INP-WealthPk

Fakiha Tariq

The Pakistan Tobacco Company Limited grabbed historically high revenues of Rs232 billion in the Calendar Year 2022, the highest of the last five years and 17% more than the sales amount posted in 2021, reports WealthPK.The company has been listed as “PAKT” in the tobacco sector on the Pakistan Stock Exchange (PSX). With a market cap of Rs184.0 billion, PAKT is the largest player of the tobacco sector in Pakistan. Founded in 1947 as a subsidiary company of British American Tobacco, UK, the PAKT is primarily engaged in the business of cigarettes and like products.

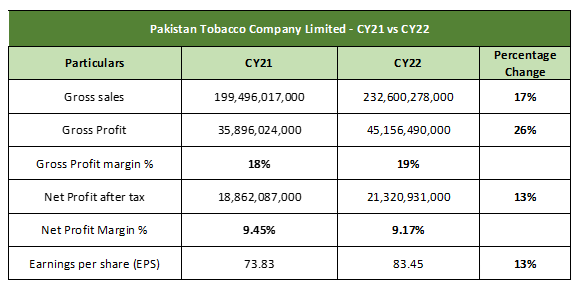

The revenues increased from Rs199 billion posted in 2021 to Rs232 billion in the Calendar Year 2022. In CY22, the company’s gross profit increased by 26% in comparison to CY21. The company posted a gross profit of Rs45 billion in CY22 against a gross profit of Rs35 billion in CY21. Thus, the gross profit ratio moved from 18% in CY21 to 19% in CY22.

With an increase of 13%, the tobacco giant posted a net profit of Rs21 billion in CY22 against a net profit of Rs18 billion in CY21. Moreover, the EPS value increased to Rs83.45 per share in CY22 compared to Rs73.83 posted in CY21.

Historical Analysis – CY18-CY22

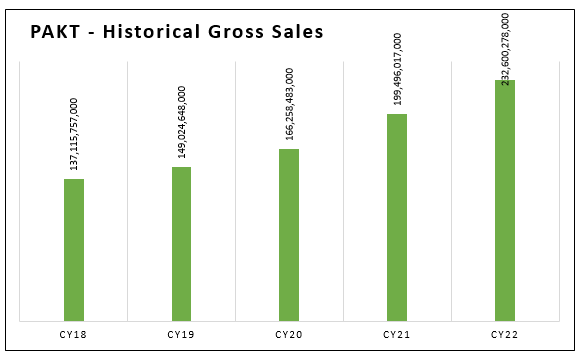

An increasing trend has been found in the company’s financials in the last five years (from CY18 to CY22). This is how the PAKT posted the highest of the previous five years’ earnings in CY22.

In 2018, the company posted a gross revenue of Rs137 billion which moved to Rs149 billion in CY19. Incremented gross sales of Rs166 billion were posted in CY20 and Rs199 billion in CY21. The highest of half-decade revenue earned by the company in CY22 was Rs232 billion.

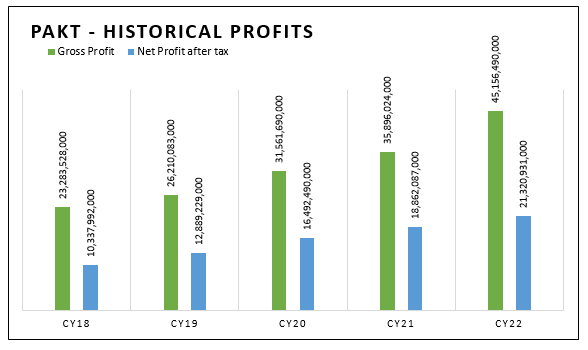

Likewise, the PAKT posted a gross profit and net profit of Rs45 billion and Rs21 billion, respectively in CY22, the highest of the last five years.

The gross profit earned in CY18 was Rs23 billion which gradually moved up to Rs45 billion in CY22. The net profit moved from Rs10 billion in CY18 to Rs21 billion in CY22, respectively.

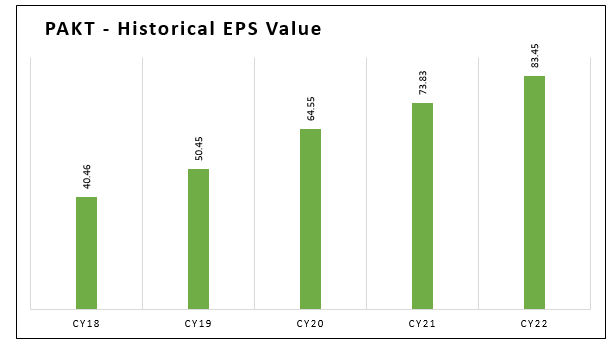

In CY22, the company achieved its highest EPS value in the last five years, posting Rs83.45 per share. The EPS value moved up from the capacity of Rs40.46 per share in CY18 to the current value.

Credit: Independent News Pakistan-WealthPk