INP-WealthPk

Shams ul Nisa

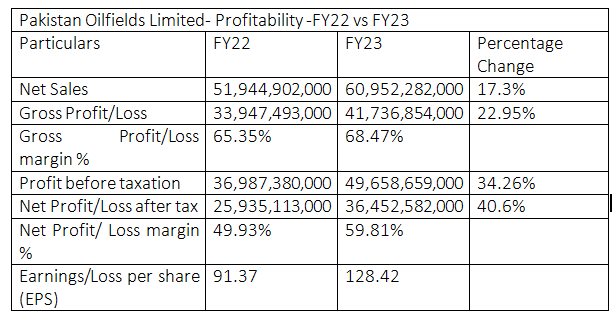

Pakistan Oilfields Limited posted 17.3% growth in net sales, 22.9% in gross profit and 40.6% in net profit during the financial year ended June 30, 2023, compared to the previous fiscal. During FY22, the net sales stood at Rs51.9 billion and gross profit at Rs33.9 billion, resulting in a gross profit margin of 65.35%. In FY23, Pakistan Oilfields Limited recorded Rs60.95 billion in net sales and Rs41.73 billion in gross profit, posting a gross profit margin of 68.47%.

The company made a 34.26% increase in profit-before-tax, which jumped to Rs49.6 billion in FY23 from Rs36.98 billion in FY22. Similarly, net profit grew 40.6% to Rs36.4 billion in FY23 from Rs25.9 billion last year. In FY22, the net profit margin stood at 49.93%, which increased to 59.81% in FY23. The company attributed this increase in profit to the positive impact of the rupee-dollar parity in oil and gas prices. Furthermore, during this period, the company observed exchange gains on financial assets and a rise in income from bank deposits because of higher interest rates. The rise in profitability resulted into earnings per share of Rs128.42 in FY23 compared to Rs91.37 in FY22.

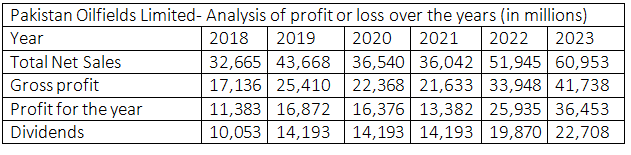

Profit or loss over the years

The company’s net sales increased from Rs32.6 billion in 2018 to Rs43.6 billion in 2019, but dropped to Rs36.5 billion in 2020 and Rs36.04 billion in 2021. However, the sales rebounded and soared to Rs51.9 billion in 2022 and Rs60.9 billion in 2023.A similar pattern was followed by gross profit from 2018 to 2023. The gross profit increased to Rs41.7 billion in 2023 from Rs17.13 billion in 2018. Two dips were observed in 2020 and 2021 compared to the previous year.

The profit for the year exhibited a similar pattern, with two dips occurring in 2020 and 2021 compared to the previous year. Overall, this profit increased from Rs10 billion in 2018 to Rs36.4 billion in 2023. The company’s dividends stood at Rs10.05 billion in 2018 and remained the same in the next three years at Rs14.19 billion in 2019, 2020, and 2021. The highest dividend was given to shareholders in 2023, worth Rs22.7 billion.

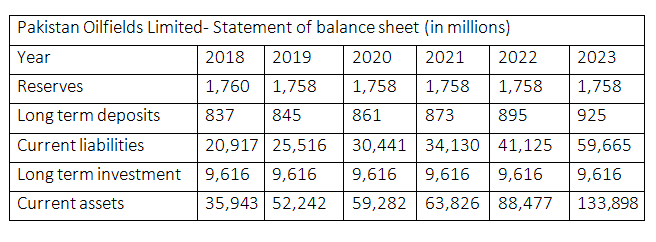

Statement of balance sheet

Pakistan Oilfields saw a marginal decline in its reserves from Rs1.76 billion in 2018 to Rs1.75 billion in the subsequent years. Long-term deposits increased gradually from Rs837 million in 2018 to Rs925 million in 2023. Likewise, the current liabilities showed an increasing trend over the years.

The company’s long-term investment remained the same at Rs9.616 billion throughout the years. However, the company observed a notable growth in current assets during this period, reaching Rs133.89 billion in 2023 from Rs35.9 billion in 2018.

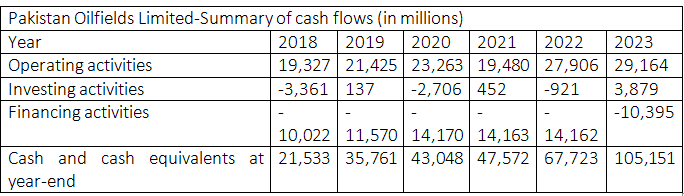

Summary of cash flows

The cash generated from operating activities showed an overall increase from 2018 to 2023, sans a dip in 2021. Cash from investing activities exhibited a mixed trend. It remained negative in 2018, 2020 and 2022 and positive in 2019, 2021 and 2023. The company used cash for financing activities such as debt repayments throughout the period, indicating cash outflow. The cash and cash equivalent at the end of the year steadily increased to Rs105.1 billion in 2023 from Rs21.53 billion in 2018.

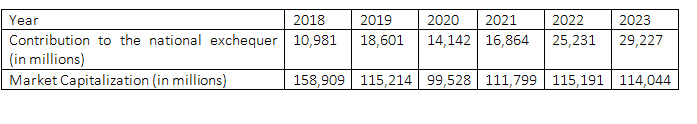

Market capitalisation

Pakistan Oilfields’ contribution to the national exchequer grew overall, reaching Rs29.2 billion in 2023. However, this contribution declined in 2020 from the previous year. The company’s market capitalisation fell from Rs158.9 billion in 2018 to Rs114 billion in 2023.

Credit: INP-WealthPk