INP-WealthPk

Ayesha Mudassar

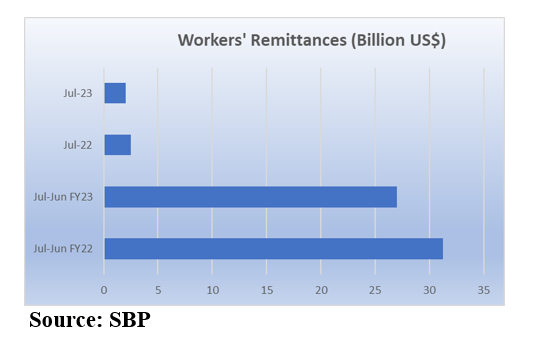

In a significant setback, Pakistan’s foreign remittances inflows through official channels dropped to a five-month low of $2 billion in July 2023. The State Bank of Pakistan (SBP) recorded a 19% decrease in remittances, with the figure plummeting to $2.03 billion in July, compared to $2.51 billion in the corresponding month of last year. While talking to WealthPK, Dr. Sajid Amin Javed, Deputy Executive Director at Sustainable Development Policy Institute (SDPI), attributed the decline in the remittances to the preference of expatriates to utilise informal channels to send money amid significant exchange rate disparity between the interbank and open markets. “The availability of better foreign currency rates in the unofficial hawala-hundi market encouraged a portion of non-resident Pakistanis to opt for this unregulated channel to transfer funds to their families back home,” he pointed out.

Concerns have been raised regarding Pakistan’s ability to sustain import payments and manage maturing foreign debt obligations as a result of a reduction in workers' remittances. Overseas Pakistanis in Saudi Arabia remitted the single largest amount in July 2023, as they sent $486.7 million. However, this was nearly 16% lower than $577.1 million sent by expatriates in the same month of the previous year. Inflows from the United Arab Emirates (UAE) registered a significant decline of 35% from $455.9 million to $315.1 million during the period under review. Remittances from the United Kingdom amounted to $305.7 million in July 2023, with a decline of 25% compared to $408.6 million in July 2022. Moreover, remittances from the European Union decreased by 4% and amounted to $283.6 million in July 2023. Overseas Pakistanis in the United States sent $238.1 million in July 2023, with a year-on-year (YoY) decline of 4%. In FY23, Pakistan received $27.02 billion in remittances, down from $31.27 billion in FY22.

Remittances play a multifaceted role in developing economies. They contribute to poverty reduction and improve living standards by providing much-needed financial support to families and individuals. They also prove instrumental for socioeconomic development through stimulating investment and numerous economic activities. “Taking cue from Bangladesh and Sri Lanka, the concerned authorities must offer a better rupee-dollar exchange rate to boost the inflow of workers' remittances and stabilise the country's dwindling foreign exchange reserves,” Dr Sajid said. He said the reduction of the gap between the two markets is a must to re-attract expatriates towards the formal channels from informal ones.

Credit: INP-WealthPk