INP-WealthPk

Ayesha Mudassar

The government needs to facilitate foreign investors by clearing the way for profit repatriation to headquarters abroad. Foreign Direct Investment (FDI) in Pakistan declined by 25% to$1.456 billionduring the fiscal year 2022-23 compared to $1.936 billion during FY22, according to the State Bank of Pakistan (SBP).With a four-month low, the FDI was recorded at $114 million inJune 2023. Speaking at an international conference,“Decade of China-Pakistan Economic Corridor (CPEC)- Belt & Road Initiative (BRI): From Vision to Reality”, Asim Saeed, Member Planning Commission of Pakistan, attributed this decline primarily to the restrictions on the outbound repatriation of profits.

He said the gigantic decline in profits and dividends haddiscouraged foreign investors, and it might take years to restore their confidence. The profits and dividends on foreign investments plummeted by approximately 85% during the fiscal year 2022-23, the SBP data shows. “Besides, persistent political unrest and economic mismanagement, particularly the massive rupee devaluation, had discouraged foreign investors,”Asim pointed out.

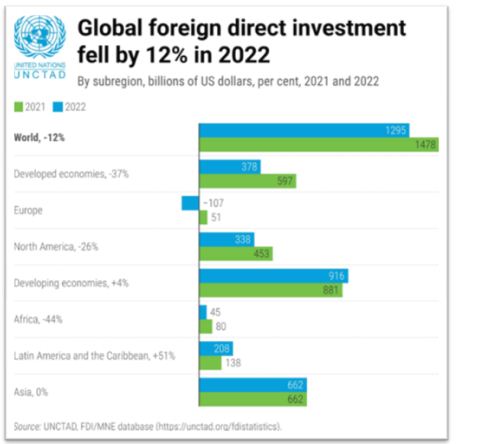

The rupee-dollar exchange rate volatility is the biggest factor discouraging foreign investors from investing heavily. In 2021, South Asia received a foreign investment of $175 billion, of which only $2 billion were invested in our country. United Nations Conference on Trade and Development (UNCTAD) World Investment Report 2023 reveals that global FDI declined by 12% during 2022to $1.3 trillion. The slowdown was primarily driven by numerous factors, including theUkraine crisis, high energy and food prices, and debt pressures. International project finance and cross-border mergers and acquisition were largely affected by tighter financing conditions and uncertainty in capital markets.

Talking to WealthPK, Director General Board of Investment (BoI) Zulfiqar Ali said macroeconomic stability is a prerequisite for fostering an investment-friendly climate in the country. “Ensuring external sector liquidity, improving sovereign credit rating, and incentivising firms with high-growth potential are necessary to attract investment,” he said. He said thatwith a comprehensive set of measures and incentives, Pakistan strives to become a preferred investment destination in the region and achieve its long-term economic development goals. Zulfiqar emphasised that the government should prioritise foreign investment by clearing the way for profit repatriation to the source of origin. “This would give investors the confidence and encourage them to pour more capital into the country,” he added.

Credit: INP-WealthPk