INP-WealthPk

Ayesha Mudassar

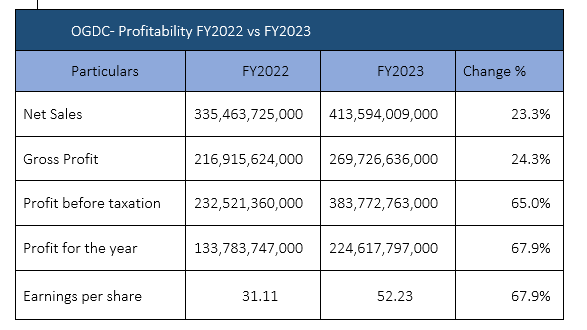

Oil and Gas Development Company (OGDC), Pakistan’s largest exploration and production (E&P) firm, saw its profit jump 67.9% to Rs224.6 billion during the fiscal year that ended June 30, 2023, due to a spike in oil prices and rupee depreciation. The company registered a profit of Rs133.7 billion the previous year, according to the profit or loss accounts filed with the Pakistan Stock Exchange.

Resultantly, the company’s earnings per share (EPS) increased to Rs52.23 during the period under review compared to Rs31.11 last year. Net sales surged by 23.3% to Rs413.5 billion during FY23 from Rs335.4 billion recorded in FY22. The increase in revenue is attributable to the weakening of the rupee against the US dollar. The company’s oil and gas exploration costs increased 22.1% to Rs19.02 billion in FY23 from Rs15.58 billion in FY22 given the higher cost of dry well (Bhambra-02) during the period tagged with higher seismic activities. The company’s other income showed an exponential growth of 232% year-on-year hitting Rs154.6 billion in FY23, compared to Rs46.5 billion in FY22, owing to massive exchange gains during the period coupled with higher interest income on cash and cash equivalents.

The fiscal year 2022-23 culminated successfully for E&P companies across the globe. The primary factors contributing to the growth of the sector were strong demand and prices of fossil fuels driven by sustained economic activities, the ongoing volatile geopolitical situation, and production supply curbs by the OPEC+ coalition. OGDC registered remarkable performance on the financial front by exploiting a favourable crude oil price environment. Moreover, a significant sum of Rs279 billion was contributed to the national exchequer on account of corporate tax, dividends, royalty, and government levies. Through successfully implementing cutting-edge technologies and industry’s best practices, the company achieved remarkable enhancements in oil and gas production across various exploration and development wells.

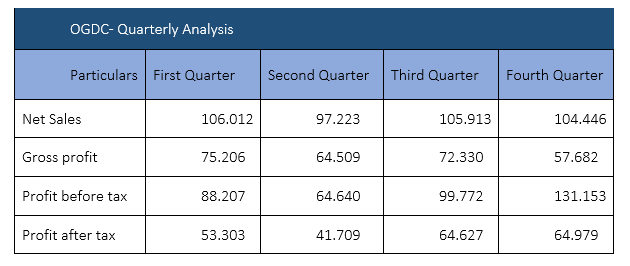

Quarterly review

Quarterly analysis reveals variations in net sales and gross profit, primarily attributable to quarter-wise fluctuations in crude oil prices and production. The profit-before-tax and profit-after-tax displayed a similar trend for Q1, Q2, and Q3.

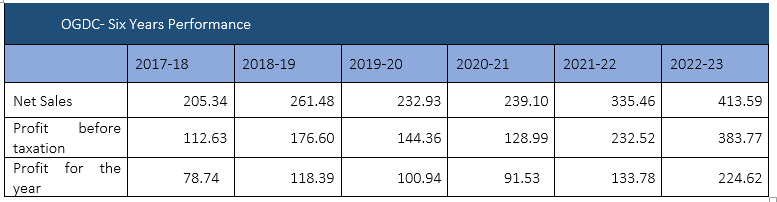

OGDC- past six years at a glance

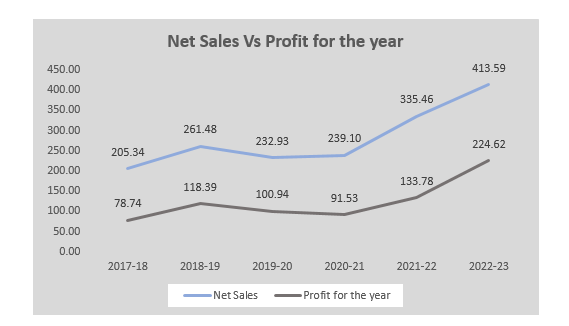

Historical analysis of OGDC net sales shows that during the last six years, the company posted the highest revenues in 2022-23. The company had a single dip in sales in 2019-20 compared to the previous year as its sales declined from Rs261.48 billion in FY19 to Rs232.93 billion in FY20.

Concerning net profit, the E&P company’s historical performance fluctuated over the years. The firm posted the highest net profit of Rs224.62 billion in FY23. However, the company had two dips in profit in FY20 and FY21.

Company profile

OGDCL was established in 1961 as a public sector corporation before being converted to a public limited company in October 1997. Its primary operations involve exploration, drilling operation services, production, reservoir management and engineering support. The company remains steadfast in its commitment to harnessing innovative technologies and best practices to further enhance production capabilities, contribute to the nation’s energy needs, and fuel economic growth.

Credit: INP-WealthPk