INP-WealthPk

Hifsa Raja

Property developer Pace (Pakistan) Limited’s revenue decreased 80% to Rs141 million in the first half of the ongoing fiscal year 2022-23 (1HFY23) from Rs712 million over the same period last fiscal. It suggests the company faced challenges in generating revenue possibly due to supply chain disruptions caused by the Covid-19 pandemic and other external factors, reports WealthPK.

The company saw its gross profit decrease by 37% to Rs109 million in 1HFY23 from Rs174 million in 1HFY22. This suggests the company was able to reduce its cost of goods sold and improve its pricing strategy, though it was still operating at a loss. The company’s loss-before-tax increased by 118% to Rs437 million from a loss of Rs200 million in the two comparable periods, indicating that the company had to incur higher finance costs, taxes and other expenses during the period. Its net loss also increased by 89% to Rs427 million in 1HFY23 from a net loss of Rs226 million in 1HFY22. This suggests that after accounting for all expenses, the company was not able to generate a profit during the period.

Overall, the financial performance of Pace (Pakistan) Limited in the first three months of FY23 remained subdued. Though the company was able to reduce its gross loss, its revenue significantly declined, and its losses before and after tax increased significantly. This indicates the company needs to focus on improving its revenue generation and cost management strategies to improve its profitability.

Performance in 2021-22

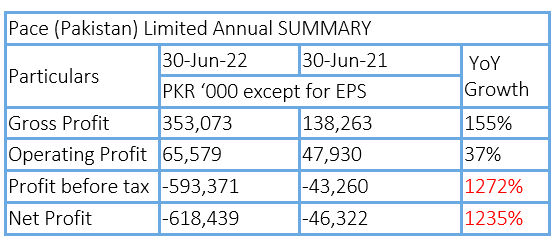

The property developer’s gross profit increased significantly by 155% to Rs353 million in FY22 from Rs138 million in FY21. This indicates that the company was able to generate more revenue and/or reduce its cost of goods sold. The operating profit also increased, but at a slower pace of 37%, from Rs47.9 million in FY21 to Rs65.6 million in FY22. This indicates that the company’s operating expenses increased, possibly due to increased marketing and administrative costs.

The company’s loss-before-tax ballooned from Rs43 million in FY21 to Rs593 million in FY22 at a phenomenal pace of 1272%. This shows the company incurred higher finance costs, taxes and other expenses during the period. The net loss also shot up to Rs618 million in FY22 from a loss of Rs46 million in FY21, posting a staggering increase of 1235%.

About the company

Pace (Pakistan) Limited was incorporated in Pakistan under the now repealed Companies Ordinance, 1984 and is listed on the Pakistan Stock Exchange. The company builds, acquires, manages and sells condominiums, departmental stores, shopping plazas, supermarkets, utility stores, housing societies, plots and other properties. It also carries out commercial, industrial and other related activities in and out of Pakistan.

Credit: Independent News Pakistan-WealthPk