INP-WealthPk

Shams ul Nisa

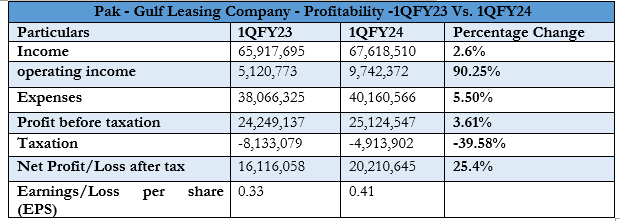

The Pak-Gulf Leasing Company's profit after tax increased by 25.4%, clocking in at Rs20.2 million for the quarter that ended September 2023, compared to a profit of Rs16.1 million in the same period last year, report WealthPK. During the 1QFY24, the company made an income of Rs 67.6 million, 2.6% more than Rs 65.9 million in 1QFY23. The operating profit stood at Rs 9.7 million against Rs5.12 million in the corresponding period of last year, depicting a fall of 93.81% year-over-year growth.

On the expenses front, the administrative and operating expenses declined slightly, but the hike in financial costs resulted in an expansion of 5.50% in overall expenses to stand at Rs40.16 million in 1QFY24. During the quarter under review, profit before tax increased by 3.61%, which was Rs25.1 million in 1QFY24, compared to the same quarter the previous year, which stood at Rs24.2 million. The earnings per share moved to Rs 0.41 during the first quarter, from Rs 0.33 in 1QFY23.

Historical Trend

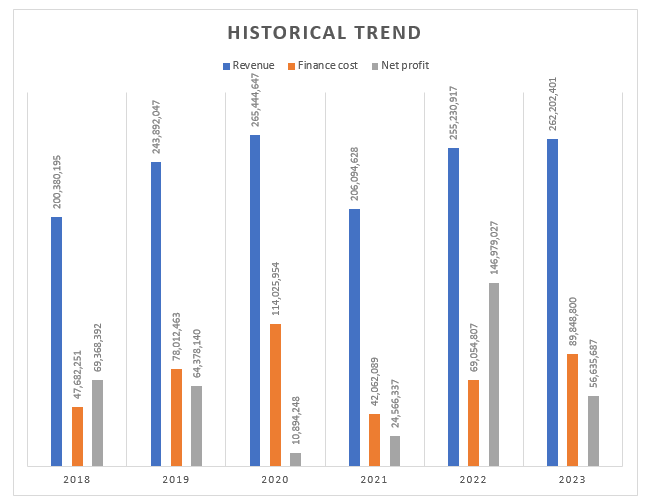

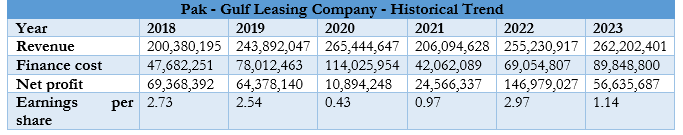

The historical revenue trend of Pak-Gulf Leasing Company shows a steady increase in the last six years. The company observed the highest revenue of Rs265.44 million in 2020. Starting from Rs200.38 million in 2018, the company's revenue went increasing, with only one dip of Rs206.09 million in 2021. However, it rebounded to Rs255.2 million in 2022. The company earned a revenue of Rs262.2 million in 2023.

A similar pattern was followed by the finance cost, moving from Rs47.68 million in 2018 to the highest of Rs114.02 million in 2020. The company observed a significant reduction of Rs42.06 million, indicating better cost management during this period. In the subsequent years, it fattened to Rs69.05 million in 2022 and Rs89.8 million in 2023. The last six years' revenue and finance cost analysis shows that the company relies on finances to foster growth.

The net profit remained volatile as it fell from Rs69.3 million in 2018 to the lowest of Rs10.89 million over the six years. In 2022, the company managed to earn the highest of Rs146.9 million net profit, but failed to sustain it in 2023, dropping to Rs56.6 million. The fluctuating trend in revenue and net profit caused varying patterns in earnings per share. The company began six years ago in 2018 with an ESP of Rs2.73, which was reduced to Rs1.14 in 2023. Over the six years, the highest earnings per share of Rs2.97 was recorded in 2022, and the lowest of Rs0.43 in 2020.

Liquidity Position

The liquidity position of the company during the past six years reflects lower risk as the debt-to-equity ratio remained low. However, in recent years the company observed an increase in ratio, standing at the highest of 0.91 in 2022. Furthermore, it stood at 0.86 in 2023.

![]()

The current ratio shows how a company manages the risks of covering debt using assets. A ratio greater than 1.2 is considered safe, and the company's current ratio remained above 1.2 over the years 2019 to 2023, while it was slightly below 1.01 in 2018.

Financial Ratios

The financial ratios of the Pak-Gulf Leasing Company grew substantially from 4.1% in 2020 to 57.59% in 2022 but declined to 21.6% in 2023. This reflects that in the recent year 2023, the company's profitability declined significantly due to macroeconomic instability. Earnings per share growth remained volatile, as the company witnessed loss per share growth of 83.07% in 2020 and 61.62% in 2023. However, 2021 and 2022 reflect ample earnings per share growth at 125.58% and 206.19%, respectively.

![]()

Similarly, price/earnings to growth (PEG) measures the value of stock. During 2021 and 2022, the PEG remained below 1, showcasing that the stock of the company is undervalued and a potential buy. In contrast, the company's PEG remained negative in 2020 and 2023, indicating negative growth of the company during this period.

Company profile

Pak-Gulf Leasing Company Limited was established in Pakistan on December 27, 1994, as a public limited company. It started operating on September 16, 1996. Leasing is the company's primary commercial activity.

inpCredit: INP-WealthPk