INP-WealthPk

Ayesha Mudassar

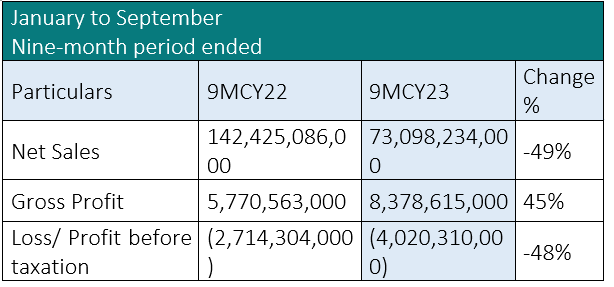

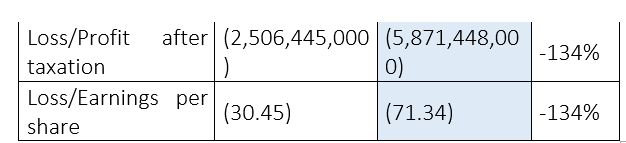

Pak Suzuki Motor Company Limited (PSMC) experienced a big decline of 49% and 134% in net sales revenue and net profits, respectively, in the first nine months (January-September) of the just-concluded calendar year 2023 compared to the corresponding period of 2022, WealthPK reports. The decline in net sales turnover and profitability was mainly due to lower sales volume of Completely Knocked Down (CKD) and Completely Built Units (CBU) on account of import restrictions and demand contraction. As per the company's quarterly report, net sales revenue declined from Rs142.4 billion to Rs73 billion in 9MCY23. The company reported a net loss of Rs5.8 billion during the nine months as compared to a net loss of Rs2.5 billion in the same period last year. The automobile assembler posted a loss per share of Rs71.34 for the first three quarters of 2023.

However, the company’s gross profit rose from Rs5.7 billion to Rs8.3 billion during the period under review.

Quarterly review

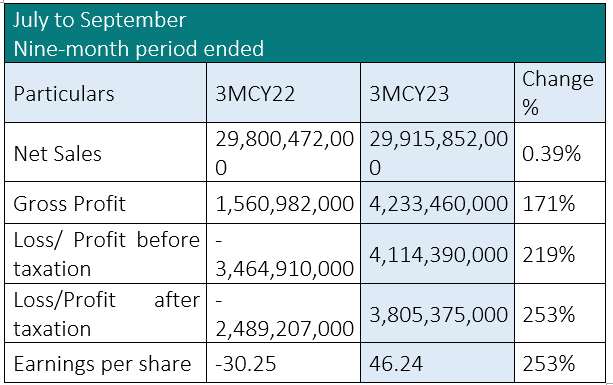

In the third quarter (July-September) of 2023, PSMC sales decreased 0.39% compared to the corresponding period of last year. However, the company posted before and after-tax profits of Rs4.1 billion and Rs3.8 billion, respectively, in this quarter compared to net losses it suffered over the same period of 2022.

Company profile

Pak Suzuki Motor Company was incorporated in Pakistan as a public limited company in August 1983. The company is engaged in the assembling, progressive manufacturing and marketing of Suzuki cars, pickups, vans, motorcycles and related spare parts.

Industry overview

With the development of the domestic engineering base, the automobile sector provides import substitution for local consumption. The industry employs more than 500,000 people directly and indirectly and makes a sizable contribution to the national exchequer. Throughout the nine months of 2023, the automotive industry had to face import compression measures, which were introduced to address the balance of payment crisis and to promote local production. However, these restrictions on essential components created immense challenges for the manufacturing processes, which also led to disruption in the vendor supply chain, frequent plant shutdowns, and underutilisation of the company’s plant capacity.

Devaluation, rising inflation, and stringent fiscal measures have driven car prices out of reach for millions. Potential buyers are experiencing unprecedented late delivery times and non-availability of desired car variants due to disruption in supplies. Moreover, the increased tax burden further constrained the sector’s growth potential. The automobile sector expects an industry-friendly operating environment in the coming months to overcome the challenges.

Credit: INP-WealthPk