آئی این پی ویلتھ پی کے

Hifsa Raja

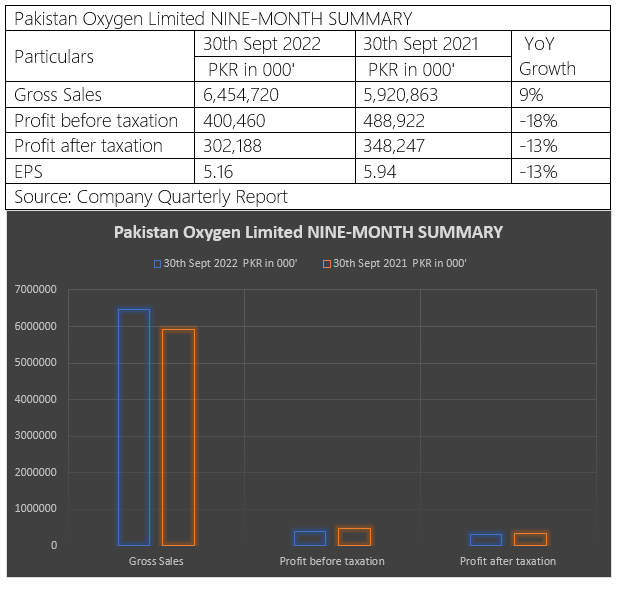

Pakistan Oxygen Limited’s gross sales increased by 9% to Rs6 billion in the first nine months (Jan-Sept) of CY2022 as against Rs5 billion in the corresponding period of CY2021, reports WealthPK. The profit before taxation during the nine-month period of CY22 dropped to Rs400 million from Rs488 million in the corresponding period of CY21. The profit after taxation shows a decrease in the profit by 13% from Rs320 million in nine months of CY22 compared with Rs348 million profit over the corresponding period of CY21.

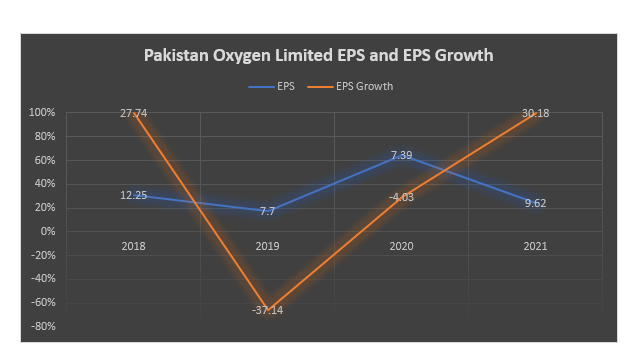

Earnings growth analysis:

The company’s EPS increased over the past few years, with a growth rate of 30.18% in 2021, which was a good sign for investors. However, it’s important to note that the EPS growth rate has been decreasing in recent years. Overall, the EPS and EPS growth indicates that the company has been performing well in terms of profitability, with increasing earnings per share.

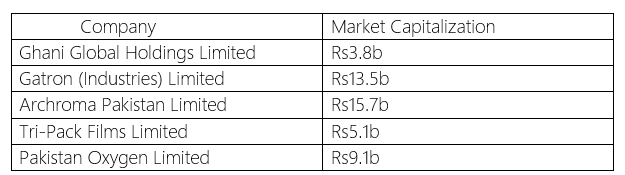

Industry Comparison:

Ghani Global Holdings Limited, Gatron (Industries) Limited, Archroma Pakistan Limited, and Tri-Pack Films Limited have all been regarded as rivals of Pakistan Oxygen Limited. Pakistan Oxygen Limited has a market capitalization of Rs9.1 billion. Investors should note that market capitalization is just one measure of a company’s size and may not necessarily reflect its overall value or potential. Other factors such as revenue, earnings, and growth prospects may also be important considerations when evaluating a company’s investment potential.

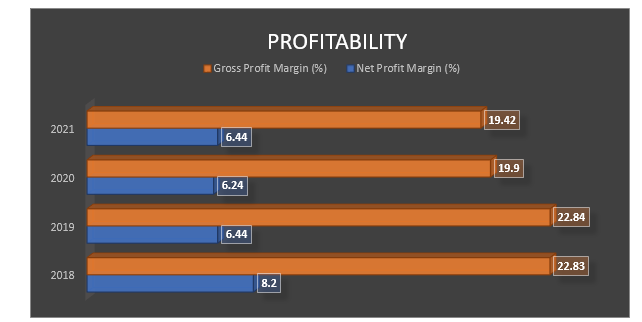

Profitability: In terms of profitability, we can look at gross and net profit margins. The gross profit margin shows the percentage of revenue that remains after deducting the cost of goods sold, while the net profit margin shows the percentage of revenue that remains after all expenses, including taxes and interest, have been deducted.

The company’s gross profit margin has been relatively stable over the past few years, hovering around 19-22%. This suggests that the company has maintained a reasonable level of profitability in its sales. The net profit margin has also been relatively stable, which is around 9-11%. This indicates that the company has been able to maintain its profitability despite an increase in expenses such as operating costs and taxes.

Overall, the financial metrics suggest that Pak Oxygen is a profitable company with stable gross and net profit margins. However, investors should also consider other factors, such as the company’s financial health, market conditions, and industry trends, before making investment decisions.

Company profile:

Pakistan Oxygen Limited was incorporated in Pakistan under the repealed Companies Act, 1913 (now Companies Act, 2017) as a private limited company in 1949 and was converted into a public limited company in 1958. The company is principally engaged in the manufacture of industrial and medical gases, welding electrodes and marketing of medical equipment.

Credit: Independent News Pakistan-WealthPk