INP-WealthPk

Shams ul Nisa

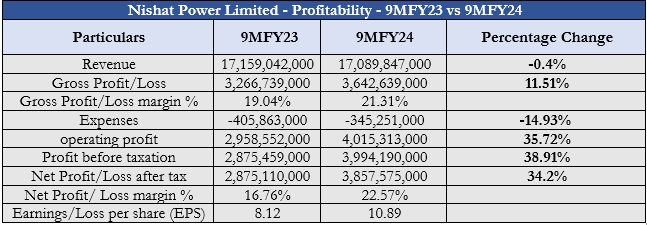

Nishat Power Limited reported a notable growth of 34.2% in net profit in nine months of the fiscal year 2024, despite a decline of 0.4% in revenue as compared to 9MFY23, reports WealthPK.

The company posted a revenue of Rs17.08 billion in 9MFY24 and a net profit of Rs3.87 billion in 9MFY23. The company's gross profit climbed by 11.51%, signifying better cost control during the review period. Thus, a higher gross margin of 21.31% was posted in 9MFY24 compared to 19.04% in 9MFY23. This implies that a larger portion of the company's income is retained as gross profit.

During this period, expenses contracted by 14.93% to Rs345.2 million, mainly due to no other expenditures. An impressive growth of 35.72% in operating profit and a notable hike of 38.91% in profit before taxes was posted in 9MFY24, showcasing improved operational efficiency and capacity to generate profit. Thus, the increase in net profit translated into a 22.57% increase in net profit margin in 9MFY24 from 16.76% in 9MFY23. The earnings per share (EPS) improved from Rs8.12 in 9MFY23 to Rs10.89 in 9MFY24, showcasing higher shareholder returns. The company’s improved performance indicates effective cost strategies to decrease expenses and a better pricing policy.

Assets, Equity, and Liabilities Analysis

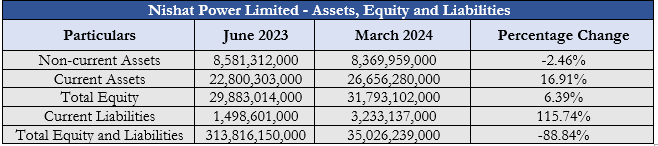

The financial statement of Nishat Power Limited from June 2023 to March 2024 demonstrates significant changes in assets, equity, and liabilities. Non-current assets dropped from Rs8.58 billion to Rs8.36 billion, a 2.46% reduction. This can be attributed to the decrease in investment and depreciation of currency. However, current assets grew sharply by 16.91%, from Rs22.8 billion to Rs26.65 billion in March 2024, highlighting higher inventories, short-term investments, cash and bank balances, and receivables. This also signifies better liquidity of the company.

Total equity increased to Rs31.79 billion, 6.39% higher than Rs29.88 billion in June 2023. However, the current liabilities more than doubled with a 115.74% increase from Rs1.49 billion to Rs3.23 billion in March 2024, signifying a rise in short-term borrowing or payables. This rise in current liabilities is much higher than the increase in current assets, notifying growing liquidity risk. The total equity and liabilities fell by 88.84% from Rs313.81 billion in June 2023 to Rs35.02 billion in March 2024.

Quarterly Analysis

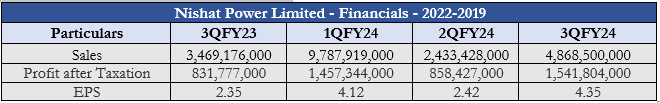

Nishat Power Limited's financial performance showed significant fluctuations in sales and profitability. Sales increased significantly from Rs3.46 billion in 3QFY23 to Rs4.86 billion in 3QFY24, with a single dip to Rs2.43 billion in 2QFY24.

Profit after taxation followed a similar growth trajectory, reaching the highest of Rs1.54 billion in 3QFY24. Earnings per share increased from Rs2.35 in 3QFY23 to Rs4.12 in 1QFY24, then slightly decreased to Rs2.42 in 2QFY24 before reaching Rs4.35 in 3QFY24.

Ratios Analysis

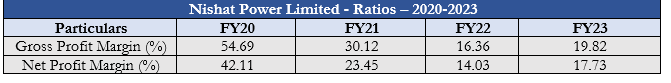

The company's financial ratios show significant changes from FY20 to FY23. The gross profit ratio, which measures the percentage change in revenue per cost of goods sold, remained at 19.82% in FY23, with the highest ratio of 54.69% in FY20. The net profit margin, which measures the percentage change in revenue after accounting for all expenditures, rose slightly from 14.03% in FY22 to 17.73% in FY23.

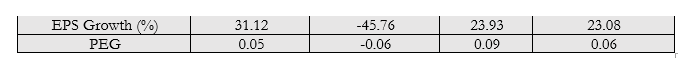

The company's ESP growth was 23.08% in FY23 and 23.93% in FY22, indicating a decimal decline in investor interest. However, the company experienced a loss per share growth of 45.76% in FY21. The company's price/earnings to growth ratio (PEG) was 0.06 in FY23, suggesting the stock may be undervalued compared to its earnings growth. The company reported a PEG value of 0.05, -0.06, and 0.09 in FY20, FY21, and FY22, respectively.

Company Profile

Nishat Power Limited was established as a public company limited in 2007 by shares in Pakistan. The firm is a subsidiary of Nishat Mills Limited. The company's primary business is building, owning, running, and maintaining a 200 MW fuel-fired power plant at Jamber Kalan, Tehsil Pattoki, District Kasur, Punjab, Pakistan.

Credit: INP-WealthPk