INP-WealthPk

Shams ul Nisa

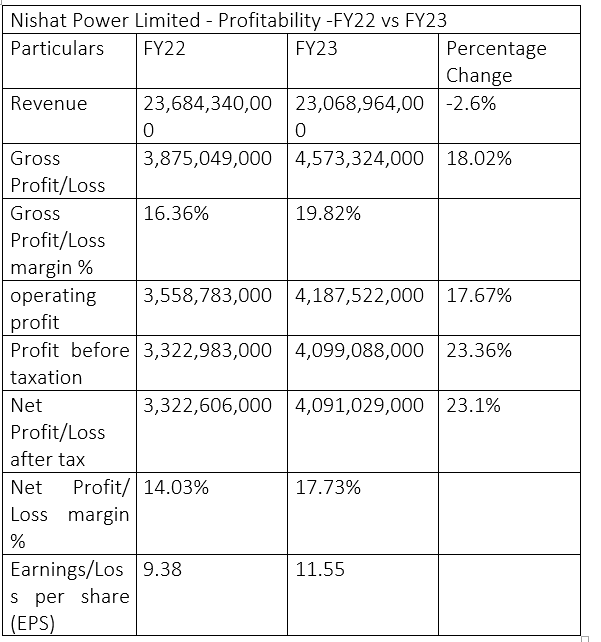

Nishat Power Limited’s revenue decreased by 2.6%, but gross and net profits increased substantially by 18.02% and 23.36%, respectively, during the fiscal year 2022-23 compared to the previous year, WealthPK reports. This decline in revenue can be attributed to the changes in electricity generation and prices, sales volume and uncertain market dynamics during this period. In contrast, the increase in gross profit and gross profit ratio indicates the effective management of the cost of goods sold and improved efficiency in the company’s operations. The rise in net profit shows the company was able to retain higher revenue after accounting for all expenses, including taxes.

In FY23, Nishat Power posted a revenue of Rs23.06 billion and gross profit of Rs4.57 billion, thus coming up with a gross profit ratio of 19.82%. The company’s operating profit increased 17.67% and the pretax profit rose by 23.36% in FY23 compared to FY22. The company recorded an operating profit of Rs4.18 billion and profit-before-taxation of Rs4.09 billion in FY23. The company registered an operating profit of Rs3.5 billion and profit-before-taxation of Rs3.32 billion during FY22. Nishat Power’s net profit stood at Rs4.09 billion and net profit ratio at 17.73% in FY23. The earning per share (ESP) stood at Rs11.55.

Nishat Power earned revenue of Rs23.06 billion, gross profit of Rs3.87 billion and net profit of Rs3.32 billion in FY22.

The company scored EPS of Rs9.38 in FY22.

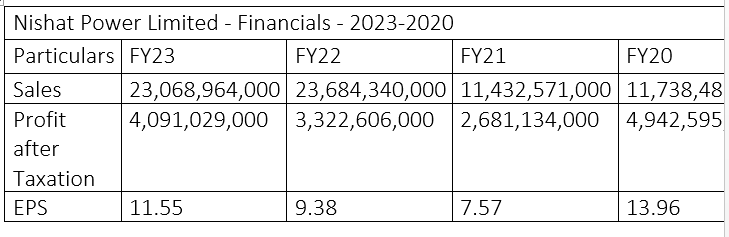

Analysis of last four years

The company managed to more than double its revenues to Rs23.6 billion in FY22 from Rs11.4 billion in the previous year. The FY22 was also the year when the company posted the highest revenue since FY20, and the FY21 was the year when the company posted the lowest revenue of Rs11.4 billion, dropping slightly from sales of Rs11.73 billion in FY20. The highest profit-after-tax of Rs4.94 billion was made in FY20 and the lowest of Rs2.68 billion in FY21. The company’s net profit stood at Rs3.32 billion and Rs4.09 billion in FY22 and FY23, respectively. The company’s EPS kept increasing from FY21 to FY23, reflecting the improved per-share profitability, but it was still below the levels achieved in FY20, which was the highest at Rs13.96. The company posted EPS of Rs11.55, Rs9.38 and Rs7.57 in FY23, FY22 and FY21, respectively.

Analysis of ratios over last four years

![]()

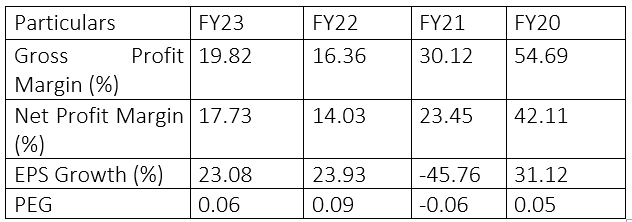

The financial ratios of the company provide a comprehensive insight into gross and net profit ratios, EPS growth and price/earnings to growth ratio (PEG) over the period from FY20 to FY23. The gross profit ratio is the percentage change in revenue per cost of goods sold. The company posted a gross profit ratio of 19.82% in FY23. The highest gross profit ratio of 54.69% was observed in FY20 followed by 30.12% in FY21 and 16.36% in FY22. The net profit margin measures the percentage change in revenue after accounting for all expenditures such as operating costs, interest and taxes.

The net profit ratio of the company showed a slight improvement form FY22 to FY23, as it rose to 17.73% in FY23 from 14.03% in FY22. The company witnessed the highest net profit ratio of 42.11% in FY20 followed by 23.45% in FY21. Nishat Power’s EPS growth stood at 23.08% in FY23 and 23.93% in FY22, which attracted investors to purchase stocks of the company. However, the company’s EPS experienced a significant drop of 45.76% in FY21. The EPS stood at 31.12% in FY20. In FY23, the company’s price/earnings to growth ratio (PEG) was 0.06, reflecting the stock may be undervalued compared to its earnings growth. The company observed PEG of 0.09, -0.06 and 0.05 in FY22, FY21 and FY20, respectively.

Company profile

Nishat Power was established as a public company limited by shares in 2007. The firm is a subsidiary of Nishat Mills Limited. The company's main operation is to construct, own, operate, and maintain a fuel-fired power station with a gross capacity of 200MW in Jamber Kalan, Pattoki tehsil of the Kasur district in the Punjab province.

Credit: INP-WealthPk