INP-WealthPk

Muneeb ur Rehman

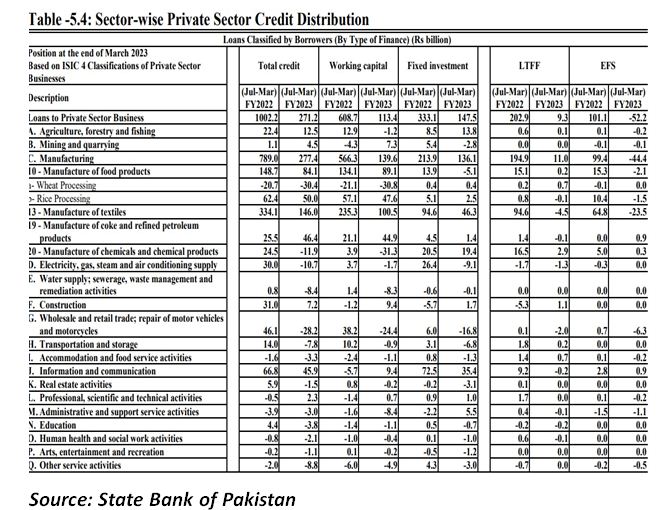

An analysis of Pakistan’s credit allocation tothe private sector indicates that certain industries have shown significant progress, while others have been slower in this aspect, with overall credit allocation experiencing a declining trend. The heightened demand for credit in specific sectors suggests their potential for expansion through loan utilisation. According to a report of the State Bank of Pakistan (SBP),the performance of themanufacturing sector shows a dismal outlook. During the fiscal year 2021-22, it attracted a credit worth Rs789 billion, while duringFY23, the value stands at Rs277.4 billion.

Raja Zaheer Abbas, Chairman ofPakistan Automotive Manufacturing Association (PAMA)told WealthPK that the low credit demand by the manufacturing sector was due to the historic rise in the policy rate to above 20% during FY23 under the International Monetary Fund (IMF) conditions. With an increase in policy rate, the demand for credit by the private sector tends to decrease in the country.

Zaheer said that in order to have sustained growth in the manufacturing sector, the government needs to ensure an uninterrupted supply of cheap electricity and promote innovation through research projects. During FY23, the credit allocated to the mining and quarrying sector significantly improved, surpassing the FY22 value of Rs1.1 billion. The latest figure indicates a notable growth rate of 400%, with the sector's credit now standing at Rs4.5 billion.

Overall, during July-March FY22 and FY23, private sector credit experienced a declining trend, from Rs1.162 trillion to Rs257.3 billion. The contraction in loans affected both working capital and fixed investment loans during the period under review. Working capital loans amounted to Rs113.4 billion during July-March FY23, compared to Rs608.7 billion during the same period of the previous year. Similarly, fixed investment loans droppedtoRs147.5 billion during FY23from Rs333.1 billion during FY22.

Credit: INP-WealthPk