INP-WealthPk

Shams ul Nisa

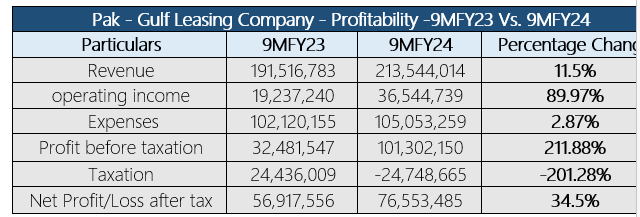

Pak-Gulf Leasing Company's financial report reveals a moderate increase in revenue by 11.5%, operating income by 89.97%, and net profit by 34.5% in nine months of the Fiscal Year 2024, reports WealthPK.

The company reported a revenue of Rs213.5 million and a net profit of Rs76.5 million in the 9MFY24 due to a rise in the lease finance activities during the review period. Furthermore, the operating income stood at Rs36.5 million compared to Rs19.2 million in 9MFY23. A slight rise in administrative and operating expenses and finance costs resulted in a 2.87% expansion in the company's expenses to Rs105.0 million in 9MFY24.

![]()

Additionally, the earnings per share (EPS) increased from Rs1.15 in 9MFY23 to Rs1.55 in 9MFY24, indicating higher value generation and returns for the shareholders.

Historical trend

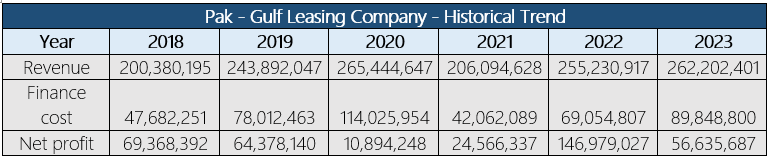

The last six years have seen a steady increase in the company's revenue, with the highest of Rs265.44 million reported in 2020. The company's revenue increased from Rs200.38 million in 2018 with only a single dip to Rs206.09 million in 2021. It increased again to Rs255.2 million in 2022 and Rs262.2 million in 2023. The finance cost also showed a similar pattern, rising from Rs47.68 million in 2018 to a peak of Rs114.02 million in 2020. The company saw a noteworthy decrease of Rs42.06 million in 2021, which suggests improved cost control during this time. In the subsequent years, it grew to Rs89.8 million in 2023. This growth in finance costs implies that the company depends on external funding for expansion.

![]()

On the other hand, the net profit fluctuated during the six years, dropping from Rs69.3 million in 2018 to a low of Rs10.89 million. The company had its highest net profit of Rs146.9 million in 2022 but failed to maintain it in 2023, resulting in a massive decline to Rs56.6 million. The earnings per share showed fluctuating patterns, mainly driven by revenue and net profit fluctuations. With an ESP of Rs2.73 in 2018, the company ended the period at an EPS of Rs1.14 in 2023. The highest earnings per share during the six years was reported in 2022 at Rs2.97, while the lowest was in 2020 at Rs0.43.

Liquidity position

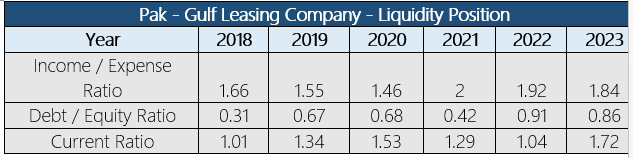

Over the last six years, the company's liquidity position has demonstrated a declining risk, as shown by the debt-to-equity ratio consistently remaining below 1. However, the company noticed a rise in the debt-to-equity ratio in 2022 to 0.91 but declined slightly in 2023 to 0.86.

The current ratio reveals how a company controls the risks by using assets to pay down debt. The company's current ratio stayed over 1.2 from 2019 to 2023. Over the years, it stayed above, indicating a stable liquidity position. Starting from 1.01 in 2018, it gradually reached the highest of 1.72 in 2023.

Leasing sector

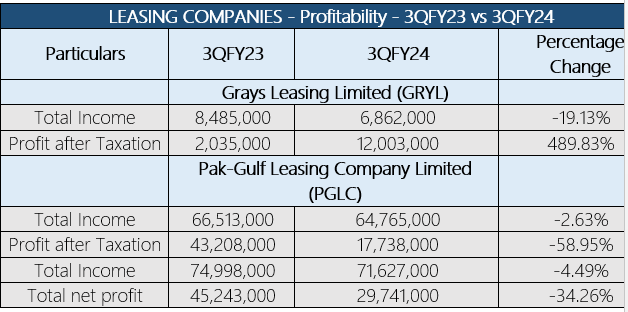

Significant variations exist in the total income and net profit of the leasing sector during 3QFY24 and 2QFY23. The sector includes Grays Leasing Limited (GRYL) and Pak-Gulf Leasing Company Limited (PGLC). Both companies witnessed a decline of around 19.13% and 2.63% in total income in 3QFY24 compared to the same quarter last year.

However, GRYL's net profit increased massively to Rs12.0 million, up by 489.83% from Rs2.0 million in 3QFY23. The PGLC's net profit dipped by 58.95% to Rs17.7 million in 3QFY24. Overall, the sector reported a decline of 4.49% in total income from Rs74.9 million in 3QFY23 to Rs71.6 million in 3QFY24. Furthermore, the total net profit of the sector slid to Rs29.7 million in 3QFY24, down by 34.26%.

Company profile

Pak-Gulf Leasing Company Limited was established in Pakistan on December 27, 1994, as a public limited company. It started operating on September 16, 1996. Leasing is the company's primary commercial activity.

Credit: INP-WealthPk