INP-WealthPk

Hifsa Raja

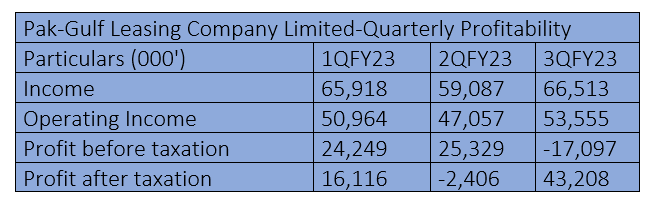

Pak-Gulf Leasing Company Limited experienced fluctuations in income, operating income and profitability in the first nine months of the just-concluded fiscal year 2022-23. In the first quarter (July-Sept) of FY23, the company posted an income of Rs65 million, an operating profit of Rs50.9 million and a net profit of Rs16 million.

In the second quarter (Oct-Dec), the company posted an income of Rs59 million and an operating profit of Rs25 million. The firm, however, posted a net loss of Rs2.4 million during this quarter. In the third quarter (Jan-March), the company posted an income of Rs66 million, an operating income of Rs53.5 million and a net profit of Rs43 million. The financial performance of Pak-Gulf Leasing Company during the first three quarters of FY23 displayed varying trends.

While the company witnessed a decline in income and operating income during the second quarter, it demonstrated resilience by recovering and achieving higher figures in the subsequent quarter. The company faced a significant challenge in the third quarter, reporting a loss-before-taxation, primarily impacting its profitability. The recovery in profitability after taxation during the third quarter from a loss-after-tax was an encouraging sign, indicating the company's management implemented effective measures to gain profitability.

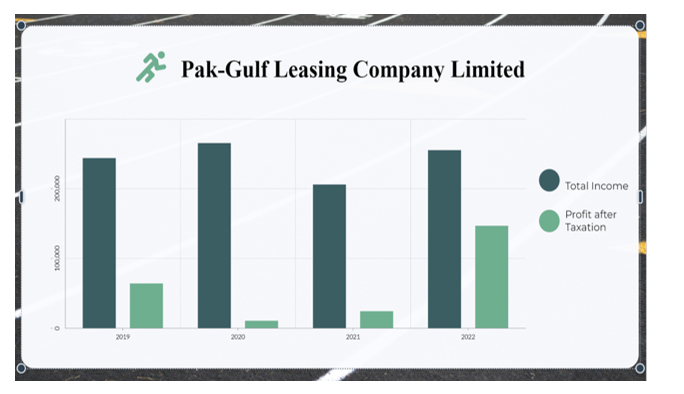

Pak-Gulf Leasing Company's fluctuating total income and varying profitability over the past four years indicate the company's ability to navigate changing market conditions and adapt to new challenges. As the company continues to grow and expand its operations, it will be crucial to focus on sustainable profitability and implement effective strategies to drive long-term success.

Performance in FY22

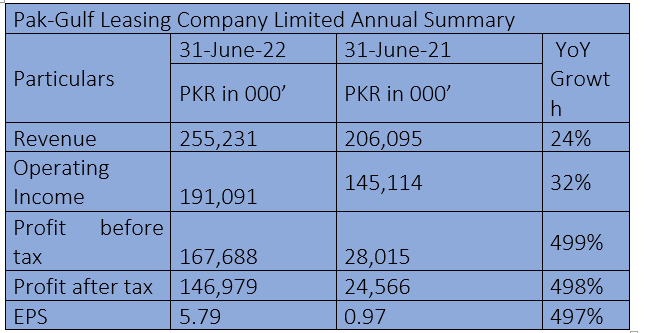

In the fiscal year 2021-22, the company's net sales increased to Rs255 million from Rs206 million the previous year, indicating a growth of 24%. The operating income increased to Rs191 million in FY22, up 32% from the previous year's Rs145 million.

The company's profit-before-tax jumped to Rs167 million in FY22 from previous year's Rs28 million, recording a mammoth 499% increase. Likewise, the company saw its profit-after-tax leap to Rs146 million in FY22 from previous year's Rs24 million, posting a gigantic 498% growth.

Earnings per share (EPS)

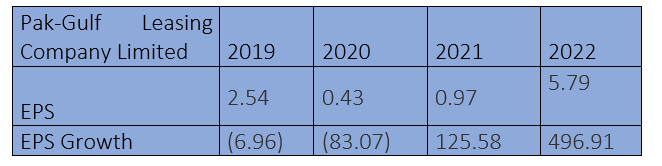

The company's earnings per share remained healthy in 2019 and 2022, but dipped in 2020 and 2021. However, the EPS remained positive throughout these years.

The fluctuations in EPS reflect the impact of various factors such as market dynamics, industry trends, and the company's strategic initiatives. Investors and stakeholders should consider these factors along with other financial indicators, such as revenue and profitability, to gain a comprehensive understanding of Pak-Gulf Leasing's financial performance. Pak-Gulf Leasing Company showcased a remarkable improvement in its EPS growth in 2022 when it stood at substantial 496.91%. This signifies the company's strong financial performance and its ability to generate higher profits. The significant EPS growth is a testament to Pak-Gulf Leasing Company's strategic initiatives, sound business practices and successful execution of its financial strategies.

Ratio analysis

In 2019, net profit margin was 26.40%, but in 2020, it declined to 4.10%. Nevertheless, it moved back up to 11.92% in 2021 before jumping to 57.59% in 2022. This remarkable turnaround in net profit margin in 2022 indicates a significant increase in profitability, which can be attributed to successful strategic decisions, effective cost management and increased revenue generation.

Industry comparison

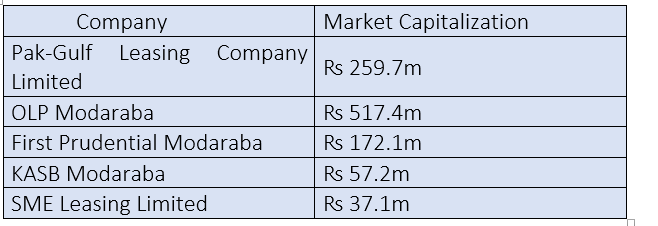

Pak-Gulf Leasing Company Limited's competitors include OLP Modaraba, First Prudential Modaraba, KASB Modaraba, and SME Leasing Limited.

Pak-Gulf Leasing Company's market capitalisation stands at ₨259 million. OLP Modaraba has the highest market value of ₨517 million, and SME Leasing Limited has the lowest value of Rs37 million.

Future prospects

Rising global and domestic commodity prices, along with rising inflation and interest rates, will impact business growth. Lease writing and financing in such a scenario will be limited until the political uncertainty ends, along with the inflationary outlook, which appears to persist due to continued international conflict and high commodity prices, coupled with a recession setting in the European and North American markets. Under the circumstances, although there will be opportunities to lease and finance, it will be imperative to maintain prudence and any substantial risk-taking will be avoided. The business is expected to continue with tried and tested customers and where there is a continued profitability track and sectoral stability exists.

Company profile

Pak-Gulf Leasing Company was incorporated in Pakistan on December 27, 1994, as a public limited company under the now repealed Companies Ordinance, 1984 (now Companies Act, 2017). It commenced its operations on September 16, 1996.

Credit: INP-WealthPk