INP-WealthPk

Ayesha Mudassar

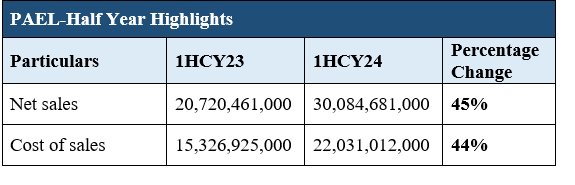

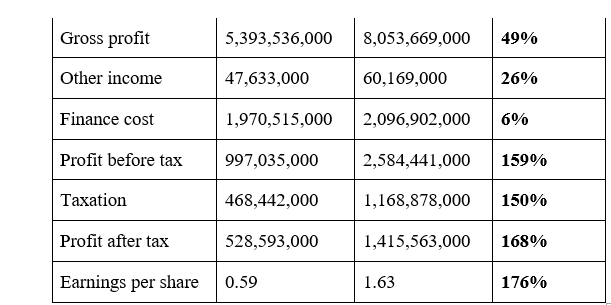

Pak Elektron Limited (PAEL) witnessed a substantial increase in profit during the first half of the ongoing calendar year of 2024, with pre-tax profit rising by 159% and after-tax profit by 168% compared to the corresponding period of the last calendar, according to WealthPK. In the first half of CY2024, the company achieved a pre-tax profit of Rs2.5 billion and an after-tax profit of Rs1.4 billion. This resulted in earnings per share (EPS) of Rs1.63 versus an EPS of Rs0.59 recorded in the same period last year.

The profit growth was primarily attributed to significant sales increases, higher other income, relaxed import restrictions, and overall market stability. The company reported a revenue increase to Rs30 billion, representing a 45% rise compared to the corresponding period of the earlier calendar year. Additionally, the cost of sales grew by 44% year-on-year (YoY); however, this increase was proportionally less than the revenue growth. Consequently, the gross profit improved by 49% YoY to Rs8 billion in the first half of CY2024.

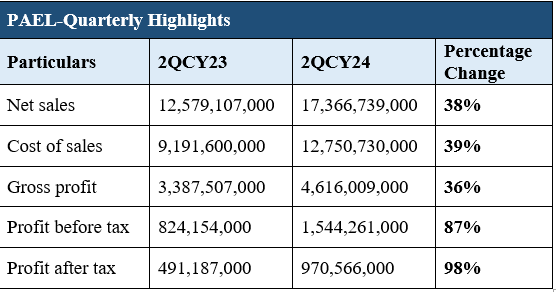

Quarterly Analysis

Compared to the second quarter of CY2023, the company demonstrated an improved financial performance in 2QCY24. The company reported a net revenue of Rs 17.3 billion, marking a 38% rise YoY. This revenue growth highlights the company’s effective sales strategies, successful product offerings, and strong customer demand. Moreover, the company experienced a substantial 98% rise in net profit mainly due to higher sales and increased additional income.

Pattern of Shareholding

As of December 31, 2023, PAL had 856 million shares outstanding distributed among 10,799 shareholders. The general public holds a substantial 48% of the shares, while 31% are owned by the company's directors, CEO, their spouse, and minor children. Insurance companies and foreign entities hold 7% and 6% of the shares, respectively. The remaining ownership is distributed among other categories including Modarabas, pension funds, and investment companies.

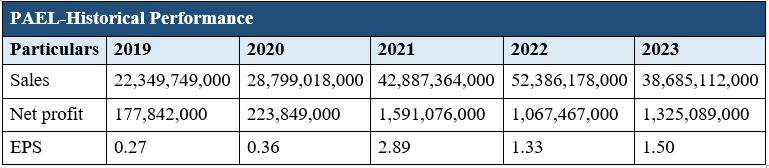

Operational Performance (2019-2023)

Pak Elektron Limited observed a significant financial growth in 2020 and 2021, with a notable increase in sales and net profit. However, in 2022, the profit margins were squeezed by higher costs and taxes despite revenue growth. In 2020, the company achieved a 29% rise in sales and a 26% increase in net profit. Key factors contributing to this growth included the amalgamation of PEL Marketing Private Limited (PMPL) into PAEL, the launch company's power transformer manufacturing facility, and a strategic partnership with Panasonic Marketing Middle East & Africa (PMMAF). In 2021, PAEL saw a 49% YoY increase in net sales which clocked in at Rs42.8 billion. Furthermore, the net profit increased by 611% to reach Rs1.5 billion with EPS of Rs2.89, representing the highest profit and EPS among all the years under review.

In 2022, Pak Elektron reported a 22% YoY increase in revenue, driven by higher revenues from its power division. However, higher finance costs and additional taxes constricted the company’s bottom line by 33% to Rs1.06 billion with EPS of Rs1.33. In 2023, the company's net sales dwindled by 26% YoY due to sluggish industrial activities, import restrictions, and reduced consumer purchasing power. Nevertheless, limited supplies enabled the company to take advantage and pass the onus of high raw material costs and currency depreciation to consumers. As a consequence, the company’s net profit grew by 24% for the year compared to 2022.

About the company

Pak Elektron Limited (PAEL) was established as a public limited company in Pakistan in 1956. The company specializes in the manufacturing and sale of domestic appliances and electrical capital goods, operating through two main divisions: power and appliances divisions. The power division focuses on the production and sale of transformers, switchgear, and energy meters, and is also involved in engineering, procurement, and construction contracting activities. The appliances division manufactures, assembles, and distributes a range of home appliances, including refrigerators, deep freezers, air conditioners, microwave ovens, LED televisions, washing machines, and water dispensers.

Credit: INP-WealthPk