INP-WealthPk

Qudsia Bano

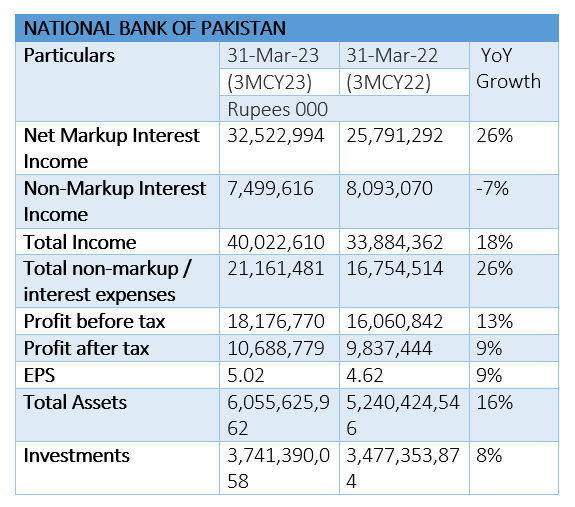

National Bank of Pakistan (NBP) achieved high profits from its investments during the first quarter (January-March) of 2023. During the three months, the bank's investment portfolio averaged Rs3.74 trillion compared to Rs3.47 trillion over the same period in 2022. The portfolio generated Rs32.5 billion in net markup/interest income, representing a substantial increase of Rs6.7 billion or 26% over Rs25.8 billion in the corresponding period of 2022. The average yield on investments was 16.85%, significantly higher than the 10.29% yield in the first quarter of 2022.

The bank's investment book is focused on shorter-duration securities in the available-for-sale category due to the higher policy rate environment. In terms of the loan book, which averaged Rs1.41 billion for the three-month period, it generated Rs43.5 billion in mark-up income. This represents a growth of Rs17.3 billion or 66.2% compared to Rs26.2 billion in the same period last year. The growth in income was achieved through both volume growth and favourable year-on-year rate variance, despite carrying a significant proportion of lower-yielding or non-performing public-sector loans.

The NBP’s operating expenses for the period under review amounted to Rs21.2 billion, reflecting a 26.3% increase compared to Rs16.8 billion in the same period last year. Human resources costs accounted for approximately 67.7% of the total operating expenses, totaling Rs14.3 billion compared to Rs11.6 billion in the first three months of 2022. The increase in human resource costs is attributed to annual pay increases, charges for defined benefit plans, and other HR-related provisions.

Property-related expenses amounted to Rs2.4 billion in the first quarter of 2023 compared to Rs2 billion over the same period of 2022, while IT-related expenses stood at Rs1.2 billion compared to Rs0.6 billion in 2022. The bank is currently making significant investments to improve and strengthen its core banking applications and IT infrastructure. Other operating expenses amounted to Rs3.2 billion, reflecting a 26.1% increase year-on-year, responding to general inflationary cost hikes. Overall, operating costs resulted in a cost-to-income ratio of 52.9%, which aligns with inflationary pressures and industry norms.

As a result, the bank achieved a profit-after-tax of Rs10.7 billion for the three-month period ending March 31, 2023, representing a Rs0.85 billion or 8.7% increase over Rs9.8 billion over the corresponding period of 2022. This translates to earnings per share of Rs5.02, up from Rs4.62 in 2022. The NBP maintains a diversified investment portfolio across zero-risk weighted government of Pakistan (GoP) instruments. These instruments are considered to have minimal or negligible credit risk, making them relatively safe investments. By investing in such instruments, the bank aims to mitigate the risk associated with its investment portfolio and ensure stability in its financial position.

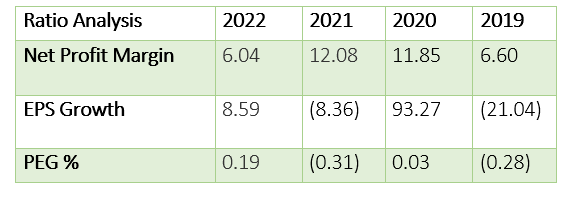

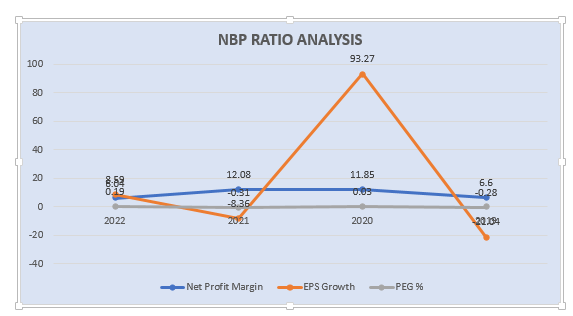

Net profit margin

The net profit margin measures the profitability of a company by determining the percentage of revenue that translates into net profit. In 2022, NBP's net profit margin declined to 6.04% from the previous year's margin of 12.08%. The bank’s profit margin stood at 11.85% in 2020 and 6.60% in 2019.

Earnings per share growth

The earnings per share (EPS) growth reflects the percentage change in a company's earnings per share over a specific period. NBP’s EPS increased by 8.59% in 2022, following a negative growth of 8.36% in 2021. In 2020, the bank achieved significant EPS growth of 93.27%, while in 2019, it had a negative growth of 21.04%. NBP's earnings per share increased in 2022 after a decline in the previous year, and the bank showed exceptional growth in 2020 compared to 2019.

Price/earnings to growth (PEG) ratio

The PEG ratio is used to assess a company's valuation relative to its earnings growth rate. A PEG ratio below 1 suggests an undervalued stock. In 2022, NBP had a PEG ratio of 0.19, indicating that the stock may have been undervalued compared to its earnings growth rate. Similarly, in 2020, the bank had a PEG ratio of 0.03, suggesting an undervalued stock, while in 2021 and 2019, the PEG ratios were negative (-0.31 and -0.28, respectively), indicating potential overvaluation. These figures imply that NBP's earnings growth rate outpaced its stock's valuation in recent years.

About the bank

NBP was incorporated in Pakistan under the National Bank of Pakistan Ordinance, 1949. The bank is engaged in providing commercial banking and related services in Pakistan and abroad. The bank also handles treasury transactions for the GoP as an agent of the State Bank of Pakistan.

Credit: Independent News Pakistan-WealthPk