INP-WealthPk

Amir Saeed

National Electric Power Regulatory Authority’s (NEPRA) 2024 report reveals systemic inefficiencies, governance failures, and financial mismanagement in the power sector, highlighting distribution companies’ losses, out-of-merit generation, and IPP penalties as key contributors to escalating circular debt and soaring electricity costs.

The NEPRA recently published its State of the Industry Report 2024, shedding light on the critical challenges plaguing Pakistan’s power sector. The report indicates that the country’s transmission system is hindered by significant inefficiencies, including inadequate infrastructure and insufficient transformation capacity.

This has led to a reliance on costlier power plants, while more efficient alternatives remain underutilised. Consequently, operational costs have surged, driving up electricity prices for consumers and highlighting the urgent need for reforms to enhance the sector’s efficiency and affordability.

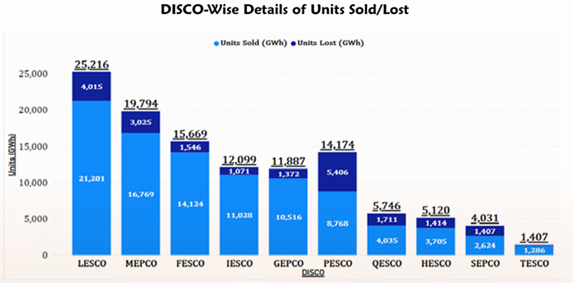

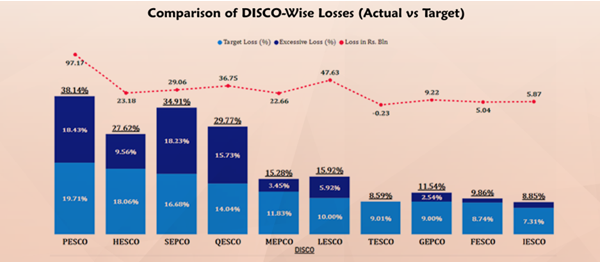

The following graph provides a detailed analysis of transmission and distribution (T&D) losses for each Disco, expressed as percentages. Total T&D losses for each Disco are displayed at the top of each bar, while the allowed losses and any additional losses exceeding the targeted thresholds are shown within the bars. Additionally, the financial implications of lost units surpassing the target losses for each Disco, measured in billion rupees, are highlighted with dotted lines.

One of the most pressing issues identified in Nepra’s report is the governance challenges faced by Discos. These companies struggle with mismanagement and lack of accountability, which prevents them from effectively recovering costs from consumers. As a result, unpaid dues have contributed to a staggering circular debt that reached Rs2.39 trillion by June 30, 2024.

This debt not only threatens the financial viability of power producers but also deters investment in the sector, further straining energy infrastructure. High T&D losses, coupled with less than full recovery of billed amounts, exacerbate this crisis. The growing circular debt compounded by defaulters owing Rs900.82 billion has hampered the operational efficacy of Discos.

High T&D losses and less than 100% recovery of the billed amount contribute to the accumulation of the circular debt. Talking to WealthPK, Ahsan Gaylani, a senior energy professional with extensive experience in sustainable energy, emphasised the urgent need for significant reforms in the power sector to address its chronic inefficiencies and governance challenges.

He advocated for major infrastructure upgrades, highlighting that the current state of Discos is marred by mismanagement and political interference, which have led to inadequate service delivery and financial losses. Gaylani suggested that privatising these distribution companies could enhance operational efficiency, as government oversight has historically resulted in poor performance.

He also pointed out that out-of-merit generation is a consequence of grid inefficiencies, where Independent Power Producers (IPPs) are compelled to operate for voltage stability due to the intermittent nature of renewable energy sources. “This situation is exacerbated by transmission constraints that prevent the use of lower-cost energy, leading to higher electricity prices for consumers.”

Gaylani stresses the importance of targeted investments in grid infrastructure and timely execution of projects to stabilise the power sector. Moreover, he called for a shift towards decentralised, renewable-based energy systems that focus on affordability and sustainability. “By promoting local resources and enhancing energy security, Pakistan can alleviate the burden of high electricity costs while fostering economic growth and industrialisation.”

Credit: INP-WealthPk