INP-WealthPk

Hifsa Raja

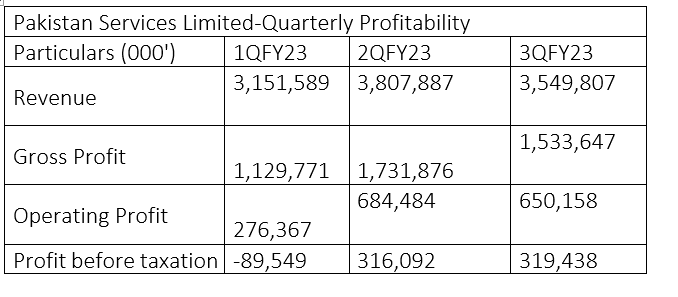

Pakistan Services Limited produced healthy net profits in the second and third quarters of the just-concluded fiscal year 2022-23, recovering from the loss in the first quarter. The owner of a hotel chain suffered a net loss of Rs151 million in the July-September quarter of FY23, but recovered from the heavy loss to post net profits of Rs287 million and Rs236 million, respectively, in the second (Oct-Dec) and third (Jan-March) quarters. The company posted gross revenue of Rs3.15 billion in the first quarter of FY23, Rs3.8 billion in the second quarter and Rs3.5 billion in the third quarter. The gross profit stood at Rs1.1 billion in the first quarter, Rs1.7 in the second quarter and Rs1.5 billion in the third quarter.

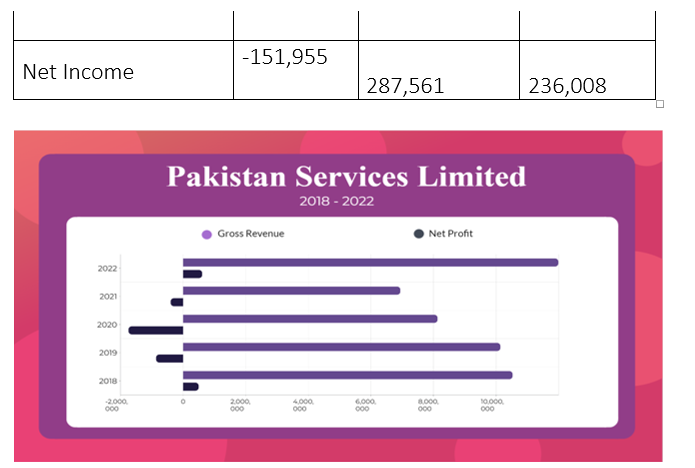

Pakistan Services Limited's financial performance over the past five years has shown mixed results, highlighting the company's resilience and its efforts to overcome obstacles. The company is committed to continuing to focus on implementing strategies to enhance its revenue and profitability. The company's performance will be closely monitored by investors and stakeholders as it works towards achieving its long-term goals.

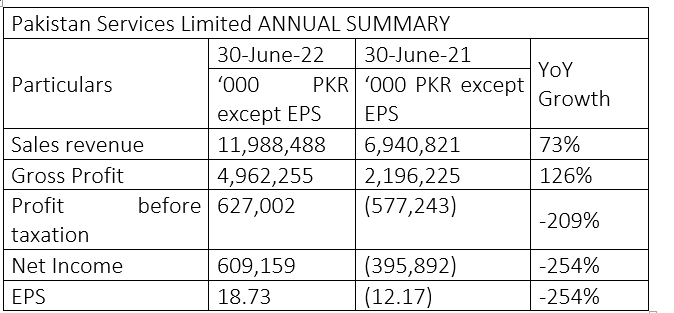

FY22 compared with FY21 Top of Form

Pakistan Services Limited experienced a 73% increase in sales revenue in FY22, which stood at Rs11.9 billion compared to Rs6.9 billion in FY21. The company managed to achieve a 126% growth in gross profit, which leapt to Rs4.9 billion in FY22 from Rs2.1 billion in FY21. The firm posted a 209% growth in profit-before-tax, which stood at Rs627 million in FY22 compared to Rs577 million loss-before-tax in FY21. Further, a 254% growth was recorded in profit-after-tax in FY22, which stood at Rs609 million compared to Rs395 million net loss in FY21.

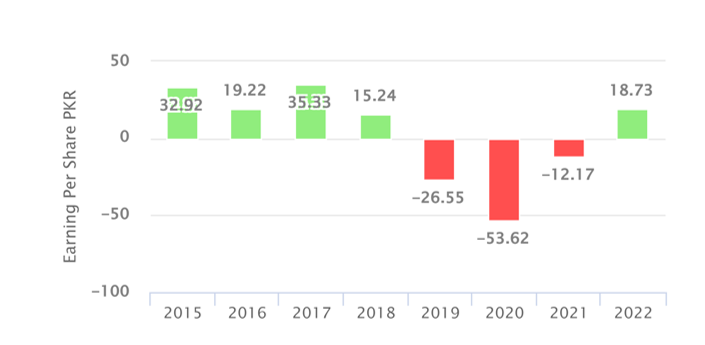

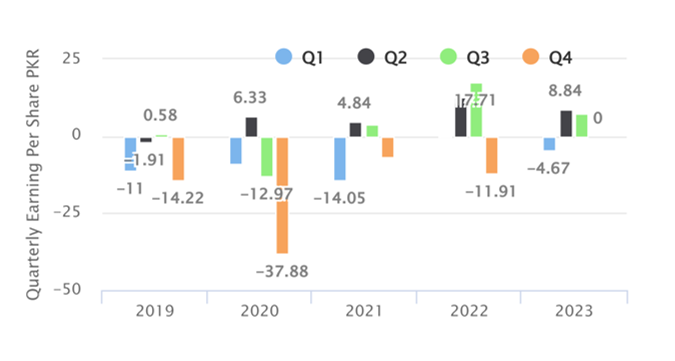

Earnings per share (EPS) over the years

The EPS has shown significant fluctuations over the past eight years, indicating a volatile financial performance. Notably, in 2017, the EPS experienced a remarkable surge, reaching an impressive value of Rs35.33. However, a loss per share was witnessed from 2019 to 2021. But EPS again rose to Rs18.73 in 2022.

These fluctuations in EPS reflect the dynamic nature of the company's financial performance, showcasing periods of significant growth as well as periods of decline. Investors and stakeholders closely monitor these developments to gauge the company's profitability and make informed decisions.

In the latest financial update for FY23, the company's EPS showcased a mixed performance. During the first quarter, the company reported EPS of minus Rs4.67. However, the second quarter witnessed an EPS of Rs8.84, posting a staggering turnaround.

Ratio analysis

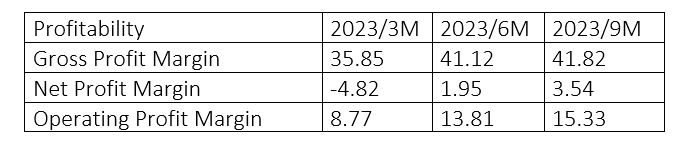

The company's profitability analysis for the first three quarters of FY23 reveals some interesting trends. The gross profit margin, which measures the profitability of core operations, stood at 35.85% in the first quarter, indicating a healthy level of profitability. This margin further increased to 41.12% in the second quarter and reached 41.82% in the third quarter, showcasing a consistent improvement in the company's ability to generate profits from its operations.

However, the net profit margin, which represents the profitability after accounting for all expenses and taxes, started in negative territory at -4.82% in the first quarter. Nonetheless, there was a significant turnaround in the second quarter, with the net profit margin rising to a positive 1.95%. This positive trend continued in the third quarter, with the net profit margin increasing to 3.54%. These improvements indicate the company's ability to effectively manage its expenses and generate higher net profits. Similarly, the operating profit margin, which measures the profitability of day-to-day operations without considering other income or expenses, was recorded at 8.77% in the first quarter.

This margin witnessed substantial growth, reaching 13.81% in the second quarter and further expanding to 15.33% in the third quarter. These figures reflect the company's efficient management of its operational costs and its ability to generate higher profits from its core business activities. Overall, the company's profitability analysis for the first three quarters of FY23 demonstrates a positive trend. The improvements in the gross profit margin, net profit margin, and operating profit margin indicate the company's ability to effectively manage its operations and generate higher profitability.

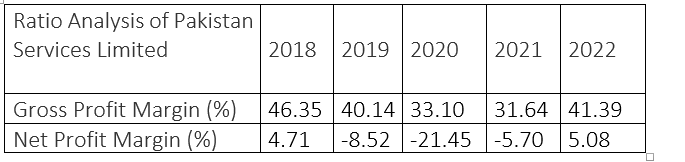

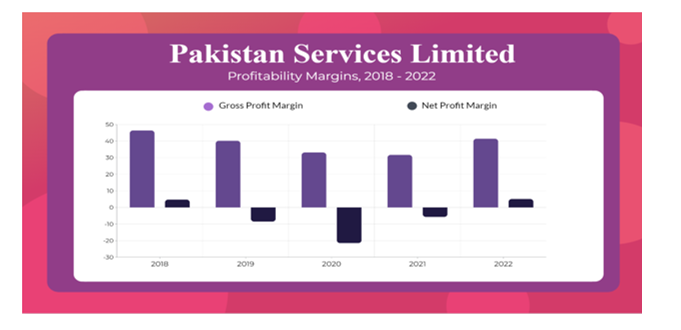

Overall, Pakistan Services Limited's ratio analysis reveals fluctuations and challenges in its financial performance over the analysed years. The company experienced a decline in gross profit margin in certain years but showed improvement in others. The net profit margin demonstrated significant volatility, with periods of losses followed by a gradual recovery. Investors and stakeholders closely monitor these trends to assess the company's ability to achieve sustainable profitability and make informed decisions regarding their investments in the company.

Paris Agreement

Pakistan Services Limited, a publicly listed company and a subsidiary of Hashoo Group (HG), signed a landmark agreement in October 2021 with the Science Based Targets Initiative (SBTi). Through this voluntary gesture of global solidarity, it is committing to aligning its climate targets with the most ambitious aim of the Paris Agreement and to what science dictates: to reach Net Zero global emissions by 2050 at the latest to limit global warming to 1.5°C.

Company profile

Pakistan Services Limited was incorporated on December 6, 1958, under the Companies Act, 1913 (now Companies Act, 2017) as a public limited company. The firm is principally engaged in the hotel business and owns and manages the chain of Pearl Continental Hotels. The company also owns a small-sized property in Lahore, operating under the budget hotel concept.

Credit: INP-WealthPk