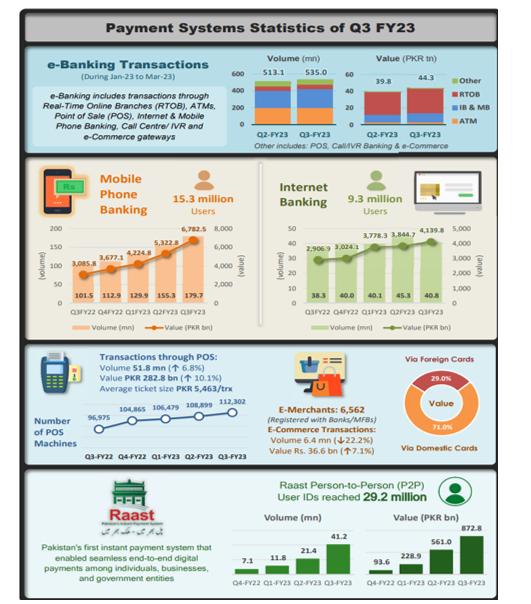

Ahsan said that digitisation would transform the corporate sector from colonial to high-tech, stabilize the rupee, and control inflation because digitisation will make it difficult for people to hide or launder their black money obtained through illegal ways. “Thus, the digitalising will solve the existing economic issues of Pakistan, including the fiscal deficit, devaluation of local currency, poor investment, inadequate exports and inflation.” According to a State Bank of Pakistan's report, digital payments and infrastructure continued to grow during the third quarter of FY23. During the quarter, network of point of sale (PoS) machines expanded by 3.1%, reaching 112,302 by the end of March 23. The number of internet and mobile phone banking users registered with banks/MFBs (microfinance banks) was 9.3 million and 15.3 million, respectively. As of quarter-end (March-23), banks/MFBs had 6,562 e-commerce merchants registered with them.

Since its launch, Raast, which enables instant end-to-end digital payments among individuals, businesses and government entities, has shown positive growth in the number of user IDs and transactions. As of Q3 of FY23, there were 29.2 million registered Raast users, which was 25.8 million in the previous quarter. The number of transactions processed through Raast increased by 92.2%, while value grew by 56%.

In addition, e-banking transactions also witnessed growth during this quarter. A total of 535 million e-banking transactions were processed by banks/MFBs worth Rs44.3 trillion, an increase of 4.3% in volume and 11.2% in value. Mobile phone and Internet banking volume increased by 9.9% and value by 19.1% during the quarter. Although volume of e-commerce transactions declined, their value increased by 7.1%.

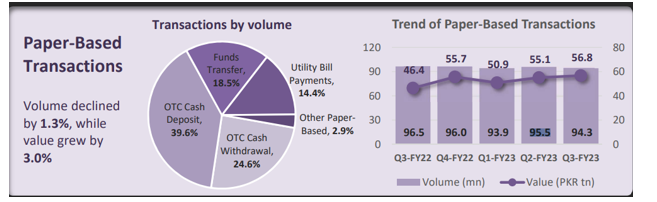

Volume of the paper-based transactions in Q2 of FY23 was 95.5 million, which decreased to 94.3 million by end of Q3 of FY23. During the same period, value of transactions increased by 3% to Rs56.8 trillion

Credit: INP-WealthPk