INP-WealthPk

Shams ul Nisa

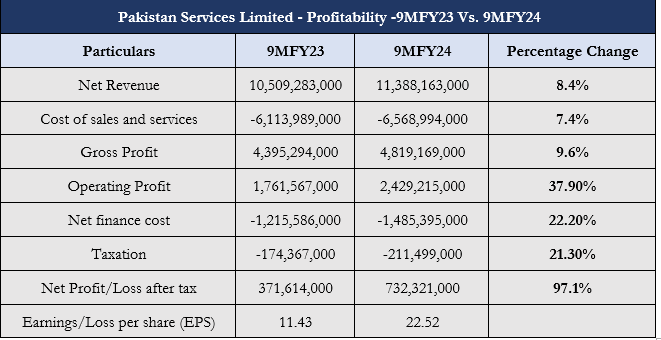

Pakistan Services Limited posted 8.4% growth in net revenue and a 97.1% increase in net profit during the nine months of the fiscal year, report reports WealthPK. The company's net revenue stood at Rs11.38 billion, indicating successful marketing tactics and rising client demand during the review period. Similarly, the net profit was nearly twice, to Rs732.32 million in 9MFY24.

The cost of sales and services increased by 7.4% from Rs6.11 billion to Rs6.56 billion in 9MFY24. Despite this rise in the cost of sales compared to revenue, the gross profit improved by 9.6% to Rs4.81 billion, showcasing effective cost control along with revenue expansion. Furthermore, operating profit grew significantly from Rs1.76 billion in 9MFY23 to Rs2.42 billion in 9MFY24.

The company's net financing cost expanded by 22.2%, implying higher interest expenses due to increased borrowing and rising interest rates. However, operating profit growth offset the increased finance costs during the period. The company experienced a 21.3% growth in taxation to Rs211.49 million in 9MFY24. The impressive performance of net revenue and profitability resulted in a significant jump in earnings per share from Rs11.43 to Rs22.52 in 9MFY24.

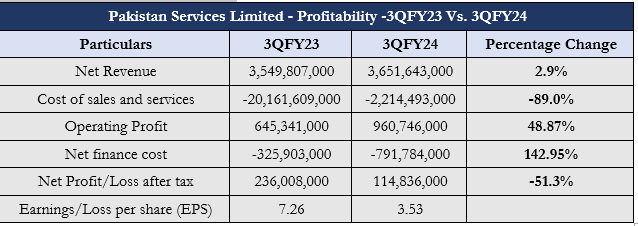

3QFY23 Vs. 3QFY24

Pakistan Services Limited's financial performance for 3QFY24 showed modest growth compared to 3QFY23, with net revenue slightly increasing by 2.9%. However, the company's net profit saw a substantial decline of around 51.3% to Rs114.83 million in 3QFY24, largely due to the rise in finance costs. Likewise, the cost of sales and services fell by 89% to Rs2.21 billion in 3QFY24, mainly due to effective cost management strategies.

However, operating profit increased by 48.87%, indicating improved profitability from core operations. During the review period, net finance costs more than doubled to Rs791.78 million, showcasing a growth of 142.95%. This expansion in costs indicates higher borrowing costs and increase in other financial expenses. EPS dropped from Rs7.26 in 3QFY23 to Rs3.53 in 3QFY24, indicating the impact of increased finance costs on shareholder returns.

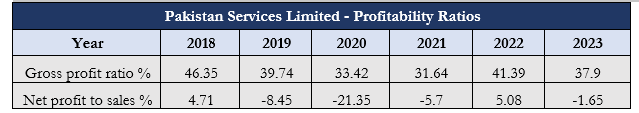

Profitability Ratios

The gross profit ratio, a profitability ratio, continues to decline from 46.35% in 2018 to 31.64% in 2021. This shows that the company's costs of sales increased over the years compared to the sales revenue. In 2022, the company managed to increase gross profit ratio to 41.39% but again collapsed to 37.9% in 2023. Over the period, the company suffered a net loss to sales ratio between 2019 to 2021 and again in 2023. A net profit to sales ratio of 4.71% and 5.08% was posted in 2018 and 2022.

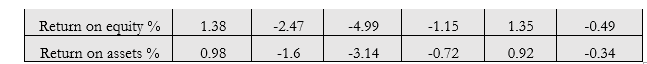

Likewise, return on equity and return on assets have been inconsistent, with positive values in only 2018 and 2022 and negative values in 2019 to 2022 and again in 2023, indicating declining profitability by efficient utilization of assets and equity. The highest return on equity of 1.28% and return on assets of 0.98% was registered in 2018. To improve the profitability ratios, the company needs to focus on enhancing operational efficiency, managing costs, and addressing factors affecting financial stability.

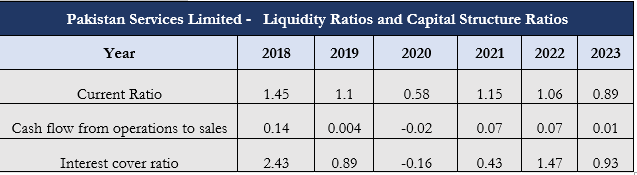

Liquidity Ratios and Capital Structure Ratios

The current ratio of the company declined significantly from 1.45 in 2018 to 0.89 in 2023, indicating a risky liquidity position. The cash flow from operations to sales ratio has varied over the period, with a peaked value of 0.14 in 2018 and a lowest of -0.02 in 2020. It improved afterwards and remained same at 0.07 in 2021 and 2022 before sliding to 0.01 in 2023. The company posted a negative interest cover ratio of 0.16 in 2020, indicating difficulties in covering interest payments. However, in recent years it stood at 0.93 in 2023.

Company profile

Pakistan Services Limited was established as a public limited company on December 6, 1958. The company's main business is hotel management, and it owns and runs the Pearl Continental Hotel network. Additionally, the company has a single modestly sized Lahore property that operates as a low-cost hotel. The company also provides franchises for the use of Pearl Continental, its trademark and brand.

Credit: INP-WealthPk