INP-WealthPk

Qudsia Bano

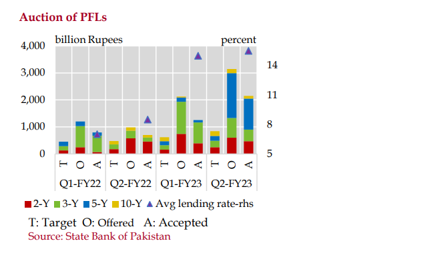

Pakistan's investment landscape has witnessed a significant shift in the first half of the Fiscal Year 2023, with the stock of Pakistan Investment Bonds (PIBs) growing by an impressive 14.8 percent to reach a staggering Rs20.3 trillion, reports WealthPK. This stark increase in PIBs, when compared to the modest 4.0 percent growth observed in H1-FY22, has attracted the attention of investors and financial experts alike. The driving force behind this surge has been the floating-rate PIBs (PFLs), which account for approximately 78.3 percent of the total PIB stock.

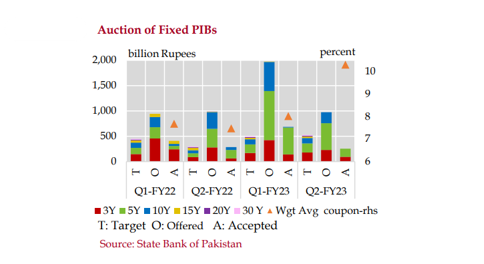

Lured by the promise of lucrative returns, the investors flocked to these floating-rate instruments. Another noteworthy trend observed in the PIB market during H1-FY23 is the shift in the investor preference for medium-term instruments. The offered amount in the auction profile of fixed PIBs suggests that due to the prevailing high-interest rates, the investors were more inclined to invest in instruments with intermediate maturities. On the contrary, in the case of fixed-rate PIBs, despite the market’s preference to lock funds in long-term bonds at high-interest rates, the government made close-to-target acceptances. On aggregate, the government issued Rs942.6 billion worth of fixed coupon PIBs against the target of Rs1,025.0 billion, leaving almost 68 percent of the offers unmet to avoid the high cost of borrowing, as the market offered amounts on significantly higher rates.

Talking to WealthPK, Asim Mustafa, Regional Head at Faysal Bank Limited, said while PFLs may have been a hit among investors, they have inadvertently increased the cost of borrowing for the government. The rise in demand for these floating-rate instruments has led to higher yields, which, in turn, increased the interest expenses incurred by the government. This presents a financial challenge for the government as it grapples with the need to fund its various projects and initiatives. According to Asim, the growth in Pakistan Investment Bonds, especially the surge in floating-rate PIBs, reflects the investors' pursuit of higher returns amidst a rising interest rate environment. However, this trend should be viewed cautiously.

While it offers the investors the potential for greater profits, the associated increase in government borrowing costs is a pressing concern. The government must carefully manage its borrowing strategy to strike a balance between attracting investments and maintaining fiscal responsibility. Furthermore, the shift towards medium-term instruments highlights the market's reaction to the prevailing interest rate conditions. Investors seem to be seeking stability and predictability in their investments, which may indicate a cautious approach towards the economy's future trajectory, said Asim.

Credit: INP-WealthPk