INP-WealthPk

Fakiha Tariq

Oil & Gas Development Company Limited (OGDCL) led the oil and gas sector by posting the highest revenue of Rs203 billion in the first six months (July-Dec) of fiscal year 2022-23, with the company’s revenue contributing 46% to the total sales achieved by the exploration sector in 1HFY23, reports WealthPK.

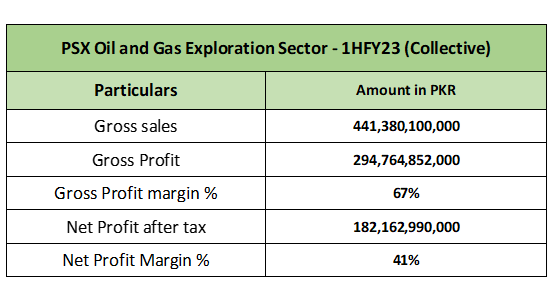

On the Pakistan Stock Exchange, the oil and gas exploration sector, with revenue of Rs441 billion in 1HFY23, consists of four large capital firms, which collectively posted gross profit of Rs294 billion and net profit of Rs183 billion in the same period. The sector came up with gross profit ratio of 67% and net profit ratio of 41% in the first half of FY23.

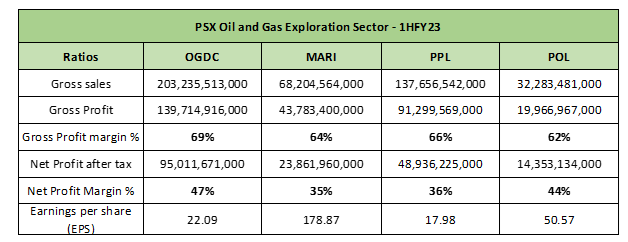

OGDCL is the largest company in the sector with a market capitalisation of Rs346.3 billion followed by Mari Petroleum Company Limited (MARI), which has a market cap of Rs190.8 billion. Pakistan Petroleum Limited (PPL) with a market cap of Rs167.7 billion is the third largest oil and gas exploration firm, whereas Pakistan Oilfields Limited (POL) ranks the fourth and the last firm with a market capitalisation of Rs119.4 billion. In the 1HFY23, OGDCL posted the highest gross profit of Rs139 billion and net profit of Rs95 billion, leaving behind its peers by a wide margin. By posting sales of Rs203 billion in 1HFY23, OGDCL contributed 46% to the sector’s collective revenue.

OGDCL posted highest gross and net profit ratios of 69% and 47%, respectively, in 1HFY23. It also posted EPS value of Rs22.09. PPL posted the second highest revenue of Rs137 billion and contributed 31% to the sector’s total revenue in 1HFY23. PPL’s gross profit and net profit clocked in at Rs91 billion and Rs48 billion, respectively. Thus, the gross profit and net profit ratios were calculated at 66% and 36%, respectively, in 1HFY23. PPL’s EPS value settled at Rs17.98.

By contributing 15% to the sector’s total revenue, MARI posted the third highest revenue of Rs68 billion in 1HFY23. MARI’s gross profit and net profit stood at Rs43 billion and Rs23 billion, respectively. Thus, the gross profit and net profit ratios were calculated at 64% and 35%, respectively, in 1HFY23. MARI’s EPS value was Rs17.98 in the first half of FY23.

Lastly, POL ranked fourth in the oil and gas exploration sector as it posted a revenue of Rs137 billion. In HYFY23, POL’s contribution to the sector’s total revenue remained the lowest at 7%. POL’s gross profit and net profit were reported to be Rs19 billion and Rs14 billion, respectively. Thus, the gross profit and net profit ratios were calculated at 62% and 44%, respectively. POL’s EPS value remained Rs50.57 in the first half of FY23.

Credit: Independent News Pakistan-WealthPk