INP-WealthPk

Ayesha Mudassar

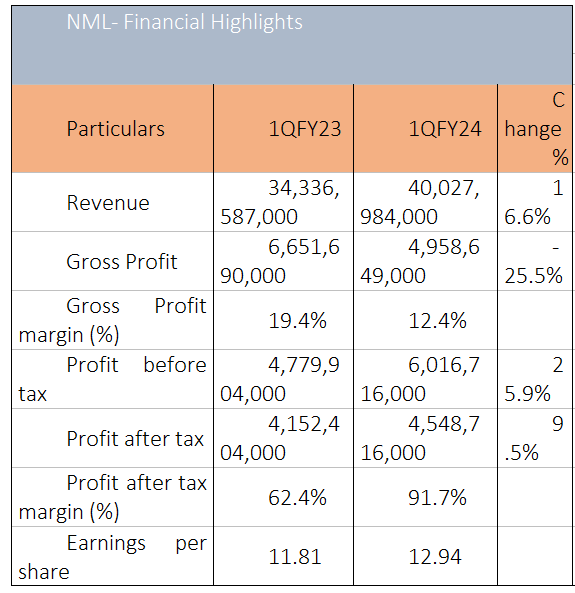

Nishat Mills Limited (NML) saw its profits grow by 26% and 9.5% before and after tax, respectively, in the first three months of the current fiscal year (1QFY24) compared with the same period last year (1QFY23), according to WealthPK. As per the company's quarterly report, NML posted a profit-before-tax of Rs6.01 billion and an after-tax profit of Rs4.5 billion in 1QFY24. Moreover, the significant fall in distribution costs and other expenses caused a 49.6% increase in profit from operations during the period under review.

Despite an unprecedented 186% and 134% increase in finance cost and tax, the company was able to report an increase of Rs396.3 million in profit-after-tax. However, the gross profit decreased by 25.5% due to an unprecedented increase in raw materials and energy costs, along with low demand for textile products in the international market.

NML observed a notable increase in revenue, amounting to Rs40.02 billion, representing a 16.6% increment from the preceding year’s first quarter. This growth can be attributed to the spinning and home textile division, which contributed an additional Rs4.3 billion and Rs115 million during the period under review.

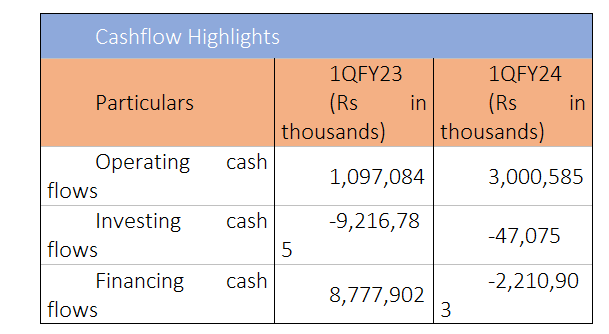

Cashflow highlights

Cash flows generated from operating activities increased 173.5% during 1QFY24. However, the considerable increase in financing cash flows was linked to the funding utilised for the expansion and modernisation of production facilities.

The company and its operations

Nishat Mills is a public limited company incorporated in Pakistan under the Companies Act, 1913 (Now Companies Act, 2017) and listed on the Pakistan Stock Exchange Limited. The company is engaged in the business of textile manufacturing and spinning, combing, weaving, bleaching, dyeing, printing, stitching, apparel, buying and selling.

General market review and future prospects

The textile sector in Pakistan has exhibited a weak performance in the first quarter of FY24. The reason is primarily attributed to a subdued demand for textile products in the US and the European markets. Additionally, the textile sector in Pakistan is facing several challenges such as high raw material costs, expensive energy, costly bank financing, and delayed sales tax refunds.

The aforementioned factors have negatively impacted the profitability and overall performance of the sector. Amidst a continuously changing economic landscape, the textile composite is determined to work closely with relevant departments to overcome these challenges to strengthen its presence and explore new growth opportunities.

Credit: INP-WealthPk