INP-WealthPk

Fakiha Tariq

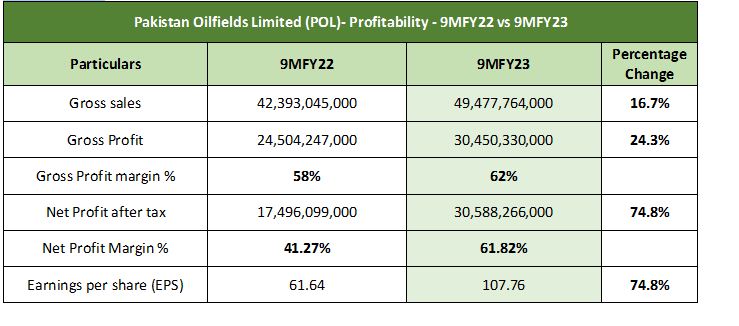

Pakistan Oilfields Limited (POL) posted a 74.8% growth in net profit in the first nine months (July-March) of the last fiscal year 2022-23 as compared to the corresponding period of the previous fiscal, reports WealthPK. During the same period, the public sector oil and gas exploration firm posted a 16.7% increase in sales and a 24.3% growth in gross profit year-on-year. In 9MFY23, Pakistan Oilfields made sales of Rs49 billion, and a gross profit of Rs30 billion, thus coming up with agross profit ratio of 62%. The company posted a net profit of Rs30.5 billion and anet profit ratio of 61.82% in 9MFY23, respectively. POL posted earnings per share of Rs107.76during the same period.

The smallest public-sector exploration firm had sales of Rs42 billion, a gross profit of Rs24 billion and a net profit of Rs17 billion in 9MFY22. The company posted a 74.8% growth in earnings per share in 9MFY23 with EPS rising from Rs61.64 in the corresponding period of FY22. Registered on Pakistan Stock Exchange with the symbol ‘POL’, Pakistan Oilfields Limited is the smallest firm in the oil and gas exploration sector with amarket capitalisation of Rs123.5 billion.

Quarterly Review

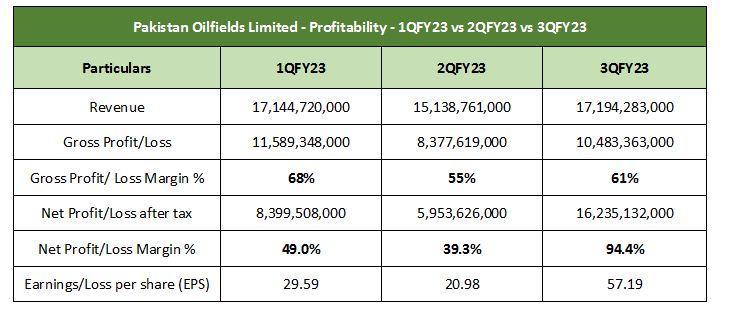

Review of quarter-based profitability reveals that POL enjoyed profits in all the three quartersunder review. The company posted the highest gross profit in the first quarter (July-September). However, the highest net profit was reported in the third quarter (January-March). In the first quarter, POL posted a gross revenue of Rs17 billion and a gross profit of Rs11billion. The company posted a net profit of Rs8.3 billion. Therefore, the gross and net profit ratioswere reported to be 68% and 49%, respectively. In 1QFY23, the company reported the earnings per share of Rs29.59.

In the second quarter (October-December), the oil explorer posted a gross revenue of Rs15 billion, and a gross profit of Rs8.3 billion. The company posted a net profit of Rs5.9billion. Thus, the gross and net profit ratiosturned out to be 55% and 39.3%, respectively. In 2QFY23, the company reported the earnings per share of Rs20.98. In the third quarter of FY23, the company posted a gross revenue of Rs17.19 billion – the highest of FY23 – and a gross profit of Rs10.4 billion. With the inflow of Rs14 billion from the head of “income from other sources”, the company posted a net profit of Rs16.2 billion. Therefore, the gross profit and net profit margins were calculated at61% and 94.4%, respectively.

In 3QFY23, the POL posted the earnings per share of Rs57.19.

Credit: INP-WealthPk