INP-WealthPk

Hifsa Raja

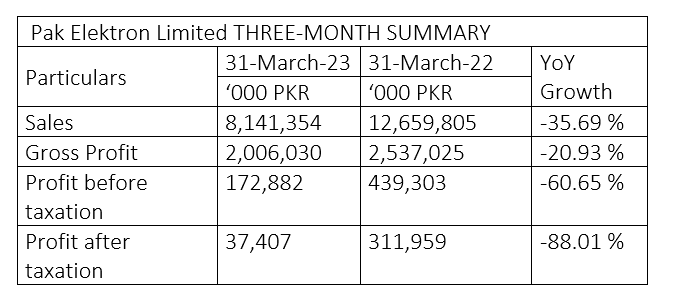

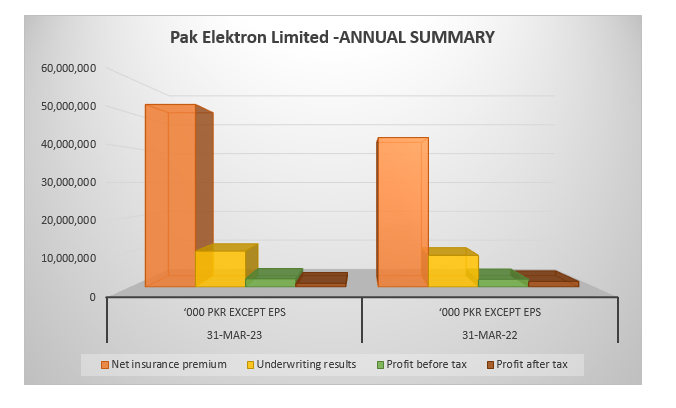

Pak Elektron Limited posted sales of Rs8.1 billion in the first quarter of the ongoing calendar year 2023 (1QCY23) compared with Rs12 billion over the corresponding period of the previous year, posting a negative growth of 35%. The gross profit also dropped 20% to Rs2 billion from Rs2.5 billion in 1QCY22. Due to an increase in expenses, the profit-before-taxation also plunged by 60% in 1QCY23 to Rs172 million from Rs439 million over the corresponding period of CY22. The profit-after-tax also plunged 88% to Rs37 million in 1QCY23 from Rs311 million in 1QCY22.

Despite the challenging quarter, Pak Elektron Limited's ability to sustain its operations and continue generating profit highlights its resilience in the face of adversity. The company's efforts to address cost management and adapt to changing market conditions are evident as it navigates through a period of uncertainty.

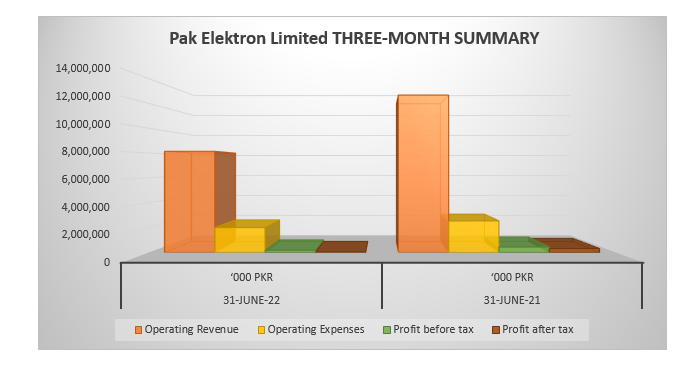

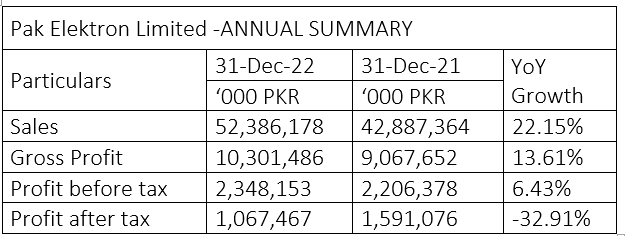

CY22 summary

During CY22, the company’s net sales went up 22% to Rs52 billion from Rs42 billion in CY21. The gross profit increased 13% to Rs10 billion in CY22 from Rs9 billion in CY21. The profit-before-tax in CY22 inched up by 6.4% to Rs2.3 billion from Rs2.2 billion in CY21. However, the profit-after-tax in CY22 decreased by 32% to Rs1 billion from Rs1.5 billion in CY21.

The annual summary of Pak Elektron Limited's financial performance indicates a company in transition. The growth in sales, gross profit, and the before-tax profit reflects the company's resilience and strategic efforts in a competitive market. However, the decline in net profit suggests the existence of challenges that impacted the company's bottom-line results.

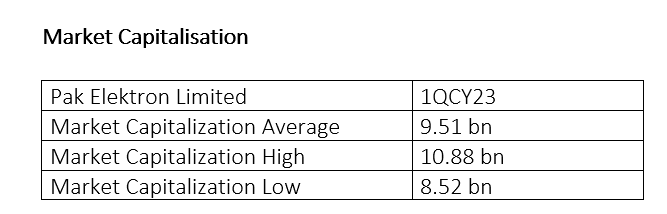

Pak Elektron Limited's average market cap in the first quarter of CY23 was Rs9.51 billion. During this time period, the company's market value peaked at Rs10.88 billion, suggesting a high level of investor trust. The lowest market valuation was Rs8.52 billion during the quarter under review.

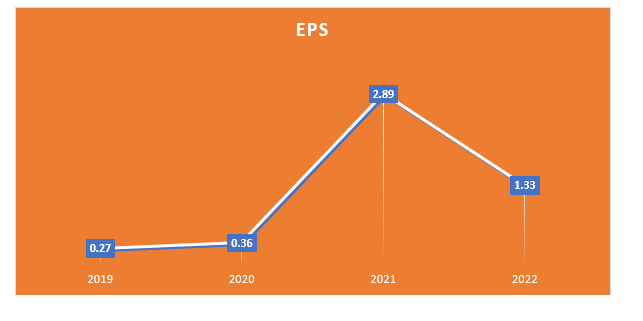

Earnings per share

The earnings per share of Pak Elektron Limited stood at Rs0.27 in 2019, Rs0.36 in 2020, Rs2.89 in 2021 and Rs1.33 in 2022. The fluctuation in EPS over the four years highlights the dynamic nature of Pak Elektron Limited's financial performance. The upward trajectory from 2019 to 2021, followed by a dip in 2022, could be influenced by various internal and external factors, including changes in revenue, expenses, cost management and market conditions.

Industry comparison

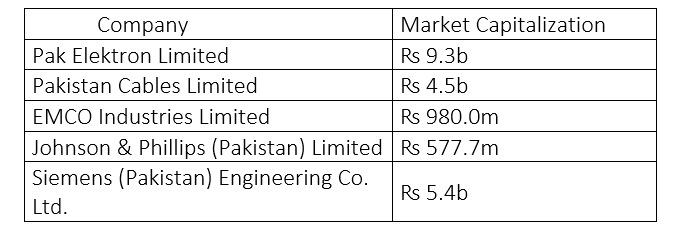

Pak Elektron Limited’s competitors include Pakistan Cables Limited, EMCO Industries Limited, Johnson & Phillips (Pakistan) Limited and Siemens (Pakistan) Engineering Co. Ltd.

Pak Elektron Limited has the highest market value of ₨9.3 billion among its competitors followed by Siemens Rs5.4 billion. Johnson & Phillips has the lowest market capitalisation of Rs577 million.

Ratio analysis

In 2018, the gross profit margin stood at 24.60%, suggesting that 24.60% of the revenue was retained as gross profit after accounting for production costs. The company had net profit margin of 4.82% during the same year. In 2019, the gross profit margin significantly decreased to 14.89%. Likewise, the net profit margin also significantly dropped to 0.80%, reflecting challenges in profitability. The company experienced a rebound in 2020, with the gross profit margin increasing to 22.23%. The net profit margin remained relatively low at 0.78%. In 2021, the gross profit margin slightly declined to 21.14%, possibly due to factors such as input cost fluctuations or market competition.

The net profit margin improved to 3.71%. The trend continued in 2022, as the gross profit margin decreased further to 19.66%. However, the net profit margin dipped again in 2022, reaching 2.04%. This indicated potential challenges in sustaining profitability. The fluctuating trends in both the gross profit and net profit margins highlight the dynamic nature of Pak Elektron Limited's financial performance over the five-year period. The variations could be influenced by a combination of internal and external factors.

About the company

Pak Elektron Limited manufactures and sells electrical capital goods and domestic appliances. It operates through power and appliances divisions. The power division manufactures and sells transformers, switchgears and energy meters, as well as engages in engineering, procurement and construction contracting activities. The appliances division manufactures, assembles and distributes refrigerators, deep freezers, air conditioners, microwave ovens, LED televisions, washing machines, water dispensers and other home appliances. The company also exports its products. Pak Elektron Limited was incorporated in 1956 and is headquartered in Lahore, Pakistan.

Credit: INP-WealthPk