INP-WealthPk

Ayesha Mudassar

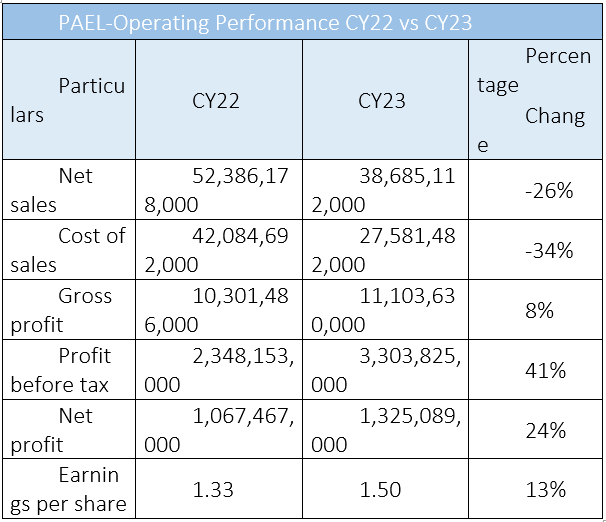

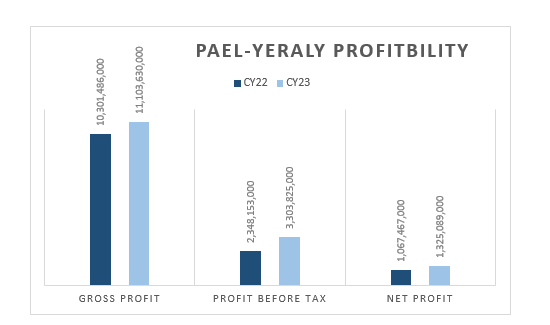

The net sales of Pak Elektron Limited (PAEL) dwindled by 26% in the calendar year 2023 as compared to CY22, reports WealthPK. Sluggish industrial activities along with reduced consumer purchasing power and import restrictions contributed to lower sales during the year.

However, the limited supplies enabled the company to take advantage and pass the onus of high raw material costs and rupee depreciation to its consumers. As a consequence, the PAEL's gross profit grew by 8%, profit-before-tax (PBT) by 41% and net profit by 24% in CY23 compared to CY22. During the year under review, the company made gross profit and PBT of Rs11.1 billion and Rs3.3 billion, respectively. The net profit stood at Rs1.3 billion compared to Rs1.0 billion in 2022, resulting in earnings per share (EPS) of Rs1.50 versus Rs1.33 in CY22.

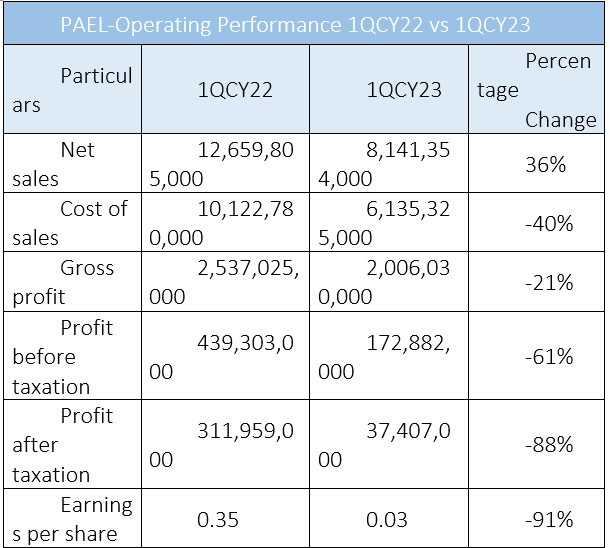

1QCY22 vs 1QCY23

In the first quarter (January-March) of 2023, PAEL sales decreased 36% compared to the corresponding period of CY22. The company's revenue was recorded at Rs8.1 billion in 1QCY23 against Rs12.6 billion in the corresponding period last year. Furthermore, the company experienced a decline of 21% and 88% in gross and after-tax profits, respectively, in 1QFY23.

During the quarter under review, the company’s operations remained under pressure due to numerous factors, including growing inflationary trends, weakening local currency and rising policy rates.

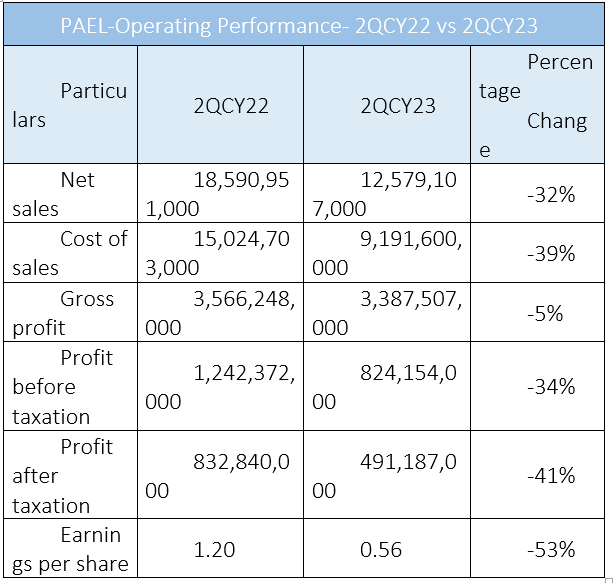

2QCY22 vs 2QCY23

In comparison to 2QCY22, PAEL’s financial performance worsened in the second quarter of CY23. The company reported a net revenue of Rs12.5 billion with a 32% decline compared to the same period last year. The revenue decline was mainly attributable to import restrictions curtailing the supply side, high inflationary pressures and lower disposable income. Moreover, PAEL witnessed a decline in profitability mainly due to higher finance costs linked with constant increases in interest rates.

3QCY22 vs 3QCY23

During the third quarter of CY23, the company achieved a revenue of Rs9.9 billion as compared to Rs12.07 billion in 3QCY22, representing a decline of 18%.

However, the gross profit, profit-before-tax and profit-after-tax increased by 19%, 44% and 18%, respectively, as compared with 3QCY22. Moreover, the company posted EPS of Rs0.48 for 3QCY23 as compared to EPS of Rs0.46 in 3QCY22.

Pattern of shareholding

As of December 31, 2023, PAEL had a total of 856 million outstanding shares held by 10,799 shareholders. The general public had a major stake of 48% followed by the company's directors, the CEO, and their spouses and minor children holding 31% shares. Furthermore, the insurance and foreign companies held 7% and 6% of outstanding shares. The remaining ownership is distributed among other categories of shareholding Modarabas, pension funds and investment companies.

Financial performance (2019-22)

PAEL’s top line followed an upward trajectory until 2022. However, its bottom line took a plunge in 2022. In 2020, the company’s sales and net profit posted a vigorous 29% and 26% year-on-year rise. Three developments, including the amalgamation of PEL Marketing Private Limited (PMPL) into PAEL, the initiation of commercial operations of the company's power transformer manufacturing facility and collaboration with Panasonic Marketing Middle East & Africa, produced a profound impact on its sales and profitability.

The year 2021 witnessed a 49% YoY increase in net sales, which clocked in at Rs42.8 billion. Furthermore, the net profit jumped by a mammoth 611% to reach Rs1.5 billion with EPS of Rs2.89 – the highest among all the years under consideration. PAEL's top line grew by 22% YoY in 2022. This was on the heels of a rise in power division revenues. However, the higher finance cost along with the implementation of additional taxes constricted PAEL's bottom line by 33%. Net profit stood at Rs1.06 billion with EPS of Rs1.33.

About the company

Pak Elektron was incorporated in Pakistan as a public limited company in 1956. The company is engaged in the manufacturing and sale of domestic appliances and electrical capital goods. It operates through power and appliances divisions. The power division manufactures and sells transformers, switchgear, and energy meters, as well as engages in engineering, procurement and contracting activities. The appliances division manufactures, assembles and distributes refrigerators, deep freezers, air conditioners, microwave ovens, LED televisions, washing machines, water dispensers and other home appliances.

Credit: INP-WealthPk