INP-WealthPk

Qudsia Bano

Pakistan needs to focus on structural reforms to accelerate growth in the business and services sectors.

This is underscored by Zafar Usmani, the Finance Manager of JS Global Capital Limited.

Zafar Usmani spoke with WealthPK on different aspects of Pakistani economy, the issues ailing it, and the steps needed to turn it around.

Q: How is your firm impacted by changes in the country’s economic and political landscape as well as other external factors, and how are you handling them?

A: Political stability and economic growth are closely related. The unpredictability caused by a volatile political climate is slowing down investment, and thus economic growth. There seems to be no planning at the policymaking level to arrest the bad economic performance. Pakistan also doesn’t seem to be coming out of political currents anytime soon, which is resulting in steady collapse of administrative machinery. However, notwithstanding persistent market-related difficulties and the nation's economic difficulties, JS Global Capital Limited is committed to keeping its growth momentum over the long term. To maximise rewards for its stockholders, the management closely monitors its resources. This entails maximising revenue production through fee-based operations, core brokerage and treasury management.

Q: What do you think is the market sentiment amid weak economic activity?

A: Market sentiment is depressed as Pakistan faces severe external imbalances in terms of high growth in imports, relatively low growth in exports, falling remittances, weak productivity, high global commodity prices, and global economic slump. The State Bank of Pakistan has hiked the policy rate to cool demand, and the government has increased the prices of energy as part of the IMF loan programme to stabilise the economy, but the devastating floods across swathes of the country have made matters worse, further depressing the chances of an economic recovery.

Q: Who creates your company's investing policies, and how do you aim to protect the value of your investment portfolio from possible market risks?

A: The audit, risk management and human resource and remuneration committees support the company’s board in carrying out its duties, including investment, risk management, human resource management policies, and corporate social responsibility.

Q: What are the major causes of economic instability in the country, and how can we address them?

A: One of the main causes has been a lack of investment, caused by volatile political situation, strict regulations, lack of a robust infrastructure and technological advancements.

Pakistan has to take advantage of exportable goods and services that require little infrastructure and funding. For instance, the demand for software and IT solutions is rising globally. Establishing a software house is easier than establishing a manufacturing facility.

Financial Performance

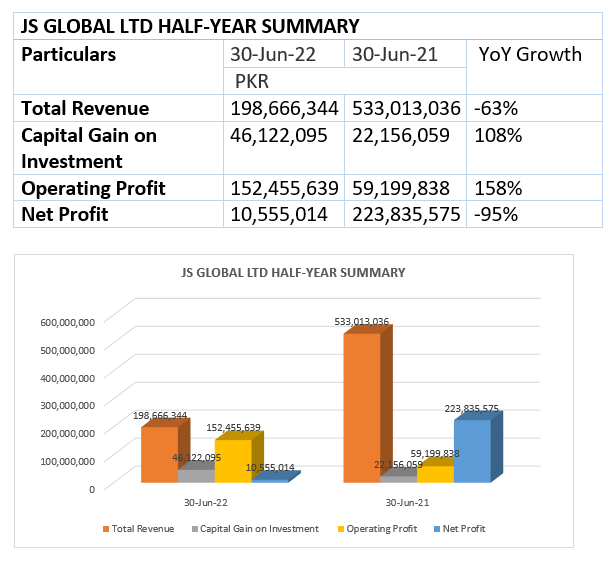

JS Global Capital Limited’s capital gains on the sale of investments increased 108% to Rs46 million in the six months ending June 30, 2022, compared with Rs22 million in the corresponding period of last year.

The revenue of the company, however, declined by 63% to Rs198 million as compared to Rs533 million in the same period last year. The operating profit registered an increase of 158% and stood at Rs152 million in 6MCY22 compared to Rs59 million in the corresponding period of the previous year.

The net income decreased 95% to Rs10.5 million compared with a profit of Rs223 million in the corresponding period last year, reports WealthPK.

Performance in 2020-21

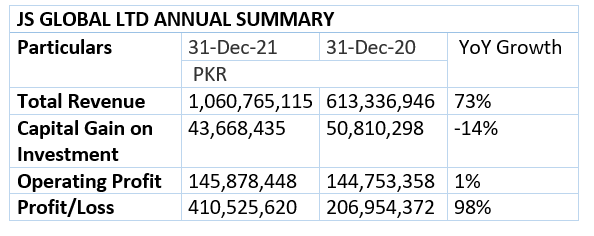

During the fiscal year 2020-21, the company maintained a strong sales trend generating revenue of Rs1.06 billion, posting an increase of 73% over Rs613 million in 2019-20.

The capital gains on investment for the year stood at Rs43.6 million, 14% down from Rs50.8 million the previous year.

Profit-after-taxation for the year stood at Rs410 million, posting an increase of 98% over the profit of Rs206.9 million the previous year.

Earnings Per Share

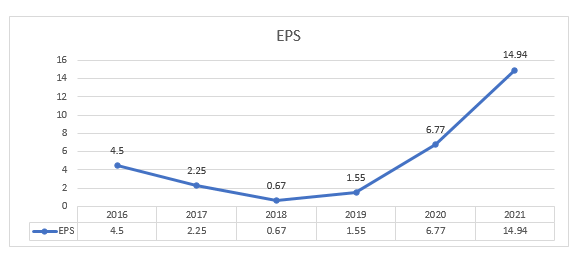

The earnings per share (EPS) of the company witnessed a mix trend during recent years. In 2016, EPS stood at Rs4.5, but decreased to Rs2.25 in 2017 and Rs0.67 in 2018, before inching back up to Rs1.55 in 2019. However, from 2019 onwards the EPS showed remarkable growth. The EPS stood at Rs6.77 in 2020 and then jumped to Rs14.94 in 2021.

About the company

JS Global Capital Limited is a Pakistan-based investment banking and broking firm. The firm offers services in the areas of consumer loans, small and medium enterprises, and digital financial services. Brokerage, investment and treasury, and other operations make up the bank's three business divisions.

Services related to sharing brokerage, money market brokerage, currency brokerage, commodities brokerage, and share subscription commission are included in the brokerage activities. The capital market, money market, and treasury functions make up its investment and treasury.

Profit or markup on bank deposits, term deposit receipts, capital gains on equities and debt securities, markup income on margin financing and term finance certificates, profit on sukuks and dividend income, and advisory and consulting services make up its other operations.

Credit : Independent News Pakistan-WealthPk