INP-WealthPk

Hifsa Raja

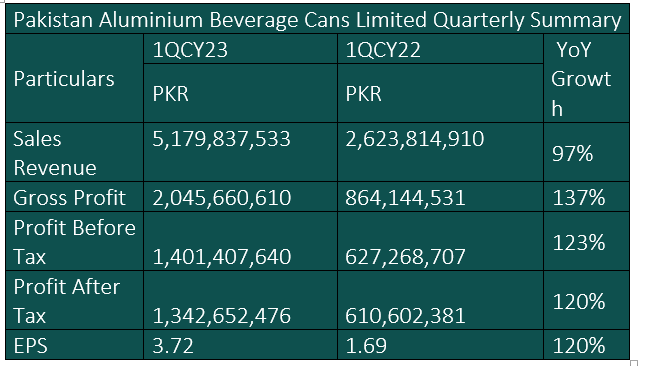

Pakistan Aluminium Beverage Cans Limited has reported impressive growth in its first-quarter results of the calendar year 2023. In the January-March quarter, the company posted an increase of 97% in sales revenue, reaching Rs5.1 billion compared to Rs2.6 billion over the same period last year. The gross profit shot up to Rs2 billion at an impressive growth of 137% from the previous year’s figure of Rs864 million.

The company’s profit-before-tax jumped by 123% to Rs1.40 billion in 1QCY23 from Rs627 million over the corresponding period of CY22. Moreover, the company had a strong 120% increase in the after-tax profit, with ballooned to Rs1.3 billion in 1QCY23 from Rs610 million in 1QCY22. With these encouraging results, Pakistan Aluminium Beverage Cans Limited is poised to continue its growth trajectory, leveraging its strong market presence and customer trust to further expand its market share.

The first-quarter results illustrate the firm’s robust market position, stable client base, and capacity to adjust to shifting market conditions. Investors and stakeholders anticipate the company’s success to continue in the remainder of the year.

Performance in CY22

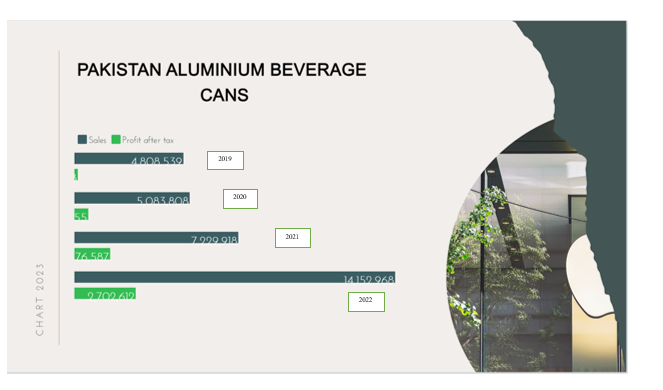

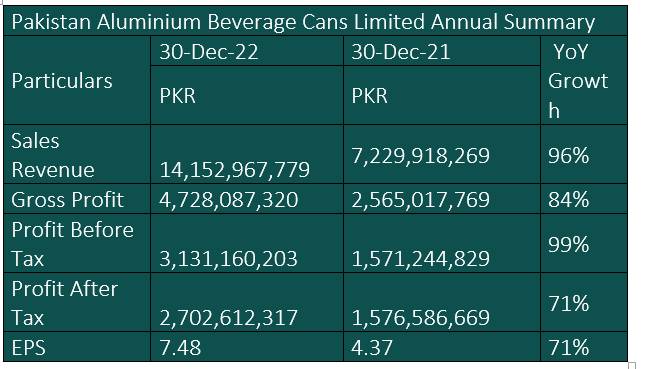

In the calendar year 2022, the company reported that its net sales revenue almost doubled to Rs14 billion from Rs7.2 billion in the previous year, posting a growth of 96%. The gross profit stood at Rs4.7 billion, up 84% from the previous year’s figure of Rs2.5 billion.

The company’s profit-before-tax increased by 99%, jumping to Rs3.13 billion in CY22 from the previous year’s profit of Rs1.57 billion. Moreover, the company had a 71% increase in profit-after-tax, which jumped to Rs2.7 billion in CY22 from Rs1.5 billion in FY21. The earnings per share (EPS) also increased by the same percentage.

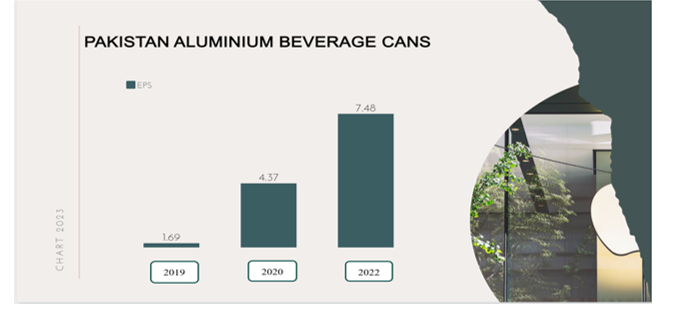

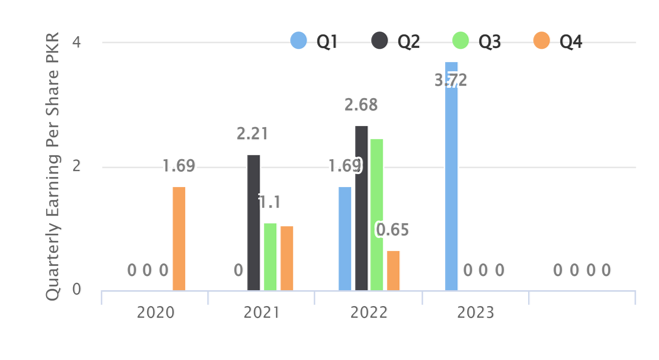

EPS growth over the years

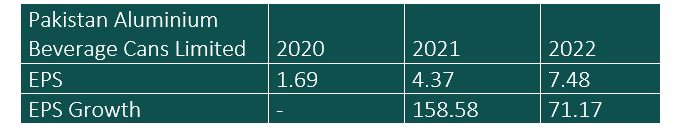

EPS continued to grow in 2020, 2021 and 2022, demonstrating that the business was profitable.

EPS growth in 2021 was quite high, indicating the business had a large increase in profits per share during that year. In 2022, EPS growth showed a considerable decline in the company’s earnings per share.

In the latest financial update for the first quarter of calendar year 2023, the company had earnings per share of Rs3.72.

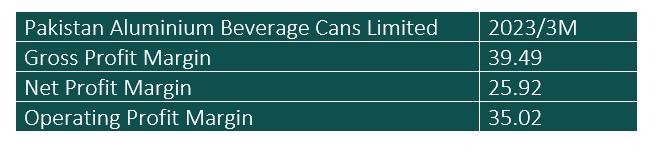

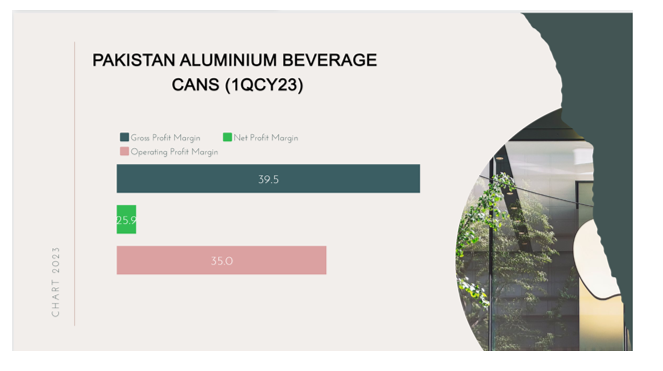

Ratio analysis

In 1QCY23, the gross profit margin stood at 39.49%, the net profit margin at 25.92% and the operating profit margin at 35.02%, respectively.

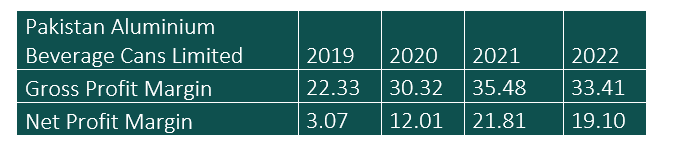

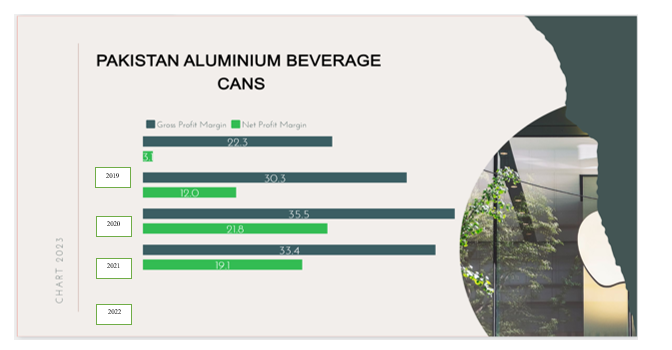

Gross, net profit margins over the years

In 2019, the gross profit margin stood at 22.33%, which increased to 30.32% in 2020 and further jumped to 35.48% in 2021 before falling slightly to 33.41% in 2022. The net profit margin was 3.07% in 2019. It jumped to 12.01% in 2020 and further to 21.81% in 2021 before falling to 19.10% in 2022.

Escalating fuel costs and volatile geopolitical situations have led to significant inflation in international commodity prices. Additionally, businesses in Pakistan are currently facing economic challenges, as high inflation and interest rates have considerably affected both production costs and demand conditions. The shortage of foreign exchange for imports and the ensuing restrictions on imports have had a severe impact on industrial activities in Pakistan. However, the company’s management is mindful of the risks and is adopting all necessary measures to effectively tackle these challenges by leveraging its expertise and resources.

Company profile

Pakistan Aluminium Beverage Cans Limited is a public unlisted company incorporated in Pakistan under the Companies Ordinance, 1984 (now Companies Act, 2017), on December 4, 2014. Ashmore Mauritius PABC Limited, the parent company, holds 51% shareholding of the company. The principal activity of the firm is manufacturing and sale of aluminium cans. The company completed the installation, testing, and commissioning of its manufacturing facility at the Faisalabad Special Economic Zone in September 2017 and commenced commercial operations thereafter.

Credit: INP-WealthPk